Ultra-Thin Glass Market Growth Opportunities and Forecast till 2032

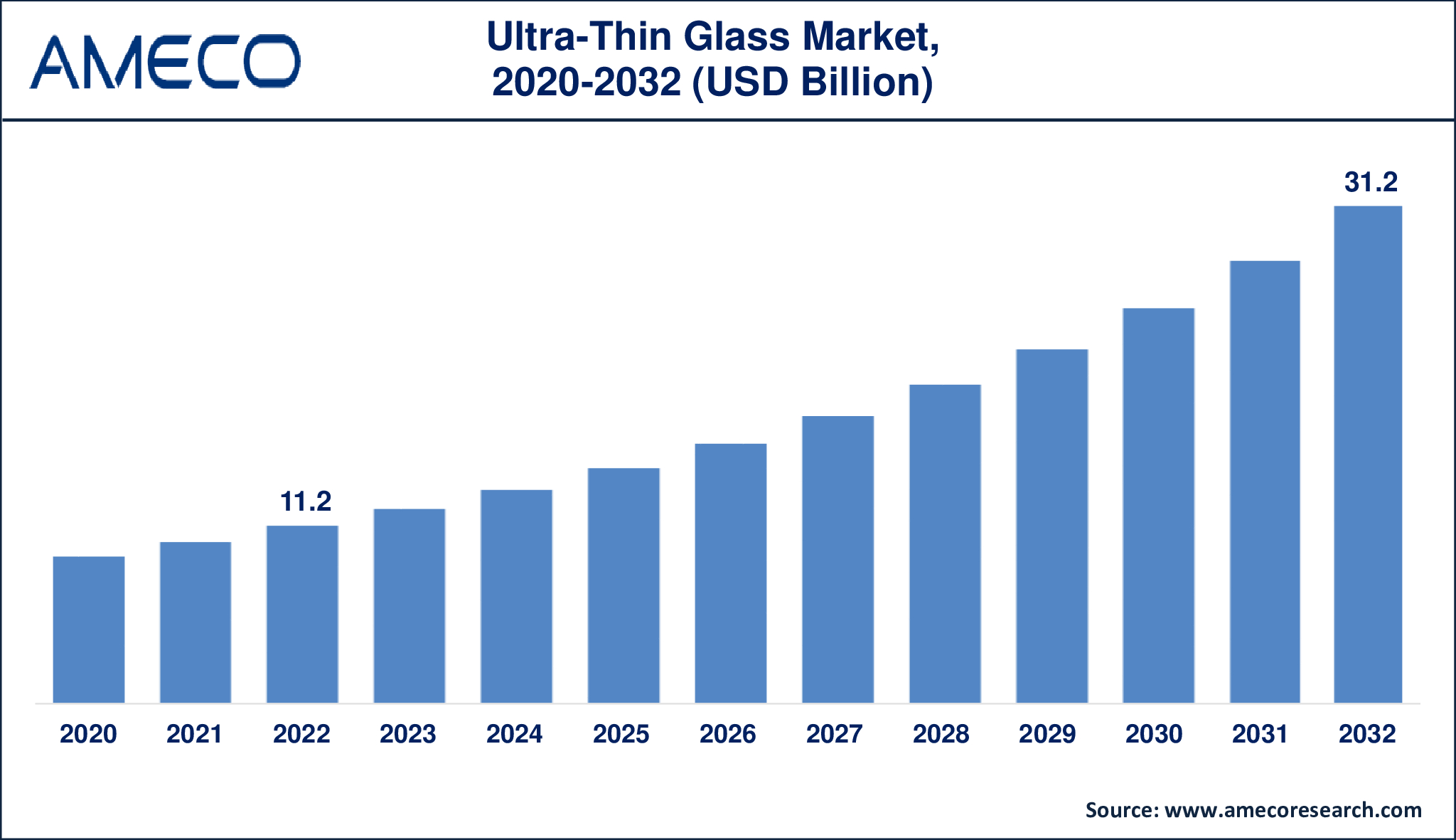

The Global Ultra-Thin Glass Market Size was valued at USD 11.2 Billion in 2022 and is anticipated to reach USD 31.2 Billion by 2032 with a CAGR of 10.9% from 2023 to 2032.

Ultra-thin glass is a form of glass that is extremely thin, typically measuring just a few micrometers in thickness. It is made using specialized procedures such as pulling molten glass into thin sheets or depositing thin layers of glass onto a substrate by chemical vapor deposition. These manufacturing technologies enable the fabrication of glass with exceptional thinness, making it suitable for applications where standard glass would be too bulky or heavy.

Ultra-thin glass has uses in a variety of sectors, including electronics, where it serves as a substrate for flexible displays, touchscreens, and other electrical components. Its thinness and flexibility make it perfect for curved or foldable devices, ensuring durability and optical clarity while being lightweight and stylish. Furthermore, ultra-thin glass is used in industries such as automotive, aerospace, and medicine, where its qualities are used for anything from windshield displays to medical implants.

|

Parameter |

Ultra-Thin Glass Market |

|

Ultra-Thin Glass Market Size in 2022 |

US$ 11.2 Billion |

|

Ultra-Thin Glass Market Forecast By 2032 |

US$ 31.2 Billion |

|

Ultra-Thin Glass Market CAGR During 2023 – 2032 |

10.9% |

|

Ultra-Thin Glass Market Analysis Period |

2020 - 2032 |

|

Ultra-Thin Glass Market Base Year |

2022 |

|

Ultra-Thin Glass Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Thickness, By Manufacturing, By Application, By End-Use Industry, and By Region |

|

Ultra-Thin Glass Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Aviation Glass & Technology BV., Suzhou Huadong Coating Glass, Changzhou Almaden, Corning, Luoyang Glass, Central Glass, Nippon Electric Glass, AEON Industries, CSG Holding, Asahi Glass, Nittobo, Xinyi Glass, Air-Craftglass, Emerge Glass, SCHOTT, and Nippon Sheet Glass. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Ultra-Thin Glass Market Dynamics

The ultra-thin glass market has grown significantly as a result of its growing uses in a variety of sectors. One of the primary factors is the increasing desire for lightweight and flexible electronic devices. With the growing popularity of smartphones, tablets, and wearables, there is a greater demand for long-lasting but flexible display materials. Ultra-thin glass has better optical clarity, scratch resistance, and flexibility than standard materials like plastic or rigid glass, making it an appealing option for manufacturers looking to create elegant and inventive gadgets.

Furthermore, the introduction of new technologies like foldable displays and flexible OLEDs has increased demand for ultra-thin glass. These technologies need materials that can bend and sustain repetitive bending without affecting performance, which ultra-thin glass excels at. As a result, firms in the electronics sector are investing extensively in R&D to include ultra-thin glass into their product lines, accelerating market expansion.

Furthermore, the automobile industry provides a potential prospect for the ultra-thin glass market. With the increasing use of heads-up displays (HUDs), augmented reality dashboards, and smart glass windows, there is a greater need for lightweight and durable glass materials that can improve the driving experience while still assuring safety. Ultra-thin glass has benefits such as greater visibility, decreased weight, and more design freedom, making it ideal for automotive applications. As automobile manufacturers focus innovation and distinction, demand for ultra-thin glass in this industry is likely to increase, boosting market growth even more.

Global Ultra-Thin Glass Market Segment Analysis

Ultra-Thin Glass Market By Thickness

· <0.1mm

· 0.1mm-0.5mm

· 0.5mm-1.0mm

In the ultra-thin glass market, the thickness category that prevails is determined by the individual uses and industry demands. Historically, the <0.1mm (100 micrometers or less) group has been the most prevalent. This ultra-thin range is very popular for applications that demand extreme thinness and flexibility, such as flexible displays for smartphones, tablets, and wearables. The need for ultra-thin glass in this category stems from the necessity for lightweight, flexible materials that can conform to curved or foldable gadget designs without sacrificing performance.

The 0.1mm-0.5mm (100-500 micrometers) category also has a large market share, serving a wide range of applications in industries such as electronics, automotive, aerospace, and medicine. This thickness range strikes a compromise between flexibility and durability, making it appropriate for applications such as touchscreens, automotive displays, and medical devices that require a slightly thicker substrate for increased structural integrity.

Ultra-Thin Glass Market By Manufacturing

· Float

· Fusion

· Others

In the ultra-thin glass sector, the float glass technology has traditionally dominated production. Float glass is made by pouring molten glass across a molten tin bath, resulting in a smooth and uniform sheet of glass that may then be progressively cooled and processed into extremely thin sheets. This process provides excellent accuracy and uniformity in thickness, making it ideal for mass manufacturing of ultra-thin glass in thicknesses ranging from micrometers to millimeters. The float glass technique is widely used by manufacturers in a variety of sectors, including electronics, automotive, and construction, due to its efficiency, scalability, and cost-effectiveness.

While the float glass method dominates the ultra-thin glass industry, the fusion draw technique is gaining popularity, particularly for applications needing even thinner glass substrates and greater degrees of customisation. The fusion draw technique involves drawing molten glass through a tiny aperture, resulting in ultra-thin glass sheets with exact thickness and composition. This technology is used for making ultra-thin glass with thicknesses less than 0.1mm, and it is commonly employed in specialized applications such as flexible displays, optical components, and medical devices that require extreme thinness and customized qualities. While the fusion draw technique does not yet dominate the market as much as float glass, its increasing popularity demonstrates the growing need for ultra-thin glass with enhanced qualities and dimensions.

Ultra-Thin Glass Market By Application

· Semiconductor Substrate

· Touch Panel Displays

· Fingerprint Sensors

· Automotive Glazing

· Others

In recent years, touch panel displays have emerged as the primary application in the ultra-thin glass sector. The widespread use of smartphones, tablets, laptops, and other touch-enabled devices has increased demand for ultra-thin glass substrates that provide improved durability, optical clarity, and responsiveness. Touch panel displays require thin and flexible glass materials to allow for smooth and precise touch interactions while keeping a stylish device design. Ultra-thin glass is widely used in consumer electronics touchscreens, vehicle infotainment systems, and industrial control panels, which contributes to its commercial significance.

Furthermore, fingerprint sensors are a crucial application boosting demand for ultra-thin glass. With the widespread use of fingerprint authentication technology in smartphones, tablets, laptops, and other electronic devices, there is an increasing demand for thin and strong glass substrates capable of supporting high-resolution fingerprint scanning while ensuring dependable performance and durability. Ultra-thin glass provides the optimum mix of thickness, strength, and transparency for fingerprint sensor applications, positioning it as a market leader as fingerprint identification becomes more common in a variety of sectors and applications.

Ultra-Thin Glass Market By End-Use Industry

· Consumer Electronics

· Automotive & Transportation

· Medical & Healthcare

· Others

In recent years, the consumer electronics industry has taken the lead in the ultra-thin glass market. The rise of smartphones, tablets, wearable devices, and other electronic gadgets has increased demand for ultra-thin glass substrates for use in displays, touchscreens, and protective coverings. The consumer electronics industry values lightweight, durable, and visually appealing materials, and ultra-thin glass satisfies these criteria admirably, providing great optical clarity, scratch resistance, and versatility. With the ongoing innovation and evolution of electronic gadgets, the consumer electronics industry's demand for ultra-thin glass is projected to continue strong, cementing its market dominance.

Furthermore, while consumer electronics now dominates the ultra-thin glass business, other industries, such as automotive and transportation, as well as medical and healthcare, make major contributions. Automotive manufacturers are increasingly using ultra-thin glass for applications such as heads-up displays, augmented reality dashboards, and smart glass windows, while the medical industry uses it in products such as medical implants, diagnostic equipment, and surgical tools. As these industries continue to embrace technological developments and lightweight materials to improve performance and functionality, demand for ultra-thin glass across a wide range of end-use sectors is likely to rise, further changing the market landscape.

Ultra-Thin Glass Market Regional Analysis

The geographical study of the ultra-thin glass market indicates a dynamic environment influenced by technical breakthroughs, industrial expansion, and consumer demand. Asia-Pacific stands out as a major hub for ultra-thin glass manufacturing and consumption, thanks to the presence of leading electronics manufacturers, notably in China, South Korea, and Japan. These countries have vibrant electronics industries and large expenditures in R&D, which drives the need for ultra-thin glass in applications such as smartphones, tablets, and televisions. Furthermore, the region's automotive industry is expanding rapidly, driving up demand for ultra-thin glass for applications such as heads-up displays and smart glass windows.

Europe is another notable location in the ultra-thin glass market, with a thriving automotive sector and an emphasis on innovation. Countries such as Germany, France, and Italy are major manufacturers and users of ultra-thin glass, notably for automobile glazing applications. The region's emphasis on sustainability and energy efficiency promotes the use of ultra-thin glass in building and architectural projects. Furthermore, North America remains a prominent market participant, owing to the presence of major electronics and automobile manufacturers in the United States and Canada. Overall, the regional study emphasizes the ultra-thin glass market's global aspect, with each area playing a distinct role in its growth and evolution.

Ultra-Thin Glass Market Leading Companies

The ultra-thin glass market players profiled in the report are Aviation Glass & Technology BV., Suzhou Huadong Coating Glass, Changzhou Almaden, Corning, Luoyang Glass, Central Glass, Nippon Electric Glass, AEON Industries, CSG Holding, Asahi Glass, Nittobo, Xinyi Glass, Air-Craftglass, Emerge Glass, SCHOTT, and Nippon Sheet Glass.

Ultra-Thin Glass Market Regions

North America

· U.S.

· Canada,

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa