Insurance Telematics Market Growth Opportunities and Forecast till 2032

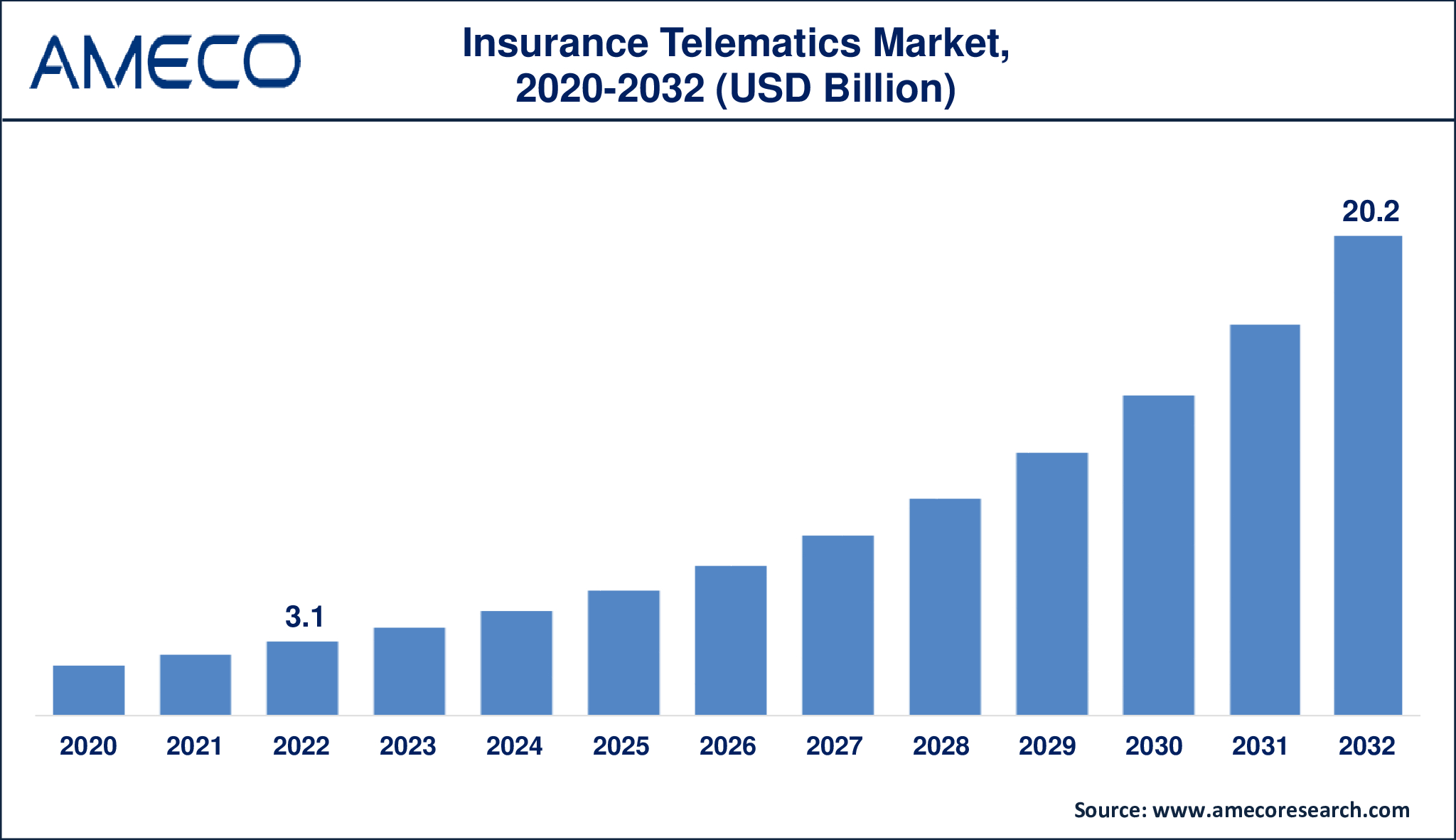

The Global Insurance Telematics Market Size was valued at USD 3.1 Billion in 2022 and is anticipated to reach USD 20.2 Billion by 2032 with a CAGR of 20.8% from 2023 to 2032.

Insurance telematics is a technology-based strategy used by insurance firms to monitor and evaluate customers' driving behavior using devices put in their vehicles. These devices, often known as telematics devices or black boxes, capture data on different elements of driving, such as speed, braking patterns, acceleration, turning, and trip times and locations. This data is subsequently provided to the insurance, who utilizes it to better properly estimate the driver's risk. By analyzing this real-time driving data, insurers can provide individualized insurance plans, potentially resulting in cheaper premiums for safe drivers and encouraging better driving behaviors.

The use of insurance telematics provides numerous advantages for both insurers and customers. For insurers, it gives a more precise risk assessment tool, lowering the chance of false claims and allowing for more competitive pricing models. Customers, particularly those who drive carefully and seldom, can save significantly on premiums with telematics. Furthermore, feedback from telematics data can help drivers improve their driving skills and safety. Overall, insurance telematics signals a substantial transition toward more data-driven and individualized insurance services in the vehicle industry.

|

Parameter |

Insurance Telematics Market |

|

Insurance Telematics Market Size in 2022 |

US$ 3.1 Billion |

|

Insurance Telematics Market Forecast By 2032 |

US$ 20.2 Billion |

|

Insurance Telematics Market CAGR During 2023 – 2032 |

20.8% |

|

Insurance Telematics Market Analysis Period |

2020 - 2032 |

|

Insurance Telematics Market Base Year |

2022 |

|

Insurance Telematics Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Offering, By Technology, By Deployment, By Size, and By Region |

|

Insurance Telematics Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Agero Inc., Masternaut Limited, IMS, Meta System S.p.A., Octo Group S.p.A, MiX Telematics, Sierra Wireless, Trimble Inc., TomTom International BV., and Verizon |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Insurance Telematics Market Dynamics

The insurance telematics market is rapidly expanding, propelled by technological developments, increased acceptance of linked automobile services, and a rising emphasis on individualized insurance products. The proliferation of Internet of Things (IoT) devices, as well as developments in data analytics capabilities, have enabled insurers to collect and process vast amounts of driving data more accurately and efficiently. This has resulted in more exact risk assessments and the development of usage-based insurance (UBI) models, which base premiums on individual driving patterns rather than traditional demographic considerations.

One of the primary drivers of the insurance telematics business is the potential for cost savings and increased safety. Telematics can help insurers cut claims costs by encouraging safer driving and giving more reliable data for investigations. Telematics technology can result in decreased insurance costs for consumers, particularly those who drive safely. Furthermore, real-time feedback and monitoring can lead to better driving practices, which improves road safety. Consumers' rising understanding of these benefits is driving up acceptability and demand for telematics-based insurance products.

Regulatory assistance and actions also have a substantial impact on the insurance telematics market dynamics. In many areas, governments and regulatory agencies are encouraging the use of telematics to improve road safety and minimize traffic accidents. For example, the European Union's eCall plan requires all new cars to be fitted with telematics systems capable of immediately notifying emergency services in the case of a collision. Such rules are encouraging the inclusion of telematics into new vehicles, hence growing the market for telematics-based insurance solutions.

Despite its great development possibilities, the insurance telematics business has problems linked to data privacy and security. The capture and transmission of precise driving data raises important questions regarding how it is stored, used, and secured. Consumers may be reluctant to share their driving information for fear of data breaches or misuse. To address these issues, insurers and telematics providers must develop strong data protection procedures and ensure transparency about data utilization. Overcoming these problems is critical to maintaining consumer trust and the market's growth trajectory.

Global Insurance Telematics Market Segment Analysis

Insurance Telematics Market By Offering

· Hardware

· Software

· Others

The hardware segment has previously dominated the insurance telematics market since telematics devices or "black boxes" must be installed in vehicles to collect driving data. These devices are critical for gathering real-time data on a variety of driving factors, including speed, braking, acceleration, and position. The initial phase of market adoption necessitated significant hardware investment to enable the collection of telematics data, resulting in the hardware segment controlling a sizable portion of the market.

However, as the business evolved, the software segment began to gain traction. The expansion of insurance telematics has transferred the attention to advanced data analytics, machine learning, and artificial intelligence, which are required for processing and analyzing the massive volumes of data acquired by hardware devices. Insurers rely largely on sophisticated technologies to evaluate driving habits, estimate risks, and tailor insurance plans. This shift emphasizes the expanding role of software in providing actionable insights and improving the overall value proposition of telematics-based insurance solutions.

Insurance Telematics Market By Technology

· OBD-II

· Smartphone

· Hybrid

· Black-Box

The insurance telematics business has seen tremendous advances in various technologies for collecting and analyzing vehicle data. Among these, OBD-II (On-Board Diagnostics) technology has long dominated the industry. OBD-II devices are generally simple to install, as they plug directly into a vehicle's OBD port, which is found in most automobiles made after 1996. These sensors can monitor a variety of vehicle metrics and driving habits, making them a popular alternative for insurers seeking accurate and complete data.

However, smartphone-based telematics technology is gaining popularity due to its simplicity and cost-effectiveness. Smartphones are equipped with a variety of sensors, including GPS, accelerometers, and gyroscopes, which may efficiently detect driving behavior without the need for additional hardware. This method appeals to both insurers and consumers since it streamlines data collecting and lowers the overall cost of installing telematics solutions. Furthermore, smartphone-based telematics is easily connected with mobile apps, increasing user engagement and delivering real-time feedback to drivers.

Insurance Telematics Market By Deployment

· On-Premise

· Cloud

Cloud deployment models are gaining traction in the insurance telematics sector because to their scalability, flexibility, and cost-effectiveness. Cloud-based solutions allow insurers to efficiently store and process large amounts of telemetry data without requiring a significant upfront investment in IT infrastructure. These technologies enable real-time data processing and reporting, giving insurers immediate insights into driving patterns and risk assessment. Furthermore, cloud platforms provide seamless upgrades, interaction with other systems, and remote access, allowing insurers to provide more flexible and user-friendly services to their policyholders.

On-premise deployment, while still utilized by some insurers, is less popular due to greater initial costs and the challenges of operating and maintaining the necessary hardware and software infrastructure. On-premise solutions may provide more control over data, which is critical for enterprises with strict regulatory requirements or specialized data privacy concerns. However, they are often less flexible and scalable than cloud systems. As the industry moves towards more data-driven and advanced technical solutions, cloud deployment is projected to gain traction, strengthening its position as the market leader in insurance telematics.

Insurance Telematics Market By Size

· Large Enterprises

· Medium and Small Enterprises

Large organizations have typically dominated the insurance telematics market due to their vast resources, greater customer bases, and capacity to invest in cutting-edge technology. These businesses, particularly big insurance companies, have the financial and technological resources to establish extensive telematics programs that require significant upfront investments in hardware and software. Large insurers can use economies of scale to cut costs while maximizing the benefits of telematics, such as better risk assessment, individualized pricing models, and more client involvement.

Large firms also benefit from established brand awareness and trust, which can help consumers adopt new technologies. Their extensive distribution networks and marketing capabilities allow them to reach a large audience and efficiently promote telematics-based insurance products. Furthermore, large organizations frequently have the infrastructure and ability to monitor and analyze the massive volumes of data generated by telematics devices, utilizing advanced analytics and machine learning to continuously improve their offerings.

Insurance Telematics Market Regional Analysis

The insurance telematics market varies significantly by region, with North America and Europe dominating in adoption and market share. North America, particularly the United States, is a significant market because of its modern technology infrastructure, high vehicle ownership rates, and the presence of multiple top telematics and insurance businesses. Consumers in the region are more aware of and responsive to telematics-based insurance products, which has resulted in tremendous growth. Furthermore, governmental assistance, such as rules for electronic logging devices (ELDs) in commercial vehicles, has accelerated the use of telematics solutions in the region.

Europe also has a significant part of the insurance telematics market, which is driven by tight regulatory requirements and a strong emphasis on road safety. The European Union's eCall project, which requires the installation of telematics equipment in all new vehicles, has greatly accelerated industry growth. Countries such as the United Kingdom, Italy, and Germany are at the forefront, with high rates of telematics-based insurance coverage. Furthermore, rising consumer awareness and a renewed emphasis on minimizing insurance fraud and improving risk assessment have expedited telematics adoption in Europe. Other regions, such as Asia-Pacific, are also showing strong growth potential, owing to rising car sales, urbanization, and increased smartphone usage, all of which make telematics solutions more easily implemented.

Insurance Telematics Market Leading Companies

The insurance telematics market players profiled in the report is Agero Inc., Masternaut Limited, IMS, Meta System S.p.A., Octo Group S.p.A, MiX Telematics, Sierra Wireless, Trimble Inc., TomTom International BV., and Verizon.

Insurance Telematics Market Regions

North America

· U.S.

· Canada,

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa