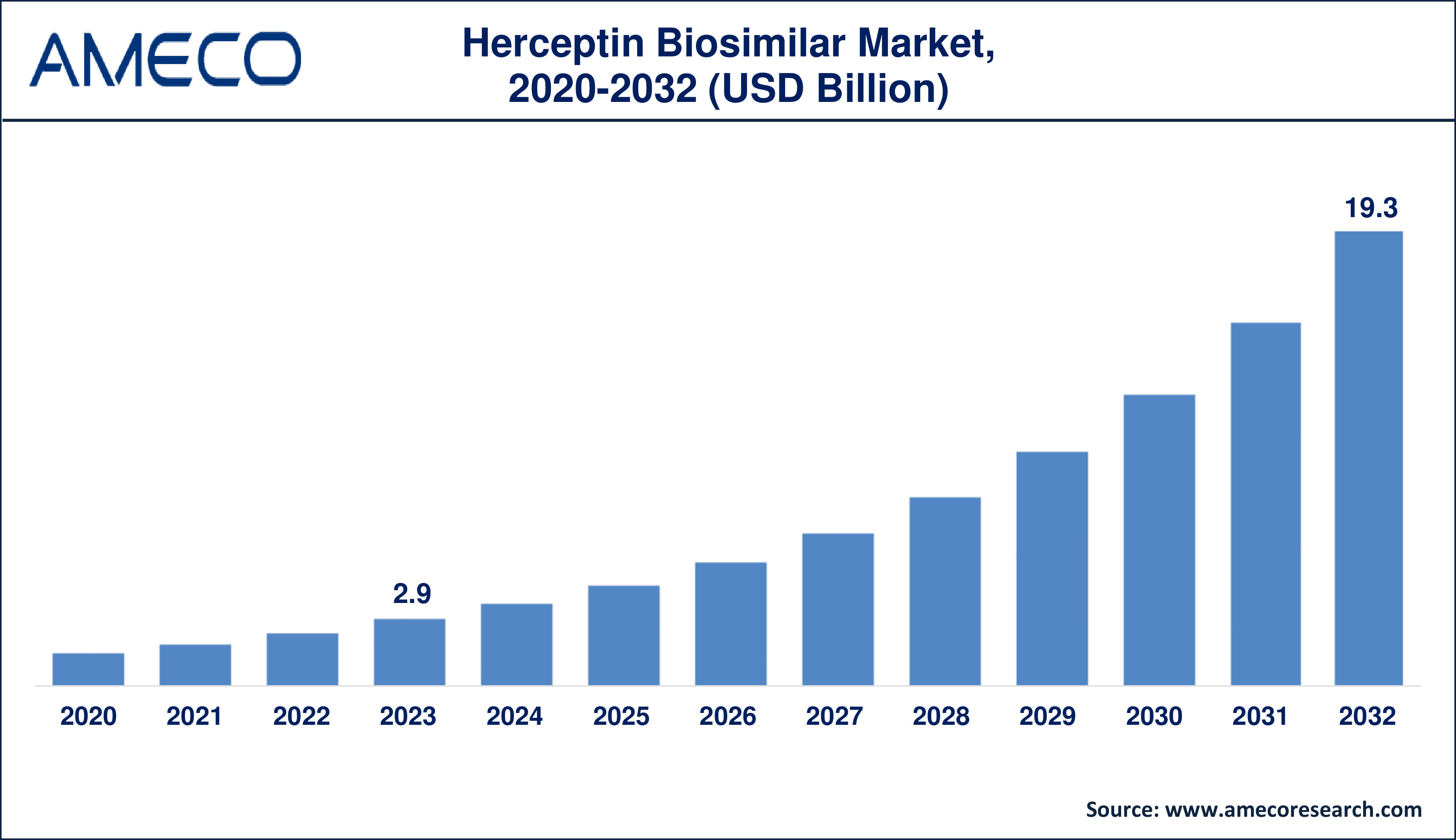

Herceptin Biosimilar Market Growth Opportunities and Forecast till 2032

The Global Herceptin Biosimilar Market Size was valued at USD 2.9 Billion in 2023 and is anticipated to reach USD 19.3 Billion by 2032 with a CAGR of 23.6% from 2024 to 2032.

Herceptin biosimilar is a biologic medicinal product that closely resembles Herceptin (trastuzumab), a monoclonal antibody used to treat HER2-positive breast cancer and other HER2-overexpressing malignancies. Herceptin inhibits the development and multiplication of cancer cells by targeting their HER2 receptor. Biosimilars are designed to have no clinically significant changes in terms of safety, purity, or potency from the original biologic substance. They are rigorously tested and evaluated to guarantee that they are as effective and safe as the reference product.

The development of herceptin biosimilars aims to give more inexpensive therapy choices while preserving good quality. These biosimilars provide a less expensive alternative to Herceptin, potentially boosting patients' access to life-saving medicines. Biosimilars, by increasing market competition, can result in lower healthcare costs and better patient outcomes. Regulatory authorities such as the FDA and EMA have strict rules and approval processes for biosimilars to assure their comparability to the reference biologic.

|

Parameter |

Herceptin Biosimilar Market |

|

Herceptin Biosimilar Market Size in 2023 |

US$ 2.9 Billion |

|

Herceptin Biosimilar Market Forecast By 2032 |

US$ 19.3 Billion |

|

Herceptin Biosimilar Market CAGR During 2024 – 2032 |

23.6% |

|

Herceptin Biosimilar Market Analysis Period |

2020 - 2032 |

|

Herceptin Biosimilar Market Base Year |

2023 |

|

Herceptin Biosimilar Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Application, By End-User, and By Region |

|

Herceptin Biosimilar Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Pfizer Inc., Biocon Limited, Roche Holding AG, Mabion SA, Accord Healthcare Ltd, Mylan N.V., Samsungbioepis Co., Ltd., AryoGen Biopharma, Genor Biopharma Company Ltd, Merck & Co., Inc., Gedeon Richter Plc, and Amgen Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Herceptin Biosimilar Market Dynamics

Regulatory advancements, competitive environment, and market adoption are among the major characteristics of the Herceptin Biosimilar market. Biosimilars are approved through stringent processes established by regulatory authorities such as the FDA in the United States and the EMA in Europe. These laws ensure that biosimilars meet demanding safety, effectiveness, and quality requirements compared to the original biologic. The expedited regulatory processes have encouraged several pharmaceutical companies to invest in the development of Herceptin Biosimilars, resulting in a growing number of biosimilars on the market.

The competitive landscape of the Herceptin Biosimilar market is characterized by fierce competition among major pharmaceutical corporations and biotechnology firms. Companies such as Amgen, Mylan, and Celltrion have developed and commercialized Herceptin Biosimilars, resulting in a varied market. This competition has resulted in lower prices, making cancer therapy more reasonable and accessible. Strategic collaborations, mergers, and acquisitions are also typical as companies seek to increase their market presence and diversify their biosimilar portfolio. Market participants also invest extensively in marketing and educational activities to improve biosimilar acceptability and adoption by healthcare providers and patients.

Physician and patient knowledge, cost-effectiveness, and reimbursement policies all have an impact on Herceptin Biosimilars market acceptance. Oncologists and patients have accepted biosimilars more readily as a result of increased awareness and education regarding their efficacy and safety. The cost savings associated with biosimilars as compared to the original biologic play an important role in pushing their adoption. Biosimilars are more likely to be included in formularies by healthcare payers and insurance companies since they have the potential to lower overall treatment costs. However, issues such as patent litigation, market exclusivity of the reference medicine, and variable reimbursement policies across regions can all have an impact on the market dynamics and growth potential of Herceptin biosimilars.

Global Herceptin Biosimilar Market Segment Analysis

Herceptin Biosimilar Market By Application

· Breast Cancer

· Colorectal Cancer

· Leukemia

· Lymphoma

· Others

The herceptin biosimilar market has previously been dominated by breast cancer applications. Herceptin (trastuzumab) was initially licensed to treat HER2-positive breast cancer, a subtype that overexpresses the HER2 protein, which stimulates cancer cell proliferation. The high prevalence of HER2-positive breast cancer, combined with Herceptin's well-established efficacy in treating this condition, has created a huge demand for biosimilars. Furthermore, breast cancer awareness efforts and screening programs have raised diagnosis rates, resulting in greater use of targeted medicines such as Herceptin and its biosimilars. As a result, breast cancer remains the greatest market for herceptin biosimilars, outperforming other applications like colorectal cancer, leukemia, and lymphoma.

Herceptin Biosimilar Market By End-User

· Hospital & Clinics

· Oncology Centers

· Others

In 2023, hospitals and clinics accounted for the majority of the herceptin biosimilar market by end user. This dominance is due to the enormous reach and comprehensive treatment facilities given by hospitals and clinics, which serve a diverse patient population. These medical facilities are frequently the first point of contact for cancer diagnosis and treatment, ensuring widespread access to herceptin biosimilars. Furthermore, hospitals and clinics are often equipped with the infrastructure and multidisciplinary teams needed to administer and manage complex therapies such as Herceptin. The incorporation of biosimilars into hospital formularies and their use in standard treatment regimens strengthened their position in the herceptin biosimilar market.

Herceptin Biosimilar Market Regional Analysis

The herceptin biosimilar market varies significantly by area, driven mostly by legislative frameworks, healthcare infrastructure, and market dynamics. North America, notably the United States, has a significant share due to early biosimilar uptake and the FDA's comprehensive regulatory framework. The existence of big pharmaceutical companies, significant healthcare expenditure, and great awareness among healthcare professionals all help to drive market expansion in this region. Furthermore, favorable payment rules and robust patient assistance programs increase accessibility and affordability, accelerating the uptake of herceptin biosimilars.

In Europe, the market is also significant, thanks to the region's robust biosimilar rules and backing from the European Medicines Agency (EMA). Biosimilar adoption is led by countries such as Germany, the United Kingdom, and France, which have well-established healthcare systems and proactive biosimilar legislation. Asia-Pacific is rising as a big market, with China, Japan, and India seeing tremendous expansion. This expansion is driven by rising cancer rates, expanding healthcare infrastructure, and supportive government programs. Biosimilars are particularly appealing in these regions because of their low cost. Overall, the regional landscape of the Herceptin Biosimilar market is defined by regulatory support, economic variables, and healthcare system maturity.

Herceptin Biosimilar Market Leading Companies

The herceptin biosimilar market players profiled in the report is Pfizer Inc., Biocon Limited, Roche Holding AG, Mabion SA, Accord Healthcare Ltd, Mylan N.V., Samsungbioepis Co., Ltd., AryoGen Biopharma, Genor Biopharma Company Ltd, Merck & Co., Inc., Gedeon Richter Plc, and Amgen Inc.

Herceptin Biosimilar Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa