Diabetes Management Device System Market Growth Opportunities and Forecast till 2032

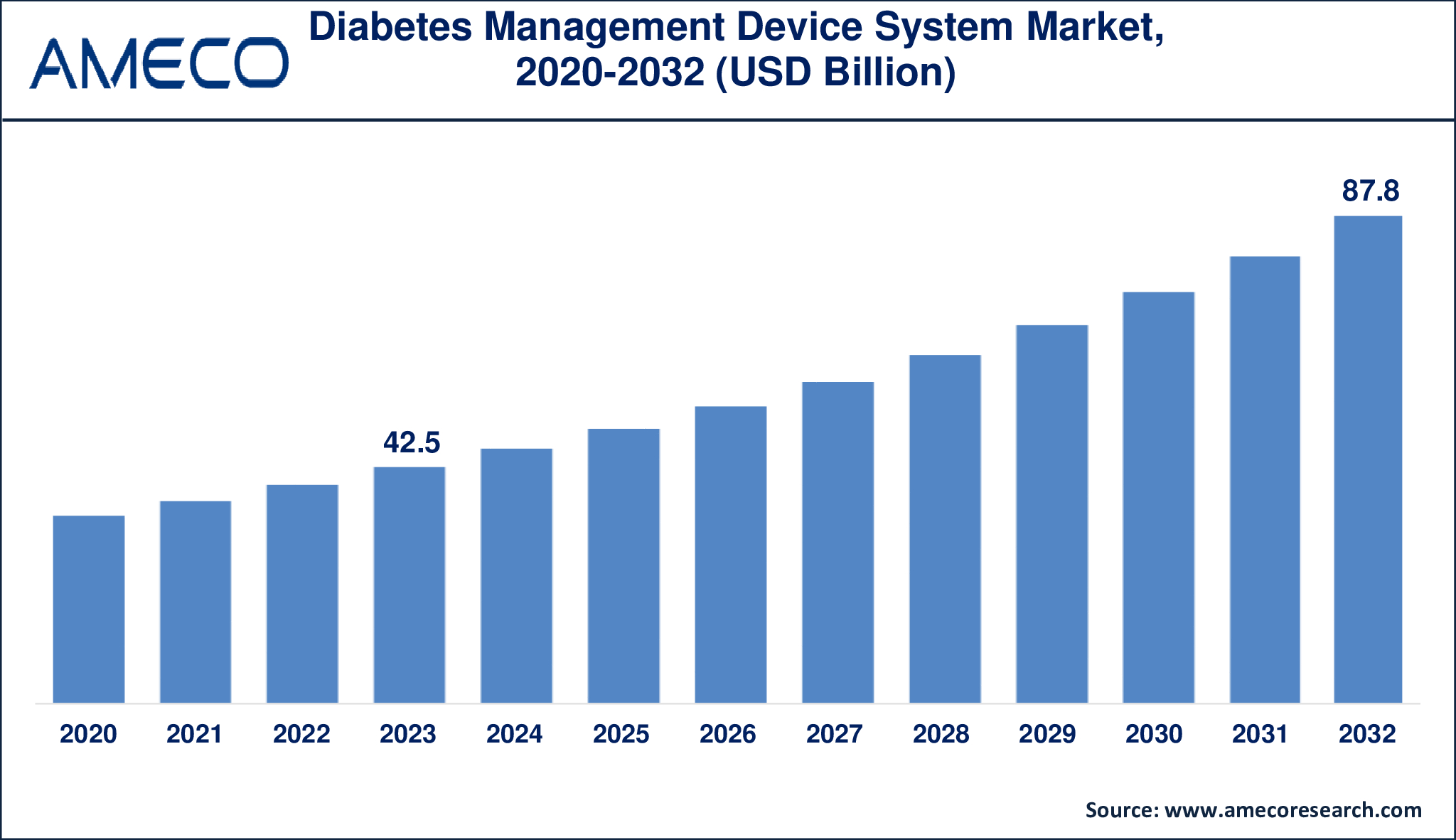

The Global Diabetes Management Device System Market Size was valued at USD 127.8 Billion in 2023 and is anticipated to reach USD 271.9 Billion by 2032 with a CAGR of 8.8% from 2024 to 2032.

A diabetes management device system is a comprehensive set of technologies that help diabetics monitor and regulate their blood glucose levels. These systems usually incorporate glucose meters, continuous glucose monitors (CGMs), insulin pumps, and software applications. A glucose meter uses fingerstick testing to monitor blood sugar levels, but CGMs use a sensor inserted under the skin to deliver real-time glucose data. Insulin pumps provide insulin continuously or in reaction to blood glucose levels, while software applications track and analyze data to enhance treatment plans.

The combination of these devices enables more accurate and proactive diabetes control. Advanced systems frequently include connectivity options for syncing with cellphones or computers, allowing users to conveniently monitor their glucose levels, insulin dosages, and other health parameters. This data helps both patients and healthcare providers make informed decisions regarding food, exercise, and medication modifications, with the goal of maintaining optimal blood glucose control and lowering the risk of diabetes-related complications.

|

Parameter |

Diabetes Management Device System Market |

|

Diabetes Management Device System Market Size in 2023 |

US$ 127.8 Billion |

|

Diabetes Management Device System Market Forecast By 2032 |

US$ 271.9 Billion |

|

Diabetes Management Device System Market CAGR During 2024 – 2032 |

8.8% |

|

Diabetes Management Device System Market Analysis Period |

2020 - 2032 |

|

Diabetes Management Device System Market Base Year |

2023 |

|

Diabetes Management Device System Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, Distribution Channel, and By Region |

|

Diabetes Management Device System Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Novo Nordisk A/S, Medtronic, Bayer AG, Sanofi, DexCom, Inc., Abbott, Braun Melsungen AG, Becton, Dickinson and Company, Hoffman-La Roche Ltd., Tandem Diabetes Care, Inc., and PHC Holdings Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Diabetes Management Device System Market Dynamics

The diabetes management device system market is being pushed by the rising global prevalence of diabetes, which is increasing need for effective management options. As the global diabetes rate rises due to factors such as aging populations, sedentary lifestyles, and rising obesity levels, the demand for sophisticated diabetes management devices grows. Furthermore, increased knowledge and education about diabetes treatment are encouraging more people to seek out technological alternatives to improve disease control.

Technological innovations play an important influence in determining diabetes management devices market dynamics. Continuous glucose monitors (CGMs) with greater accuracy and user comfort, as well as insulin delivery systems such as smart insulin pumps, are increasing the number of alternatives available to patients. Integration with digital health technologies and mobile apps improves data tracking and patient involvement, resulting in more tailored and successful diabetes control. As technology advances, the adoption of these gadgets increases, driving market development.

Despite this optimistic prognosis, the market confronts hurdles such as the high cost of modern diabetes care devices, which may limit access for some patients. Furthermore, regulatory constraints and the necessity for constant innovation to meet changing patient needs are ongoing problems for producers. Market players must handle these challenges while working to make gadgets more affordable and accessible. Furthermore, in order to maintain a competitive advantage in the market, businesses must constantly innovate and differentiate their offerings.

Global Diabetes Management Device System Market Segment Analysis

Diabetes Management Device System Market By Product

· Monitoring Devices

o Blood Glucose Meters

o Continuous Glucose Monitoring Devices

o Self-monitoring Blood Glucose Systems

o Test Strips

o Lancets

o Others

· Treatment Devices

o Insulin Pen

o Insulin Pumps

o Insulin Jet Injectors

o Insulin Syringes

o Others

According to the diabetes management device system industry analysis, the blood glucose meters and continuous glucose monitoring (CGM) devices dominate the diabetes devices market in 2023. Blood glucose meters have become a diabetes management mainstay due to their low cost, convenience of use, and widespread adoption. However, continuous glucose monitoring devices are gaining popularity because they provide real-time glucose readings and improved glycemic control, both of which are critical for more efficient diabetes management. The CGM industry is rapidly expanding as technology advances and need for more precise monitoring grows. While blood glucose meters continue to have a large share, the transition to CGMs demonstrates a rising preference for more sophisticated and continuous monitoring options.

Diabetes Management Device System Market By Distribution Channel

· Institutional Sales

· Retail Sales

According to the diabetes management device system market forecast, the retail sales sector is predicted to hold the largest share from 2024 to 2032. This expansion is being driven by expanding customer demand for convenience and accessibility, as well as increased availability of diabetes control devices in pharmacies, online stores, and specialized retail locations. Retail sales channels give patients direct access to a variety of products, such as blood glucose meters, continuous glucose monitors, and insulin delivery systems, making it easier to buy and manage diabetes care at home.

Additionally, the growth of e-commerce platforms and developments in digital health has made it easier for consumers to access these gadgets, increasing the importance of retail sales. The ability to readily compare products, get reviews, and receive prompt delivery promotes the retail channel's expansion, positioning it as a vital actor in the diabetes management device market's distribution ecosystem.

Diabetes Management Device System Market Regional Analysis

The diabetes management device system market varies significantly by geography, with North America leading due to its advanced healthcare infrastructure, high diabetes prevalence, and rapid acceptance of new technology. The United States, in particular, is a significant market due to its huge diabetic population, well-established healthcare systems, and strong presence of key industry participants. The high degree of diabetes management awareness, as well as significant investment in research and development, contribute to North America's dominance.

In contrast, the Asia-Pacific area is rapidly expanding, driven by increased diabetes prevalence, rising healthcare costs, and improved healthcare infrastructure. Diabetes management devices are in high demand in China and India due to their vast populations and increased awareness about diabetes care. The expansion of retail and institutional sales channels, together with government measures to improve diabetes care, drives market growth in this region. As healthcare systems evolve and access to modern technologies increases, the Asia-Pacific industry is likely to make a substantial contribution to the worldwide diabetes management device market.

Diabetes Management Device System Market Leading Companies

The diabetes management device system market players profiled in the report is Novo Nordisk A/S, Medtronic, Bayer AG, Sanofi, DexCom, Inc., Abbott, Braun Melsungen AG, Becton, Dickinson and Company, Hoffman-La Roche Ltd., Tandem Diabetes Care, Inc., and PHC Holdings Corporation.

Diabetes Management Device System Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa