Steel Rebar Market Growth Opportunities and Forecast till 2032

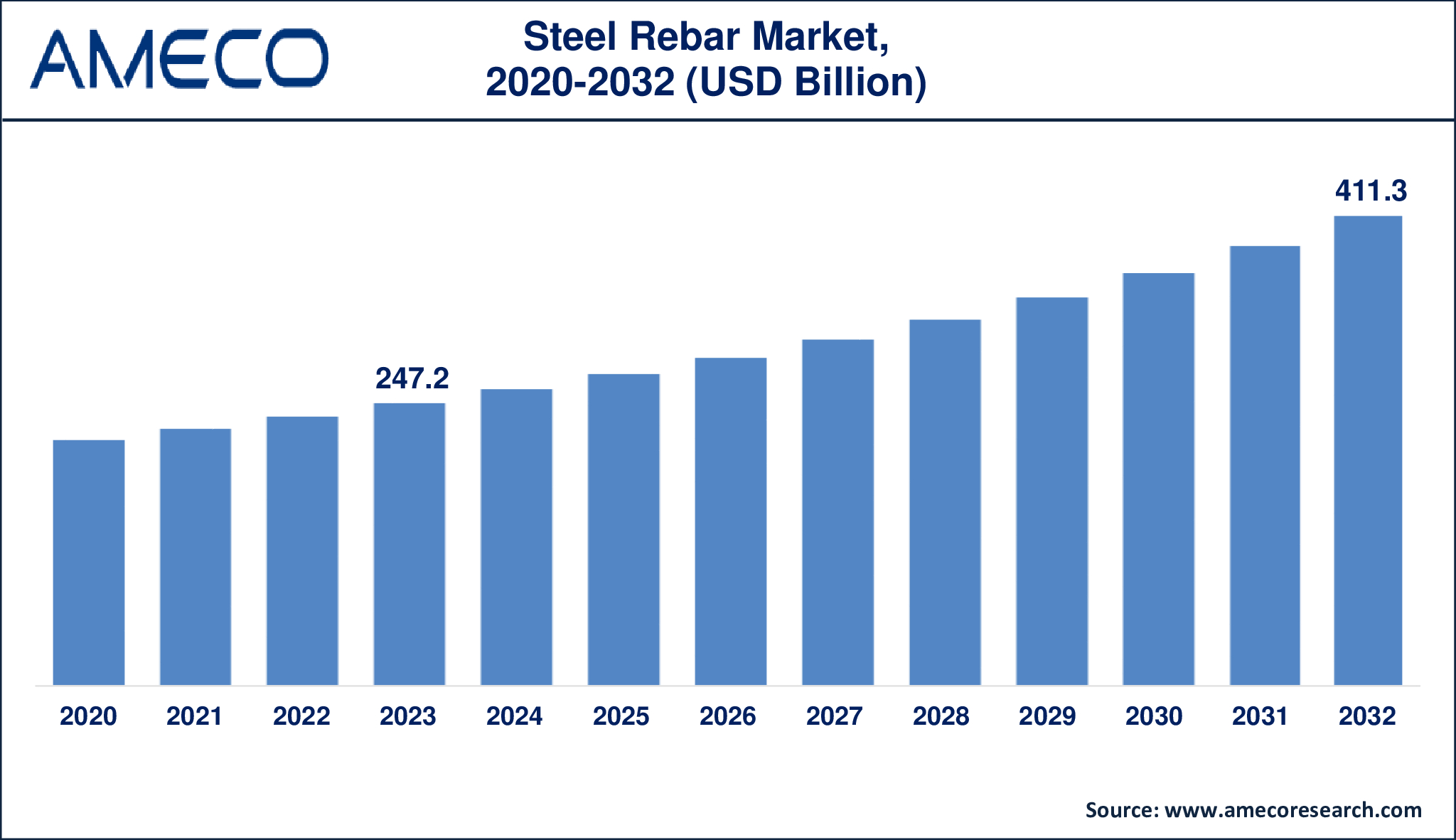

The Global Steel Rebar Market Size was valued at USD 247.2 Billion in 2023 and is anticipated to reach USD 411.3 Billion by 2032 with a CAGR of 5.9% from 2024 to 2032.

Steel rebar, often known as reinforcing bar, is a type of rod used in the building of reinforced concrete. They are normally ribbed to prevent slippage within the concrete and provide a variety of advantages, including increasing the structural strength of concrete constructions. Steel is only utilized as rebar because it has a thermal expansion coefficient that is almost identical to that of concrete due to its prolonged exposure to high temperatures. Concrete has extremely high compression strength but low tensile and torsional strength. Steel contributes to this by providing great strength in such regions while also preventing the creation and spread of fractures, which may damage the entire project. Furthermore, steel is the optimum material for rebar use because to its identical thermal expansion qualities to concrete, which eliminates many temperature-related difficulties.

|

Parameter |

Steel Rebar Market |

|

Steel Rebar Market Size in 2023 |

US$ 247.2 Billion |

|

Steel Rebar Market Forecast By 2032 |

US$ 411.3 Billion |

|

Steel Rebar Market CAGR During 2024 – 2032 |

5.9% |

|

Steel Rebar Market Analysis Period |

2020 - 2032 |

|

Steel Rebar Market Base Year |

2023 |

|

Steel Rebar Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Application, and By Region |

|

Steel Rebar Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

ArcelorMittal, Jiangsu Shagang Group, JSW, NIPPON STEEL CORPORATION, NLMK, Nucor, POSCO HOLDINGS INC., SAIL, Steel Dynamics, Inc., and Tata Steel.. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Steel Rebar Market Dynamics

The rise of the construction sector in emerging countries is a major driver driving the global steel rebar market. The rise of the building sector in these regions, together with urbanization, infrastructure development, and population growth, will drive up demand for steel rebar. Developing nations such as China, India, and Brazil demonstrate enormous population and economic expansion, boosting the need for residential constructions, new structures, and infrastructure projects, all of which require huge quantities of steel rebar. The residential sector is expected to thrive in the future due to increased per capita income, expanding populations, and generally improved living circumstances. As a result, a number of nations throughout the world, including India, are proposing substantial housing and smart city plans to assist the growth of the residential sector. Rapid urbanization in emerging nations creates new opportunities for economic growth and development.

Government actions and investments drive this demand, with significant infrastructure projects underway across the world. These projects, which include large-scale infrastructure like roads, bridges, and dams, heavily rely on steel rebar to increase structural integrity and safety. As a result, the steel rebar business is quickly increasing, fueled by significant building and infrastructure projects. For example, the United States government estimates that 45,000 bridges and key highways need to be fixed across the nation. The Act requires 110 billion to be put up for infrastructure rehabilitation. Furthermore, the increasing emphasis on building earthquake-resistant and long-lasting structures encourages the usage of high-strength steel rebar, which contributes to market expansion.

Despite these growth factors, the steel rebar industry confronts various challenges. Raw material price fluctuations, particularly those involving iron ore and scrap metal, can have an influence on manufacturers' production costs and profit margins. Stringent environmental rules governing steel manufacturing processes present additional obstacles, as firms must invest in greener technology and meet emissions limits, which can raise operational costs. Furthermore, the industry is extremely competitive, with many companies fighting for market dominance, resulting in price wars and margin pressures.

The steel rebar market is expected to grow due to innovation and progress, creating possibilities for established and developing companies. Steel rebar's use in high-end applications drives industry innovation. Epoxy-coated, earthquake-resistant, and corrosion-resistant steel rebar is increasingly employed in construction applications. Steel rebar producers may capitalize on a huge market potential by developing value-added goods to meet strict government criteria and enhance product quality.

Global Steel Rebar Market Segment Analysis

Steel Rebar Market By Type

· Deformed

· Mild

According to the steel rebar industry analysis, the deformed type, which is distinguished by its ridges and surface flaws, will have the largest market share in 2023 due to its widespread use in a variety of end-use sectors. Deformed rebar offers improved mechanical anchoring in concrete constructions, increasing overall strength and stability. High building production in key countries, as well as government regulations to promote the use of high-strength rebar grades to extend the lifespan of construction projects, are also driving the deformed steel rebar market. This makes it the preferred choice for most construction projects, particularly in infrastructure and high-rise structures where stronger reinforcing is required. Thus, deformed rebar dominates the market, outperforming mild rebar, which is often employed in less demanding applications.

Steel Rebar Market By Application

· Residential Buildings

· Public Infrastructure

· Industrial

As per the steel rebar market forecast, the construction segment is projected to gather more than 50% share throughout 2024 to 2032. Numerous investments in the construction sector are expected to help the category flourish. For example, in 2022, Alliance Group announced a $1.12 billion investment in residential development projects in key Indian cities like Bengaluru, Hyderabad, and Chennai.

The public infrastructure industry is likely to grow significantly in the future years. This supremacy is attributed to increased government investment in infrastructure development, including roads, bridges, railroads, and public buildings. The increased emphasis on modernizing and expanding infrastructure to support urbanization and economic growth, particularly in emerging nations, is driving up demand for steel rebar. Projects to fortify transportation networks, water and sewage systems, and create resilient buildings to withstand natural disasters all contribute to a strong demand for deformed steel rebar, which is utilized to reinforce concrete structures in these large-scale projects. As a result, public infrastructure has been the largest application category in the steel rebar market throughout this period.

Steel Rebar Market Regional Analysis

The Asia-Pacific steel rebar market is expected to reach USD 148 billion in 2023, driven by rising economies and increased building activity in countries such as China and India. The construction industry's investment in infrastructure and housing is driving market share growth. The demand for steel rebar in this region has expanded as a result of several infrastructure projects in the public and private sectors.

North America is expected to increase at a CAGR of 6.4% between 2024 and 2032. The increase in funding for different infrastructure projects by the governments of the United States, Mexico, and Canada is likely to have an impact on growth. For example, in April 2022, the Mexican government announced the third infrastructure development fund, which would work with private investors to revitalize the country's economy. The fund focuses on the rehabilitation of the country's airports, rail lines, and ports.

Steel Rebar Market Leading Companies

The steel rebar market players profiled in the report is ArcelorMittal, Jiangsu Shagang Group, JSW, NIPPON STEEL CORPORATION, NLMK, Nucor, POSCO HOLDINGS INC., SAIL, Steel Dynamics, Inc., and Tata Steel.

Steel Rebar Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa