Healthcare Drone Market Growth Opportunities and Forecast till 2032

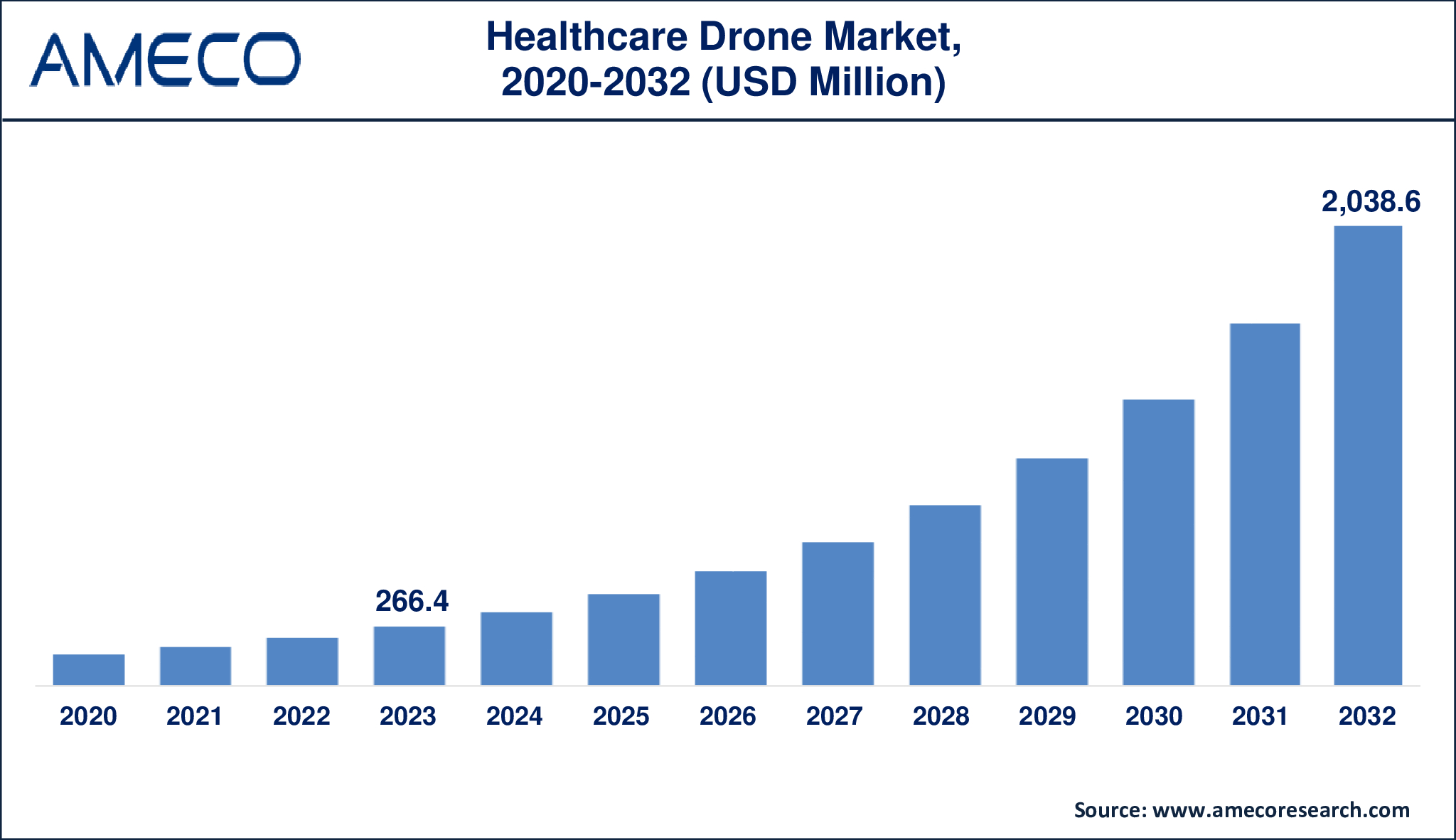

The Global Healthcare Drone Market Size was valued at USD 266.4 Million in 2023 and is anticipated to reach USD 2,038.6 Million by 2032 with a CAGR of 25.5% from 2024 to 2032.

Health care drone is a UAV that is used to deliver medical and health care services to the targeted population. These drones are applied to deliver medical products including, vaccines, blood, pharmaceuticals, diagnostic samples, and even defibrillators to areas that are remote or difficult to access. Using GPS, tracking, and reefer options, healthcare drones deliver vital medical supplies on time and in safe conditions. They are especially useful in cases of emergencies, disaster, and in the rural areas where the conventional means of transport may take time or are unavailable.

Besides the supply transportation, the application of healthcare drones is also extended to patient monitoring and telemedicine. With cameras and sensors, they can help in sharing data in real time between patients and health care givers. For instance, drones can ferry medical kits to accident scenes and at the same time stream live video to first responders. With each passing day, healthcare drones are becoming part and parcel of the healthcare delivery systems, enhancing the access, speed, and general functional ability of healthcare systems in emergency medical situations.

|

Parameter |

Healthcare Drone Market |

|

Healthcare Drone Market Size in 2023 |

US$ 266.4 Million |

|

Healthcare Drone Market Forecast By 2032 |

US$ 2,038.6 Million |

|

Healthcare Drone Market CAGR During 2024 – 2032 |

25.5% |

|

Healthcare Drone Market Analysis Period |

2020 - 2032 |

|

Healthcare Drone Market Base Year |

2023 |

|

Healthcare Drone Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Technology, By Package Size, By Application, and By Region |

|

Healthcare Drone Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Avy Technologies, Inc., EHang Holdings Ltd., Embenation, Matternet, Sierra Nevada Corporation, SZ DJI Technology Co., Ltd., Vayu Drones, Volocopter GmbH., Yuneec Holding Ltd, and Zipline international inc.. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Healthcare Drone Market Dynamics

Health care drones are quickly becoming one of the most innovative solutions in health care by increasing patient survival, results, and overall well-being. These delivery drones are also ambulance drones that can take automated external defibrillators (AEDs) to patients experiencing cardiac arrest. One of them is the ambulance drone created by Delft University that is intended to help to increase the speed of the response. This drone can deliver care during life-altering events including heart attacks, accidents, near-drowning, choking, among others. It is equipped with AEDs, medications, and CPR kits to address medical emergencies within critical time frames enhancing patient outcomes.

Furthermore, the use of drones in the health sector has helped in the delivery of crucial medical products to areas that are hard to reach or which have no access to such products at all, thus saving many lives. In the course of the current COVID-19 outbreak, they were used to ferry PPE kits, testing materials, and vaccines to hard-to-reach areas. In March 2021, Zipline, a US-based company, transported more than 11,000 doses of the Oxford-AstraZeneca vaccine in Ghana in a matter of days. Likewise, in India, through the ICMR’s i-Drone service, 900 doses of COVID-19 vaccines were transported to Manipur. The market for healthcare drones is expected to grow significantly in the future years as more benefits of healthcare drones for enhancing the delivery of healthcare services are realized.

However, there are many challenges despite the numerous applications and the appealing features of the healthcare drones due to lack of infrastructure and lack of pilots. The lack of a single system of air traffic management to guarantee safety of flights in controlled air space across all airborne systems and platforms presents a fundamental challenge. Also, risks and operational issues related to Beyond Visual Line of Sight (BVLOS) flights are still a problem. The expansion of remotely operated drones for medical deliveries is also restricted by the scarcity of pilots who can handle BVLOS, thus restricting market growth.

Global Healthcare Drone Market Segment Analysis

Healthcare Drone Market By Type

· Fixed Wing

· Rotary-Wing

· Hybrid

The rotary-wing segment was cited as the largest market for healthcare drones in 2023 by the global healthcare drone industry. This is because it can hover, take off and land vertically and move within tight spaces, which is essential in making medical deliveries in congested city centres and remote areas. Also, the ability of rotary-wing drones to transport medical supplies including blood, vaccines and medications in emergencies also played a major role in increasing its market share.

Healthcare Drone Market By Technology

· Fully Autonomous

· Semi-Autonomous

· Remotely Operated

Using the healthcare drone market size projection, it was found that the remotely operated segment had a large market share in the healthcare drone market. This dominance is due to the fact that, medical deliveries especially emergency deliveries, are often carried out by remotely operated drones. They are reliable and suitable for different terrains and conditions thus preferred in healthcare use especially in developing countries.

Healthcare Drone Market By Package Size

· Less than 2 kg

· 2-5 kg

· More than 5 kg

Based on the market forecast of the healthcare drone market, the 2-5 kg segment has received the highest market share in the healthcare drone market. The package size chosen is a compromise between the amount of payload and the ability to transport a large number of medical products such as vaccines, blood units, and emergency drugs. These factors played a major role in determining the dominance of the product in the market as it can be used in both urban and rural health care delivery system.

Healthcare Drone Market By Application

· Emergency Blood Logistics

· Medical Drug & Vaccine

· Emergency Organ Logistics

· Others

The market forecast of healthcare drone reveals that the medical drug & vaccine segment held the largest market share in the healthcare drone market. The increasing need for timely delivery of life-saving drugs and vaccines especially during emergencies such as the current COVID-19 pandemic contributed greatly to the growth of this segment. Drones have been very useful in delivering healthcare products in remote and hard-to-reach areas hence increasing their application in the medical drug and vaccines’ transport.

Healthcare Drone Market Regional Analysis

North America holds the largest revenue share in the healthcare drones market, driven by significant research funding for drone technology and its widespread adoption across hospitals, clinics, and ambulatory surgical centers (ASCs). The region benefits from supportive regulatory frameworks in the United States and Canada, which facilitate drone deployment in the healthcare sector. These factors collectively bolster the market's dominance in North America.

Europe ranks as the second-largest market for healthcare drones, supported by high investments in unmanned technology by OEMs, favorable regulations, and government initiatives aimed at enhancing healthcare systems. Within the region, Germany leads in market share, while the UK exhibits the fastest growth, reflecting its increasing adoption of healthcare drones.

Healthcare Drone Market Leading Companies

The healthcare drone market players profiled in the report is Avy Technologies, Inc., EHang Holdings Ltd., Embenation, Matternet, Sierra Nevada Corporation, SZ DJI Technology Co., Ltd., Vayu Drones, Volocopter GmbH., Yuneec Holding Ltd, and Zipline international inc.

Healthcare Drone Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa