Metal Implants and Medical Alloys Market Growth Opportunities and Forecast till 2032

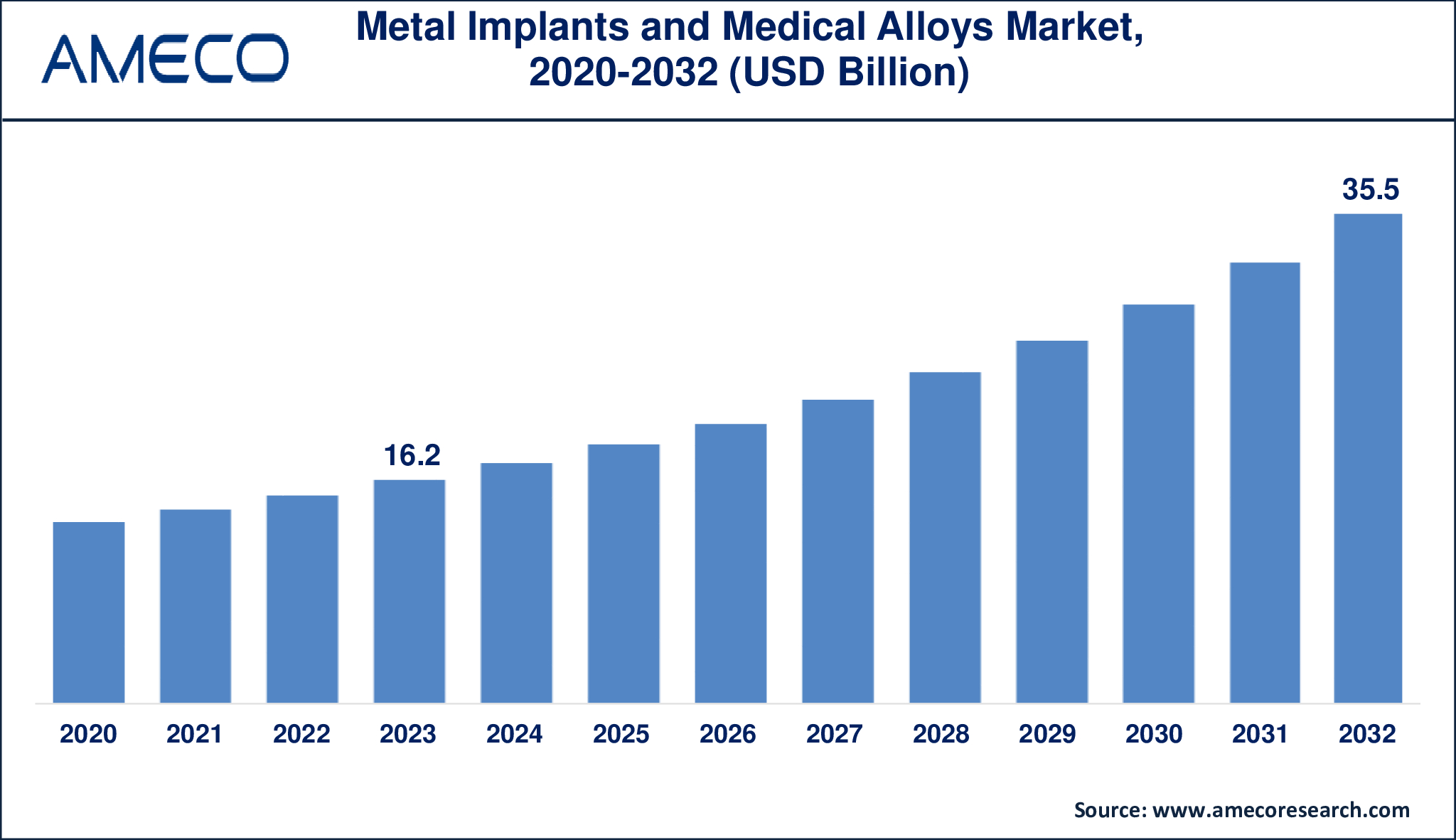

The Global Metal Implants and Medical Alloys Market Size was valued at USD 16.2 Billion in 2023 and is anticipated to reach USD 35.5 Billion by 2032 with a CAGR of 9.3% from 2024 to 2032.

Metal Implants and Medical Alloys are specific products utilized in the medical industry to fix or replace any diseased body part. These materials are appreciated for their outstanding mechanical characteristics, biocompatibility and resistance to corrosion and thus their applications in the orthopedic implant, dental implant and cardiovascular application. Some of the materials used include titanium, cobalt-chromium alloys, and stainless steel because they have high strength, can bear bodily forces and are biocompatible. Moreover, medical alloys are modified to improve certain characteristics of the application, for example, wear or bone attachment, making the implants durable and effective.

The market for metals for implants and medical alloys is growing due to the rise in the rate of chronic diseases, global population aging, and progress in the healthcare industry. As the field of minimal invasive surgery and individualized medicine has evolved, so have the requirements for new alloys like shape-memory alloys and bioresorbable metals. Such changes are intended to decrease adverse effects, enhance the quality of life of patients, and provide customized approaches to various health conditions. The market for such materials remains a promising one, as the increasing research and innovation in the field broadens their use in different branches of medicine.

|

Parameter |

Metal Implants and Medical Alloys Market |

|

Metal Implants and Medical Alloys Market Size in 2023 |

US$ 16.2 Billion |

|

Metal Implants and Medical Alloys Market Forecast By 2032 |

US$ 35.5 Billion |

|

Metal Implants and Medical Alloys Market CAGR During 2024 – 2032 |

9.3% |

|

Metal Implants and Medical Alloys Market Analysis Period |

2020 - 2032 |

|

Metal Implants and Medical Alloys Market Base Year |

2023 |

|

Metal Implants and Medical Alloys Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material Type, By Product Type, By Application, and By Region |

|

Metal Implants and Medical Alloys Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

B. Braun Melsungen AG, DePuy Synthes Companies, Dentsply Sirona Inc., Globus Medical, Inc., Johnson & Johnson, Medtronic plc, NuVasive, Inc., Olympus Corporation, Smith & Nephew plc, Stryker Corporation, Straumann Holding AG, and Zimmer Biomet Holdings, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Metal Implants and Medical Alloys Market Dynamics

The rise in number of geriatric population is one of the leading factors driving the metal implants and medical alloys market growth. Patients of the older population are even more at risk of developing degenerative joint diseases, making them more inclined to undergo joint replacement surgeries. As stated by the World Health Organization (WHO), the global population of the aging population will rise to one in six by 2030. This aging demographhic has greatly boosted the need for metals and medical alloy, mostly utilized to fix damaged or missing bones, joints, and tissues. As people age, they are more likely to develop diseases like osteoporosis, osteopenia, diabetes, xerostomia, stress related bruxism, advanced chronic periodontal disease and cognitive decline which in turn increases the need for surgical implants. Moreover, elderly patients also have a preference for implant therapy for the rehabilitation of edentulous spaces, further driving the demand for metal-based implants. Conditions such as osteoporosis, which cause bones to become fragile and prone to fracture, is common in women, especially those in the post menopausal period, hence the need for bone and joint repair. All these factors jointly point towards the increasing importance of medical alloys and implants in the growing population

The growth of the market has been propelled by the development of the healthcare facilities and the access to technical surgical procedures. The increase in the incidences of musculoskeletal disorders such as osteoarthritis, and fractures has created a high demand for metal implants and medical alloys. In addition, advancement in material used in the orthopedic implant like titanium alloys, cobalt-chromium alloys and steel have made the orthopedic implant to be more durable and effective hence leading to their use. Dental implants are also one of the significant product categories of the market. Rising consciousness about oral esthetics and the rising requirement for aesthetic dentistry has further bolstered the usage of these implants and has become an essential segment of the progressing market.

The factors that are acting as risks to dental implants are having a detrimental effect on the metal implants and medical alloys segment. The most common material used in the manufacture of dentures is titanium, and this material is known to cause hypersensitivity, thus causing symptoms of rejection of the implants. Also, problems like biofilm development and different types of corrosion: fretting, galvanic, and pitting corrosion are typical. Titanium may corrode and this will lead to mechanical instability of the implant and therefore not be very effective. Moreover, metallic debris produced during corrosion may cause hypersensitivity reactions among the patients. Implants also form a surface that promotes the formation of biofilm, which in turn raises the risk of infection. These challenges call for more development in materials and methods to overcome these drawbacks.

Global Metal Implants and Medical Alloys Market Segment Analysis

Metal Implants and Medical Alloys Market By Material Type

· Titanium and Titanium Alloys

· Stainless Steel

· Cobalt-Chromium Alloys

· Nickel-Titanium (Nitinol) Alloys

· Other Alloys

Market share of metal implants and medical alloys in 2023 was led by titanium and titanium alloys. For instance, they are more biocompatible, corrosion resistant and have light weight strength making them suitable for medical use such as in orthopedic and dental implants. Titanium’s compatibility with human tissue and high strength guarantees long service life of implants, which explains its popularity. Moreover, increased investment in the healthcare sector, the increase in the incidence of musculoskeletal diseases and dental diseases also contributed to the increase in demand for titanium based materials in medical applications.

Metal Implants and Medical Alloys Market By Product Type

· Orthopedic Implants

· Dental Implants

· Cardiovascular Implants

· Neurological Implants

· Others

According to the report, orthopedic implants were the largest segment of the metal implants and medical alloys market in 2023. This dominance is attributed to the growing incidence of diseases of musculoskeletal system including osteoarthritis and fractures and also growing geriatric population with orthopaedic ailments. Joint reconstruction devices and spinal fusion systems are key segments of orthopedic implants, which experience growth due to the use of materials such as titanium alloys that improve the devices’ strength and compatibility with the human body. Such factors, along with the increase in trauma surgery, strengthen the segment’s leadership in the market.

Metal Implants and Medical Alloys Market By Application

· Joint Replacement

· Trauma and Orthopedic Surgeries

· Dental Surgeries

· Cardiovascular

The metal implants and medical alloys market is anticipated to be dominated by the joint replacement segment during the course of the forecast period (2024-2032). This dominance is because of the rising incidence of degenerative joint diseases including osteoarthritis, especially in the elderly group, which leads to a high increase in joint replacement procedures including hip and knee reconstructions. These have been made possible by the improvement in surgical procedures and materials like the titanium and cobalt-chromium alloys that are used in manufacturing these products since they are durable and compatible with the human body. Also, increasing consciousness and availability of health care facilities in the developing world increase its need across the world.

Metal Implants and Medical Alloys Market Regional Analysis

Among all regions of the global metal implants and medical alloys market, North America is still the most influential region. This can be attributed to the fact that the country has a well-developed healthcare system, a high number of healthcare costs, and a large number of patients. The region has many prominent medical equipment makers and healthcare companies, which will also increase the need for metal implants and medical alloys. Further, a benign reimbursement environment and advanced medical technologies contribute to North America’s market dominance.

On the other hand, the Asia-Pacific region is growing most rapidly in the market. China, India and Japan are leading this growth due to the fast growth of healthcare sector, increase in per capita income and better health care facilities. A rise in medical tourism and the rise in the number of chronic diseases in the region are also other factors that have boosted the demand for better medical devices and implants.

Metal Implants and Medical Alloys Market Leading Companies

The Metal Implants and Medical Alloys market players profiled in the report is B. Braun Melsungen AG, DePuy Synthes Companies, Dentsply Sirona Inc., Globus Medical, Inc., Johnson & Johnson, Medtronic plc, NuVasive, Inc., Olympus Corporation, Smith & Nephew plc, Stryker Corporation, Straumann Holding AG, and Zimmer Biomet Holdings, Inc.

Metal Implants and Medical Alloys Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa