Sustainable Packaging Market Growth Opportunities and Forecast till 2032

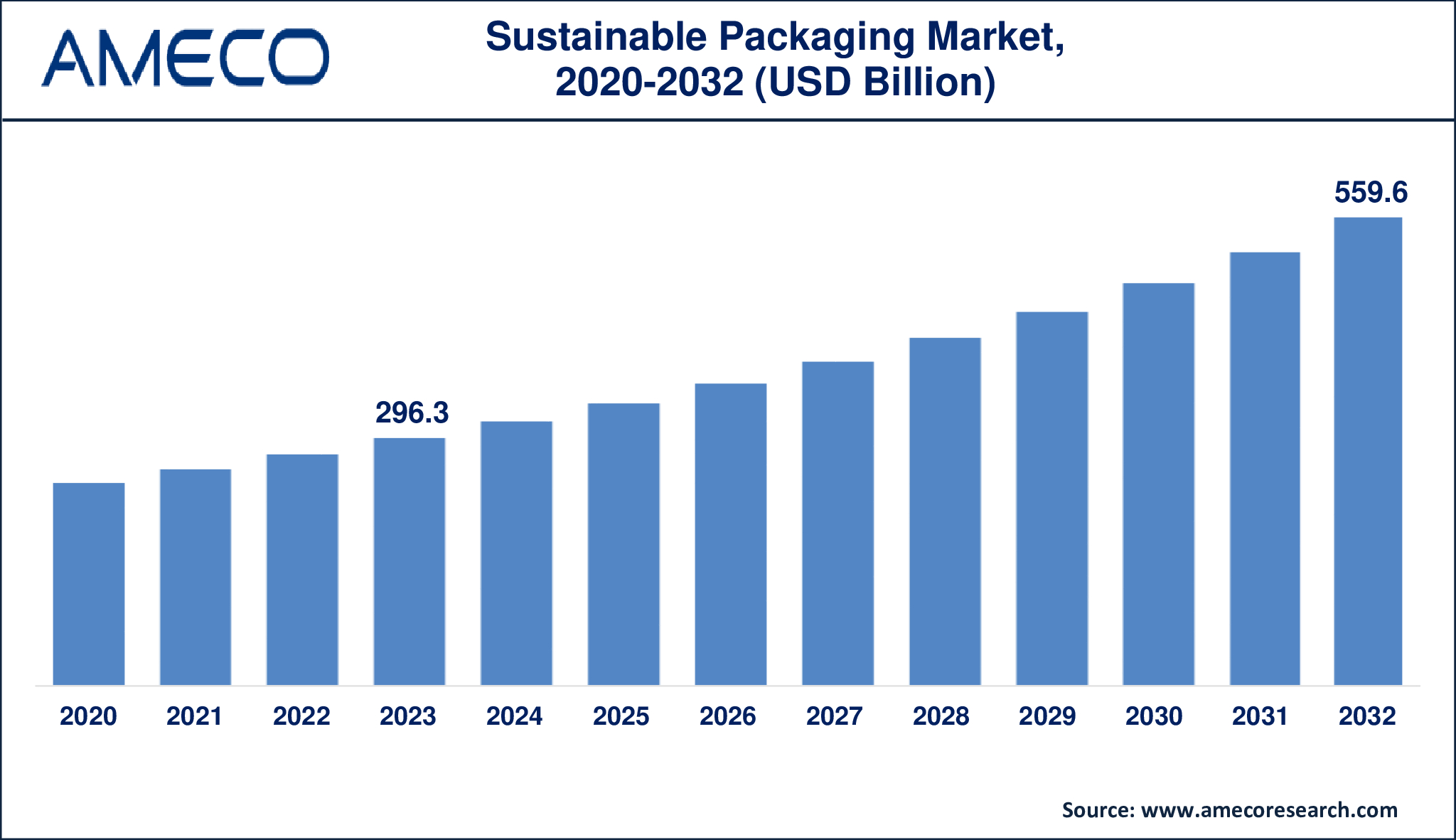

The Global Sustainable Packaging Market Size was valued at USD 296.3 Billion in 2023 and is anticipated to reach USD 559.6 Billion by 2032 with a CAGR of 7.4% from 2024 to 2032.

Sustainable packaging, also known as green or eco-friendly packaging refers to designing and using materials that are environmentally friendly. Sustainable packaging focuses on reducing waste, preserving natural resources, and ensuring that packaging has minimal impact on the planet. This approach emphasizes responsible choices, for instance using reusable or renewable materials, to create packaging that aligns with environmental values without compromising functionality.

The goals of sustainable packaging are to significantly reduce the amount of packaging used, encourage the adoption of eco-friendly materials, and lower production costs. It also aims to eliminate harmful substances from packaging production and make recycling easy and accessible. By implementing these solutions, consumers and businesses can take significant steps toward protecting the planet while meeting everyday packaging needs effectively.

|

Parameter |

Sustainable Packaging Market |

|

Sustainable Packaging Market Size in 2023 |

US$ 296.3 Billion |

|

Sustainable Packaging Market Forecast By 2032 |

US$ 559.6 Billion |

|

Sustainable Packaging Market CAGR During 2024 – 2032 |

7.4% |

|

Sustainable Packaging Market Analysis Period |

2020 - 2032 |

|

Sustainable Packaging Market Base Year |

2023 |

|

Sustainable Packaging Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Product, By Material, By Application, and By Region |

|

Sustainable Packaging Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Amcor plc, Sonoco Products Company, Sealed Air Corporation, Plastipak Holdings, Inc., Crown Holdings, Inc., Mondi plc, BASF SE, Ball Corporation, DS Smith plc, Smurfit Kappa Group PLC., SGF Packaging Co., Ltd., Elopak AS, Ardagh Group S.A., and Nampak Ltd |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Sustainable Packaging Market Dynamics

The rising use of plastic packaging that effects the environment is a primary factor that drives the sustainable packaging market growth. As per the Down to Earth data, the world produced about 360 million tonnes of plastic waste, with 70% of it left uncollected in 2023. This waste often ends up polluting the environment, being dumped in landfills, or openly burned. The data also states that over 50% of this plastic waste comes from packaging, while 30% comes from industry, construction, and agriculture. Similarly, strict environmental regulations against the use of plastic are also supporting the sustainable packaging market growth. Government organizations across the world are passing laws targeting plastic waste, focusing on banning single-use plastics, stringent recycling mandates, and pollution-curbing agreements. Plastic Waste Management Amendment Rules (2021), Business Coalition for a Global Plastics Treaty, World Wildlife Fund (WWF), Global Plastic Laws, the Ministry of Environment, Forests, and Climate Change (MoEFCC) and the Central Pollution Control Board (CPCB) are some of the leading organizations that have created strict regulations for the ban of plastics around the world. These regulations are transforming the plastic industry’s operations and driving it towards innovative and sustainable practices.

However, significant cost of sustainable packaging and limited availability of this material is currently hampering the green packaging market growth. Producing eco-friendly packaging currently costs more because the industry and its manufacturing methods are still evolving. For instance, making plastic bags costs about one cent but creating paper bags costs about four cents. Another common challenge that firms struggle is lack of sustainable packaging materials available. The time needed to make sustainable packaging means that materials might be in short supply. This forces companies to work faster, and when they run out of sustainable materials, they may have to wait longer to deliver products as planned.

On the other hand, governments all across the world are rewarding businesses with incentives on using renewable sources, opening numerous growth opportunities for the eco-friendly packaging market. For instance, the United States Environmental Protection Agency (EPA) grants tax incentives and subsidies if the company follows its eco-friendly packaging standard. In addition to the US, other countries that also give subsidies for green practices are Canada, the UK, and Japan. As a result, the world is experiencing a rapid shift from traditional packaging solutions to sustainable alternatives.

Global Sustainable Packaging Market Segment Analysis

Sustainable Packaging Market By Type

· Tubes

· Bags & Pouches

· Corrugated Box

Among the three, corrugated box is currently leading the market with maximum share. Corrugated boxes serve many industries as it offers better sustainability and provide excellent protection. Corrugated boxes serve two big markets that are food & beverage and personal care and cosmetics. Food and beverage companies use them to hold and ship food, while personal care and cosmetics firms depend on them for biodegradable packaging. The world's growing personal care and cosmetics industry is increasing corrugated box market growth over the next few years. According to METI data, Japan became the world's third-biggest market for personal care and cosmetics, with a worth of US$ 35 billion in 2019.

Sustainable Packaging Market By Product

· Recycled

· Degradable

· Re-Usable

Based on our sustainable packaging industry analysis, the recycled products have generated largest share of the market in 2023. Countries all over the world are focusing on recycling plastic or other waste thus contributing towards sustainable packaging. A recent report The Plastic Life Cycle says that India recycles 12.3% of its plastic waste and burn 20% of it. India's Ministry of Environment, Forests and Climate Change created a central database showing that the country has 14.2 million tonnes of yearly plastic waste treatment capacity. As a result, the country can handle 71% of its plastic production through two ways i.e. by recycling and incineration.

Sustainable Packaging Market By Material

· Paper & Paperboard

· Metal

· Plastic

· Glass

Paper and paperboard packaging offer an efficient and cost-effective solution for transporting, storing different products. The demand for paper-based packaging is steadily growing due to its sturdiness, lightweight design, and is customizable to meet product or customer-specific needs. Manufactured from renewable sources, paper & paperboard packaging helps make the world cleaner, healthier, and safer while offering numerous other benefits. Packaging made from paper is used widely by manufacturers as it provides users with convenient storage, functional and visually appealing solutions that are easy to handle. In addition, they are produced in different forms and shapes using recycled materials that are exceptionally environmentally friendly choice compared to other materials.

Sustainable Packaging Market By Application

· Healthcare

· Food & Beverages

· Personal care

· Others

As per our sustainable packaging market forecast, the food & beverage packaging application is expected to lead the market throughout 2024 to 2032. Food & beverage packaging companies are now shifting from using traditional plastic and turning to greener solutions. Companies are introducing innovation in packaging that come from biodegradable plant-based plastics, are edible, and use recycled materials. For instance, Notpla, a UK startup, makes packaging from seaweed and other natural sources that can decompose in a few weeks. This change is largely driven by consumers. As people learn more about environmental problems, they are choosing products that come with eco-friendly packaging. The University of Oxford study found that 60% of UK people choose to buy items that have either little or reusable packaging, proving that more customers want sustainable packaging solutions.

Sustainable Packaging Market Regional Analysis

On the basis of regional analysis, the APAC region contributed the most in terms of revenue in 2023. Asia-Pacific leads the market, and its dominance will keep growing because more people are using pharmaceutical and medical products. Countries like Japan, South Korea, and Thailand have made strict laws to reduce plastic waste and push people to choose eco-friendly packing options. The Asia-Pacific sustainable packaging market is also expected to grow the fastest between 2024 and 2032. Factors such as rising disposable incomes, a growing urban population, more spending on e-commerce, changing consumer preferences, and government regulations promoting eco-friendly packaging are all contributing to this growth.

North America is also seeing significant growth in sustainable packaging, driven by more eco-conscious consumers and companies focused on sustainability. More people buying green products makes manufacturers look for better eco-friendly ways to package their goods. The US and Canada have done well to support better packaging that protects the environment. The demand for sustainable packaging in North America will continue to grow, thanks to multiple efforts and changing customer tastes.

Sustainable Packaging Market Leading Companies

The sustainable packaging market players profiled in the report is Amcor plc, Sonoco Products Company, Sealed Air Corporation, Plastipak Holdings, Inc., Crown Holdings, Inc., Mondi plc, BASF SE, Ball Corporation, DS Smith plc, Smurfit Kappa Group PLC., SGF Packaging Co., Ltd., Elopak AS, Ardagh Group S.A., and Nampak Ltd.

Sustainable Packaging Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa