Ambulatory EHR Market Growth Opportunities and Forecast till 2032

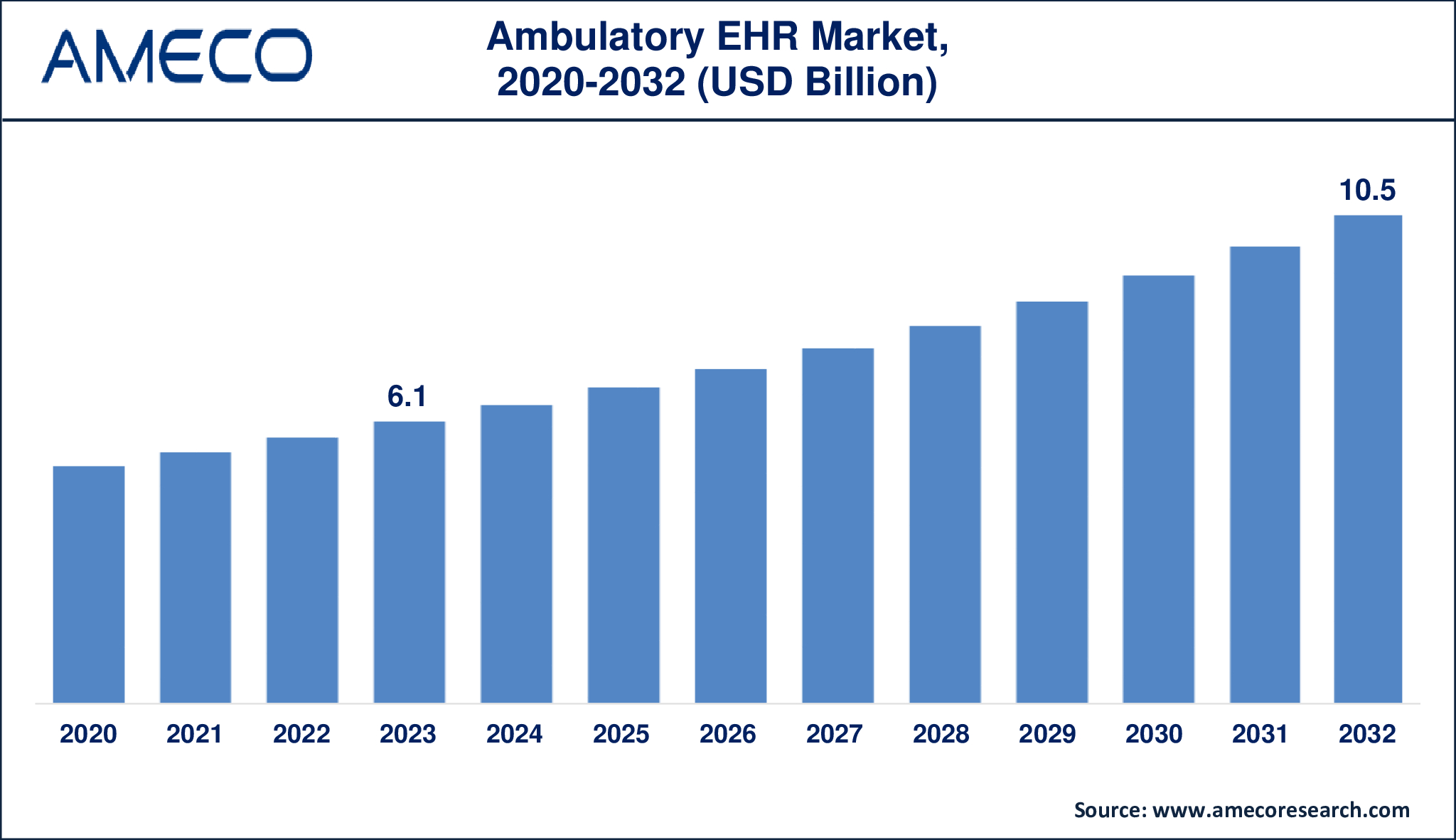

The Global Ambulatory EHR Market Size was valued at USD 6.1 Billion in 2023 and is anticipated to reach USD 10.5 Billion by 2032 with a CAGR of 6.3% from 2024 to 2032.

Ambulatory electronic health records (EHRs) serve as digital patient records, enabling physicians to document treatment activities. These systems operate with a model of continuous patient care that includes chronic disease management and other critical healthcare-related data. Most patient data within these systems originates from physician office visits and surgical center appointments, although some hospital data is also included. Ambulatory EHRs help providers make diagnoses, write prescriptions, make specialty referrals, and record patient interactions. These systems operate outside hospital facilities by providing patient care at outpatient clinics, specialty practices, and primary care practices. The implementation of easy-to-use patient portals allows patients to access their data, request refills, and pay bills through online services.

|

Parameter |

Ambulatory EHR Market |

|

Ambulatory EHR Market Size in 2023 |

US$ 6.1 Billion |

|

Ambulatory EHR Market Forecast By 2032 |

US$ 10.5 Billion |

|

Ambulatory EHR Market CAGR During 2024 – 2032 |

6.3% |

|

Ambulatory EHR Market Analysis Period |

2020 - 2032 |

|

Ambulatory EHR Market Base Year |

2023 |

|

Ambulatory EHR Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Deployment Mode, By Type, By Practice Size, By Application, By End User, and By Region |

|

Ambulatory EHR Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

NextGen Healthcare Information Systems, Modernizing Medicine, Inc., Cerner Corporation, Kareo, McKesson Corporation, CureMD Healthcare, DrChrono, Epic Systems Corporation, Athenahealth, AdvancedMD, Inc., eClinicalWorks, GE Healthcare, Practice Fusion Inc., Greenway Health, LLC, and Allscripts Healthcare Solutions, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Ambulatory EHR Market Dynamics

The healthcare sector shows growing acceptance of ambulatory electronic health record (EHR) systems as part of its digital transformation initiative. These systems have become critical components in healthcare because more than 90% of hospitals now use EHRs to improve care quality and streamline workflows and boost clinical decision support. Risk assessments improve significantly through ambulatory EHRs while maintaining regulatory program compliance according to Centers for Medicare and Medicaid Services (CMS) standards. Ambulatory service optimization through efficient electronic health record integration stands as an essential priority since 92% of patients don’t require hospitalization.

The ambulatory EHR market grows because healthcare organizations transition from fee-for-service models to value-based care and advance digital healthcare operations and seeks enhanced outpatient treatment methods. Healthcare facilities and patients experience reduced costs through improved provider communication that enables better care coordination enabled by these systems. Healthcare institutions implementing EHRs will find ambulatory solutions to be essential tools that enhance both clinical results and operational performance.

Healthcare providers encounter major difficulties when implementing ambulatory EHR solutions because of their inadequate technological resources as well as insufficient data infrastructure. Healthcare organizations need to invest heavily in their EHR system infrastructure setup and ongoing maintenance to reach successful adoption. The essential healthcare technologies face funding challenges because healthcare providers must overcome financial constraints to acquire them. The implementation of new EHR systems becomes complex because providers must bear the expenses of training staff and integrating patient data as well as implementing regulatory changes. Keeping an efficient reliable EHR infrastructure in place through continuous updates and potential system downtime demands a substantial long-term financial commitment which creates a difficult implementation path for smaller or underfunded practices.

Furthermore, rapid advancement in telemedicine is expected to create significant growth opportunities for the ambulatory electronic health records market throughout the forecast period between 2024 and 2032. The healthcare industry has experienced quick telemedicine advancement which the COVID-19 pandemic accelerated. The system enables real-time patient-provider interactions and operates efficiently to store private health information (PHI) securely. Telehealth features embedded within electronic health record systems enhance patient care by enabling virtual healthcare visits and secure communication while also improving data management and supporting medical education and prescription handling as well as regulatory adherence and practitioner educational programs.

In addition, the ambulatory EHR market will undergo a major transformation through the integration of artificial intelligence (AI) and machine learning systems into electronic health records (EHRs). Through AI technology EHR solutions gain enhanced flexibility along with increased intelligence to support applications which include data mining and natural language processing while delivering data analytics and visualization capabilities and predictive analytics and regulatory compliance. AI systems now help clinicians make decisions through their analysis of electronic health record data. As a result, the industry will undergo significant transformation with the rapid expansion of technology in the EHR sector.

Global Ambulatory EHR Market Segment Analysis

Ambulatory Electronic Health Record (EHR) Market By Deployment Mode

· Cloud/Web-Based

· On-Premise

In terms of deployment model, the cloud/web-based model accounted for more than 75% of the share in the market. This dominant share of the cloud/web-based ambulatory EHR market is ascribed to the fact that they are increasingly adopted because they facilitate the exchange and integration of data from multiple locations or systems in real time. In addition, several factors contribute to this growth, such as the rising demand for cloud-based deployment due to its extensive benefits, real-time monitoring capabilities, flexibility, data security features, and lower implementation cost compared to on-premise deployment.

Ambulatory Electronic Health Record (EHR) Market By Type

· All-in-One

· Modular

Based on our ambulatory EHR industry analysis, the all-in-one segment remains the dominant segment because of its comprehensive and user-friendly capabilities. These solutions unite patient management together with billing and scheduling functions and clinical documentation capabilities into one unified platform. Healthcare providers benefit from their software-hardware integration through streamlined operations and reduced administrative work and optimized workflows. Ambulatory care facilities choose this EHR solution because the centralized system provides efficient data management and professional coordination while maintaining accessible features that lead to both cost-effective and scalable solutions.

Ambulatory Electronic Health Record (EHR) Market By Practice Size

· Large Practices

· Small-to-Medium-Sized Practices

· Solo Practices

The global ambulatory EHR market grabbed 48% market share from large practices in 2023. Large facilities can utilize their financial strength to acquire premium EHR systems because their budgetary limitations are minimal. The implementation of EHR requires specialized staffs who handle productivity challenges successfully leading to better workflow continuity for large practices. Their freedom to select vendors from multiple sources enables large ambulatory practices to find solutions which precisely match their needs. Large medical practices invest in EHR systems because they need them for both regulatory compliance and data-driven healthcare decisions which improve patient care and practice performance.

Ambulatory Electronic Health Record (EHR) Market By Application

· Practice Management

· Patient Portals

· Computerized Physician Order Entry (CPOE)

· Clinical Decision Support (CDS)

· Population Health Management

· Referral Management

· Other Applications

As per the ambulatory health record industry analysis, the practice management segment occupied the largest market revenue accounting for USD 1.5 billion in 2023. Practice management consists of vital operational tasks including appointment scheduling, patient record management, billing, document handling and claim processing which ambulatory practices need to function daily. Ambulatory surgical centers drive the substantial market share of this segment because they use practice management extensively. These EHR systems demonstrate high value through their advanced features which enable efficient patient scheduling together with simplified billing and claims management capabilities. Healthcare providers are implementing practice management solutions because these systems enhance workflow efficiency while decreasing administrative workloads to produce better patient care.

Ambulatory Electronic Health Record (EHR) Market By End User

· Hospital-owned Ambulatory Centres

· Independent Ambulatory Centres

As per our ambulatory EHR market forecast, the hospital-owned ambulatory centers will generate the maximum revenue and is projected to achieve USD 5.8 billion by 2032. These outpatient service facilities situated in hospital networks offer quick patient access to care while enabling healthcare facilities to deliver care outside standard inpatient services. Patient convenience and resource optimization combined with operational efficiency enhancement are the key benefits of these centers. Through their integrated care models hospital-owned centers enable continuous healthcare delivery which leads to improved patient results. Their ability to enhance revenue diversity together with operational cost reductions makes healthcare facilities more resilient in the industry.

Ambulatory EHR Market Regional Analysis

North America leads the global ambulatory EHR market with a projected market share of 34% for 2023. Healthcare infrastructure throughout North America demonstrates advanced development while medical practices together with hospitals across both the U.S. and Canada widely implement electronic health record systems. The progressive technological orientation of healthcare providers drives the smooth integration of electronic health records into regular operational practices. The Centers for Medicare and Medicaid Services (CMS) issued regulatory requirements that drove healthcare institutions to transition from paper records to digital systems which created a major business opportunity for EHR vendors in the region.

The Asia-Pacific ambulatory EHR market will likely gain significant traction throughout 2024 to 2032 due to quick digital transformation efforts that many healthcare systems in China, India and Japan are implementing. For instance, China leads the world in EHR implementation because its government maintains robust policies combined with strategic planning at the highest levels. Through substantial financial investment of US $4 billion the Chinese government has established 31 national policies and 134 technical standards that support total medical system digitization. Public healthcare facilities in China are driving digital healthcare ecosystem transformation through EHR acceptance as a performance measurement standard.

Ambulatory EHR Market Leading Companies

The ambulatory EHR market players profiled in the report is NextGen Healthcare Information Systems, Modernizing Medicine, Inc., Cerner Corporation, Kareo, McKesson Corporation, CureMD Healthcare, DrChrono, Epic Systems Corporation, Athenahealth, AdvancedMD, Inc., eClinicalWorks, GE Healthcare, Practice Fusion Inc., Greenway Health, LLC, and Allscripts Healthcare Solutions, Inc.

Ambulatory EHR Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa