Automotive VVT System Market Growth Opportunities and Forecast till 2033

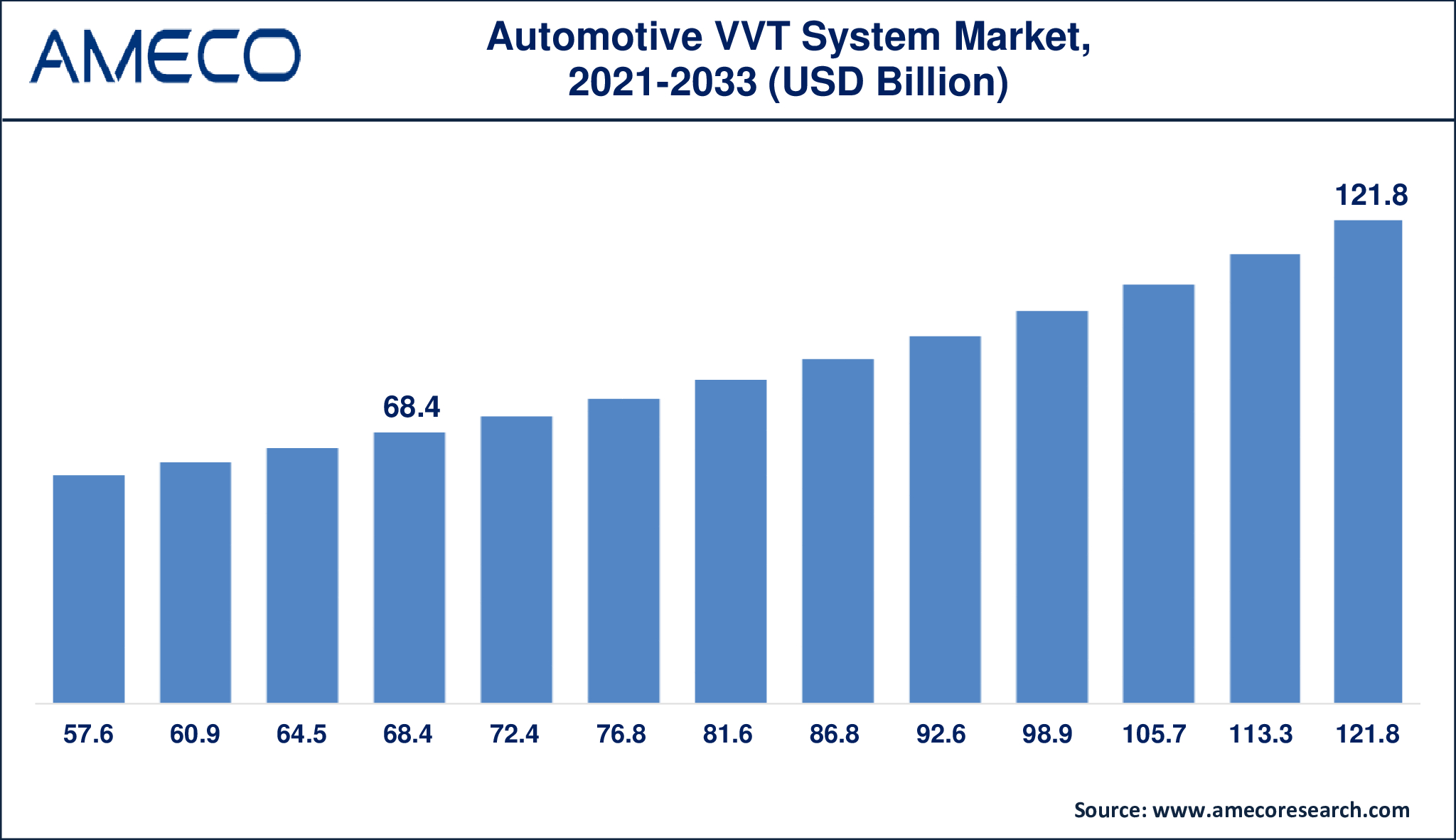

The Global Automotive VVT System Market Size was valued at USD 68.4 Billion in 2024 and is anticipated to reach USD 121.8 Billion by 2033 with a CAGR of 6.7% from 2025 to 2033.

The automotive variable valve timing (VVT) system represents an advanced engine technology that improves performance alongside fuel efficiency and emission control. Engine performance and airflow efficiency improves because VVT controls valve operation timing according to speed and load conditions. Engine power increases dynamically when needed through this system which also supports lower fuel consumption during normal driving operations. Modern internal combustion engines use VVT systems together with valve lift mechanisms to deliver efficient operation across different RPM ranges which results in improved driving performance with reduced emissions and better responsiveness.

Automotive VVT systems have experienced substantial advancements since their introduction as major automakers added them to different engine designs. The automotive brands Honda BMW and Porsche have developed VVT technology to operate efficiently with direct injection and turbocharged powertrains and Chrysler launched dual VVT technology through its 'World Engine' products. Modern automobile production utilizes different valve control methods which helps vehicles reach their best fuel efficiency and emission levels. The variable valve timing system functions as a key component to minimize engine noise while reducing vibrations which leads to enhanced driving smoothness especially during high-speed driving or heavy load conditions.

|

Parameter |

Automotive VVT System Market |

|

Automotive VVT System Market Size in 2024 |

US$ 68.4 Billion |

|

Automotive VVT System Market Forecast By 2033 |

US$ 121.8 Billion |

|

Automotive VVT System Market CAGR During 2025 – 2033 |

6.7% |

|

Automotive VVT System Market Analysis Period |

2021 - 2033 |

|

Automotive VVT System Market Base Year |

2024 |

|

Automotive VVT System Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product Type, By Fuel Type, By Method, By Application, And By Region |

|

Automotive VVT System Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Federal-Mogul LLC, Camcraft, Inc., Aisin Seiki Co. Ltd., BorgWarner Inc., Eaton Corporation, Mitsubishi Electric Corporation, DENSO Corporation, Robert Bosch GmbH, Schaeffler AG, Toyota Motor Corporation, Honda Motor Co., Ltd., and Johnson Controls, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Automotive VVT System Market Dynamics

The automotive VVT system market shows consistent growth because customers seek fuel-efficient vehicles and worldwide governments enforce emission regulations. Automakers face new environmental regulations from governments which compel them to use advanced automotive VVT systems for better fuel efficiency and lower greenhouse gas emission rates. The increasing market demand for hybrid and electric vehicles encourages manufacturers to use advanced valve timing systems that boost engine performance efficiency. Market expansion for VVT systems will continue through ongoing innovations in engine engineering alongside increasing sustainability requirements.

The automotive industry has adopted VVT technology alongside other advanced engine systems to fulfill consumer and government demands for sustainable transportation. Automobile performance and efficient combustion result from the VVT system which controls valve operations at optimal times. Kelley Blue Book documented in January 2024 that electric vehicle sales in the United States reached 1.2 million units in 2023 while gaining 7.6% of market share which increased from 5.9% in 2022. Modern vehicle design incorporates automotive VVT systems as essential components because the trend toward fuel efficiency continues to increase their adoption rates.

Vehicle production costs increase due to the integration of variable valve timing (VVT) systems because manufacturers need advanced engineering and additional components and sensors. Consumers view these extra costs negatively because they add to the already high price sensitivity of their market. ICCT conducted analysis to determine the expense of pollution control systems including VVT technology within automotive production. The studies demonstrated that production expenses for vehicles rise by approximately 10 to 15 percent according to the complexity of the installed system.

The automotive variable valve timing (VVT) system market receives significant enhancement through recent technological advancements that include cam-phasing which improves fuel efficiency and engine performance. The cam-phasing system enables automatic camshaft position regulation which optimizes valve timing according to engine speed and load conditions. The system achieves improved combustion efficiency and cuts down emissions while delivering greater power output. The market demand for advanced VVT systems has increased because hybrid vehicles need them to optimize fuel efficiency when internal combustion engines operate with electric drivetrains. The International Energy Agency (IEA) reported that hybrid vehicle sales worldwide exceeded 6.6 million units in 2023 as compared to previous years. The increasing popularity of hybrid vehicles creates an essential business opportunity for VVT system companies to build next-level cam-phasing systems that match updated environmental standards.

The automotive VVT system market continues to grow due to increasing acceptance of start-stop technology in the vehicle industry. The engine power of start-stop systems automatically pauses during idle times at traffic signals to minimize both fuel consumption and emission levels. The operation of this system heavily depends on VVT to deliver effective fuel delivery while achieving smooth engine restarts. Automakers continue to implement start-stop systems among conventional and hybrid vehicles because of worldwide tightening emission regulations. The European automotive market adopted start-stop technology for 85% of new vehicle sales during 2023 but both U.S. and Asia-Pacific regions are quickly following suit. The market shows a rising need for advanced VVT solutions which boost engine efficiency so it will continue expanding during upcoming years.

Global Automotive VVT System Market Segment Analysis

Automotive Variable Valve Timing (VVT) System Market By Product Type

· Continuous VVT

· Non-Continuous VVT

According to our industry analysis, the automotive VVT system market in 2024 was controlled by continuous variable valve timing (VVT) systems because they provide optimal performance alongside superior fuel economy and emission control capabilities. The precise adjustments possible with Continuous VVT override Non-Continuous VVT's fixed operation intervals to provide enhanced power output together with reduced fuel consumption during engine operation. The automotive industry selects VVT systems because of their ability to adapt to various applications especially in modern internal combustion engines and hybrid vehicles. Continuous VVT's dominance in the market expanded due to increasing market requirements for efficient fuel consumption as well as progressively stringent government emission regulations.

Automotive Variable Valve Timing (VVT) System Market By Fuel Type

· Diesel

· Gasoline

Gasoline serves as petrol while deriving from refined crude oil to power spark-ignition internal combustion engines that operate in passenger vehicles. The engines use spark plugs to ignite precise vaporized fuel-air mixtures which enable efficient combustion performance. Because gasoline burns rapidly it provides engines with both steady performance and smooth acceleration capabilities. Variable Valve Timing (VVT) operates as an essential system in gasoline engines since it controls valve timing to achieve maximum combustion efficiency under different engine loads for enhanced fuel economy and engine power. Modern vehicles utilize advanced fuel-saving technologies which enable an automatic engine shutdown feature to minimize both fuel usage and emissions.

Automotive Variable Valve Timing (VVT) System Market By Method

· Cam Phasing

· Variable Valve

· Cam Changing

· Cam Phasing & Changing

The automotive variable valve timing (VVT) system market's leading segment is cam phasing because it provides enhanced performance at a competitive cost while maintaining simple design. The camshaft timing adjusts through this method according to engine speed and load conditions to optimize valve operations which enhances fuel efficiency and diminishes emissions output. The solution has gained widespread acceptance in numerous vehicle types because it works effectively with gasoline and diesel engines. Automakers select cam phasing technology because it demonstrates reliable performance and requires less complexity than the alternative of cam changing systems. As the demand for fuel-efficient and eco-friendly vehicles continues to rise, cam phasing is expected to maintain its dominance in the market.

Automotive Variable Valve Timing (VVT) System Market By Application

· Passenger Vehicle

· Light Commercial Vehicle

· Heavy Commercial Vehicle

The market segment for passenger vehicles contains major proportions from sedan, hatchback, SUV, and coupe categories. These vehicles balance comfort alongside style together with fuel efficiency which makes them suitable for commuting and leisure travel and family use. Passenger cars achieve improved engine performance while reducing their fuel consumption through the fundamental role of Variable Valve Timing (VVT) technology integration. The power output and efficiency benefit from VVT when valve timing adjusts according to present driving conditions. Prospects for segment growth will increase because consumers want efficient fuel usage in their vehicles and many people buy new cars.

Automotive VVT System Market Regional Analysis

The Asia-Pacific automotive VVT system market will experience the fastest expansion while becoming the largest market because developing economies continue to increase their passenger vehicle sales. The market will grow in the region because rising consumer purchasing power and an increasing demand for efficient vehicles with enhanced features will boost VVT system adoption.

The North American market is expected to maintain a substantial revenue control in 2024. Strong market expansion occurs in the North American automotive VVT system market because customers need fuel-efficient vehicles and face strict emission standards. Engine advancements together with growing sustainability awareness of consumers drive market growth through both factors. The leading automotive companies in North America continue to invest in VVT system research and development as they strengthen their position in the automotive sector.

Automotive VVT System Market Leading Companies

The Automotive VVT System market players profiled in the report is Aisin Seiki Co. Ltd., BorgWarner Inc., Camcraft, Federal-Mogul LLC, Inc., DENSO Corporation, Eaton Corporation, Honda Motor Co., Ltd., Johnson Controls, Inc., Mitsubishi Electric Corporation, Robert Bosch GmbH, Schaeffler AG, and Toyota Motor Corporation.

Automotive VVT System Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa