Narrow-Body Aircraft Market Growth Opportunities and Forecast till 2033

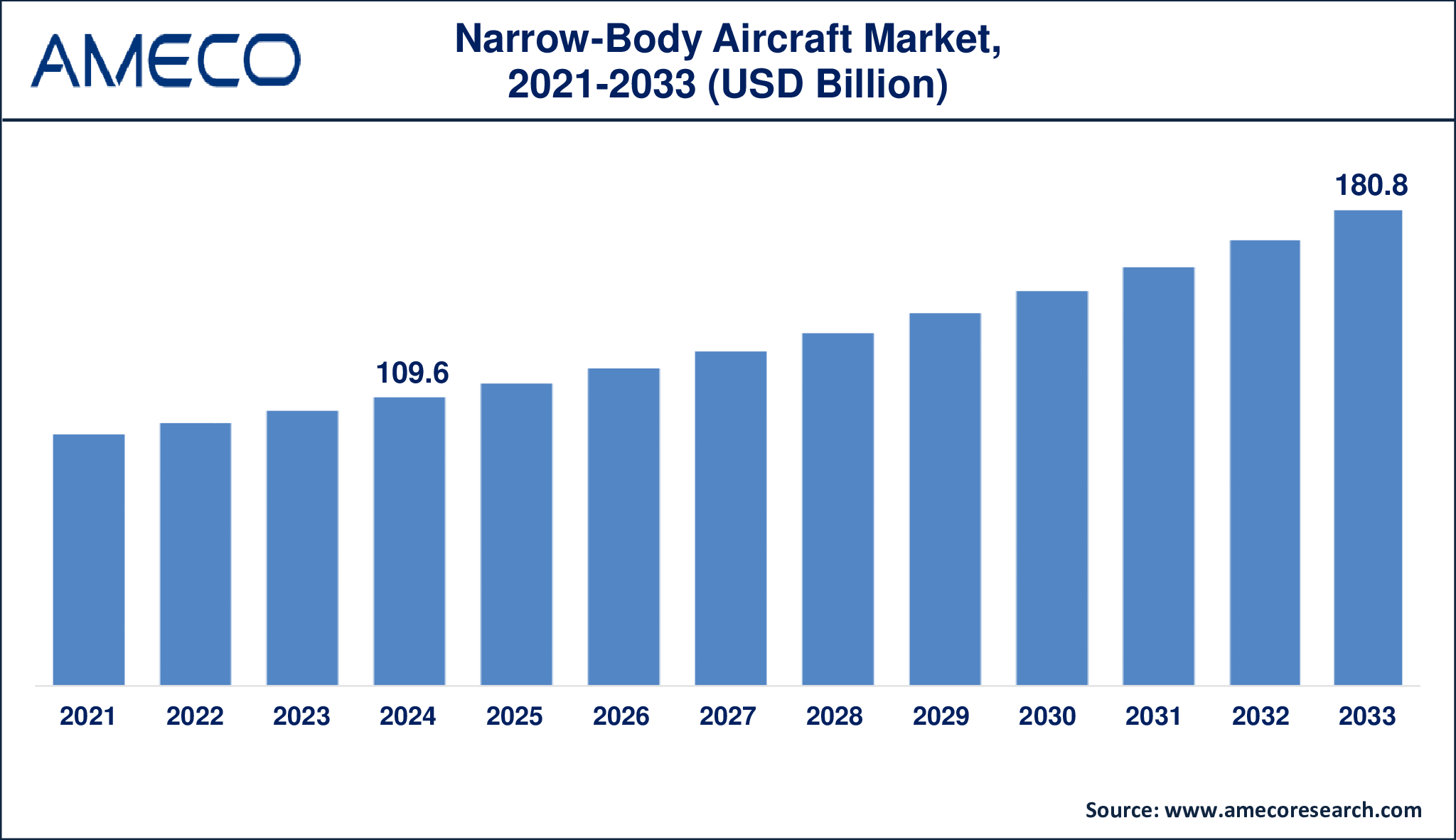

The Global Narrow-Body Aircraft Market Size was valued at USD 109.6 Billion in 2024 and is anticipated to reach USD 180.8 Billion by 2033 with a CAGR of 5.8% from 2025 to 2033.

Commercial airlines, regional carriers, and the military frequently use narrow-body aircraft, also known as single-aisle aircraft, for short- to medium-haul flights. The narrow-body aircraft market is an important segment of the global aviation industry, driven by increased air travel demand, technological advancements, and the need for fuel-efficient solutions. As air passenger traffic increases, particularly in developing countries, airlines are expanding their fleets with newer, more efficient narrow-body aircraft to reduce operational costs and increase profitability. Furthermore, the rise of low-cost carriers (LCCs) has boosted demand for these aircraft, which provide a cheap and flexible option for airlines looking to enhance seating capacity while maintaining fuel efficiency.

|

Parameter |

Narrow-Body Aircraft Market |

|

Narrow-Body Aircraft Market Size in 2024 |

US$ 109.6 Billion |

|

Narrow-Body Aircraft Market Forecast By 2033 |

US$ 180.8 Billion |

|

Narrow-Body Aircraft Market CAGR During 2025 – 2033 |

5.8% |

|

Narrow-Body Aircraft Market Analysis Period |

2021 - 2033 |

|

Narrow-Body Aircraft Market Base Year |

2024 |

|

Narrow-Body Aircraft Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Range, By Engine Type, By Application, By End-User, and By Region |

|

Narrow-Body Aircraft Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

COMAC, Airbus, Yakovlev, Boeing, Tupolev, Irkut Corporation, Embraer, De Havilland Aircraft of Canada Limited, Sukhoi, and Bombardier. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Narrow-Body Aircraft Market Dynamics

The narrow-body aircraft industry is expanding rapidly due to a variety of drivers. One of the key causes is the increasing demand for low-cost air travel. As global passenger traffic grows, airlines are focusing more on cost optimization while retaining profitability. Narrow-body aircraft are preferred because they have lower operating costs than wide-body equivalents, making them appropriate for domestic and regional trips.

Another important factor is the advancement of fuel-efficient technologies. Aircraft manufacturers like Boeing and Airbus are investing in innovative materials and aerodynamics to create next-generation narrow-body aircraft with lower fuel consumption and carbon emissions. The use of composite materials, more efficient wing designs, and next-generation engines such as turbofan engines have considerably increased the fuel efficiency of narrow-body aircraft, making them appealing to carriers trying to save operational costs.

Significant challenge is the high initial investment required for airlines to purchase new aircraft. While narrow-body aircraft provide long-term cost advantages through improved fuel efficiency and cheaper maintenance costs, the initial cost of purchasing new planes can be prohibitively expensive for smaller airlines and fledgling companies. Furthermore, interest rate changes and financial insecurity in particular countries may limit airlines' capacity to access capital for fleet development.

The rising demand for air travel in emerging nations creates a huge potential opportunity for the narrow-body aircraft market. Countries in Asia-Pacific, the Middle East, and Africa are undergoing fast economic development and urbanization, resulting in higher disposable incomes and increased demand for low-cost air travel. As a result, airlines in these regions are extending their narrow-body aircraft fleets to meet rising passenger demand.

Another possibility arises from technology developments in airplane manufacture. The development of more efficient engines, lightweight composite materials, and digital avionics systems improves the performance of narrow-body aircraft, making them more appealing to airlines. Furthermore, advances in electric and hybrid-electric propulsion systems are creating opportunities for more environmentally friendly aircraft solutions in the future.

Global Narrow-Body Aircraft Market Segment Analysis

Narrow-Body Aircraft Market By Type

· Six-Abreast Cabin

· Five-Abreast Cabin

· Four-Abreast Cabin

· Three-Abreast Cabin

· Two-Abreast Cabin

The six-abreast cabin segment has the biggest market share due to its ability to enhance passenger capacity while maintaining comfort levels. Airlines like six-abreast cabins because they strike an ideal mix between seating efficiency and passenger experience. These layouts are frequently employed in aircraft models including the Airbus A320 and Boeing 737, which account for the vast majority of the global narrow-body fleet. The segment's expansion is being driven by the demand for increased seat density to reduce operational costs and boost profitability on short- to medium-haul routes.

Narrow-Body Aircraft Market By Range

· Medium

· Short

· Long

Short-range narrow-body aircraft generate the most income in the industry, owing to their widespread use in domestic and regional air travel. These aircraft are designed for itineraries of less than 3,000 nautical miles, making them excellent for frequent flights operated by both low-cost and full-service airlines. The rising demand for air travel in urban and regional centers, particularly in Asia-Pacific and North America, has spurred the development of short-range narrow-body aircraft.

Narrow-Body Aircraft Market By Engine Type

· Turboprop

· Turbofan

Turbofan engines dominate the market because they are more fuel efficient, produce less noise, and perform better at high altitudes than turboprops. Most modern narrow-body aircraft, such as the Boeing 737 MAX and Airbus A320neo, are powered by sophisticated turbofan engines that enable significant fuel savings and pollution reductions. Engine manufacturers like CFM International and Pratt & Whitney are always developing more efficient turbofan technology to improve aircraft performance and sustainability.

Narrow-Body Aircraft Market By Application

· Aircraft Lease

· Self-Support

The major application category is aircraft leasing, which allows airlines to increase their fleets without making substantial financial commitments. Leasing businesses like AerCap and Avolon offer airlines flexible financing alternatives, allowing them to fly newer and more efficient aircraft. The leasing industry has grown in popularity among low-cost carriers and new airlines seeking to expand operations while reducing financial risk.

Narrow-Body Aircraft Market By End-User

· Commercial

· Military

According to the narrow-body aircraft industry analysis, the commercial segment is the most important end user in the market, accounting for a sizable portion of total aircraft deliveries. The development of low-cost carriers, growing air travel demand, and fleet expansion plans by major airlines are propelling the category forward. Commercial airlines rely significantly on narrow-body aircraft for domestic and regional flights, making them an important part of airline operations around the world.

Narrow-Body Aircraft Market Regional Analysis

North America is a largest region in the market, characterized by a well-established aviation infrastructure and a strong emphasis on fleet modernization. Major airlines in the United States and Canada are investing in newer, more fuel-efficient aircraft, such as the Boeing 737 MAX and Airbus A320neo, to replace outdated fleets. The region also has a robust aircraft leasing industry, which enables airlines to expand their operations efficiently without incurring significant capital investment.

The Asia-Pacific area is the fastest growing in the narrow-body aircraft market forecast period, owing to increased urbanization, rising disposable incomes, and expanding air travel networks. Countries such as China and India are witnessing substantial increases in air passenger traffic, leading airlines to put large orders for fuel-efficient, next-generation narrow-body aircraft. Furthermore, the arrival of developing low-cost carriers (LCCs) in Southeast Asia is hastening market expansion, as these airlines rely largely on single-aisle aircraft for short-haul and regional services.

In Europe, strong environmental rules and sustainability initiatives are forcing airlines to use more fuel-efficient planes. The demand for narrow-body aircraft is being fueled by increased intra-European air travel and the presence of prominent carriers such as Ryanair and easyJet, which operate significant LCC networks. The Middle East and Latin America are emerging as prospective growth areas, owing to increased tourism, improved connectivity, and investments in airline fleet development, particularly in the UAE, Brazil, and Mexico.

Narrow-Body Aircraft Market Leading Companies

The narrow-body aircraft market players profiled in the report is COMAC, Airbus, Yakovlev, Boeing, Tupolev, Irkut Corporation, Embraer, De Havilland Aircraft of Canada Limited, Sukhoi, and Bombardier.

Narrow-Body Aircraft Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa