Plasmid DNA Manufacturing Market Growth Opportunities and Forecast till 2033

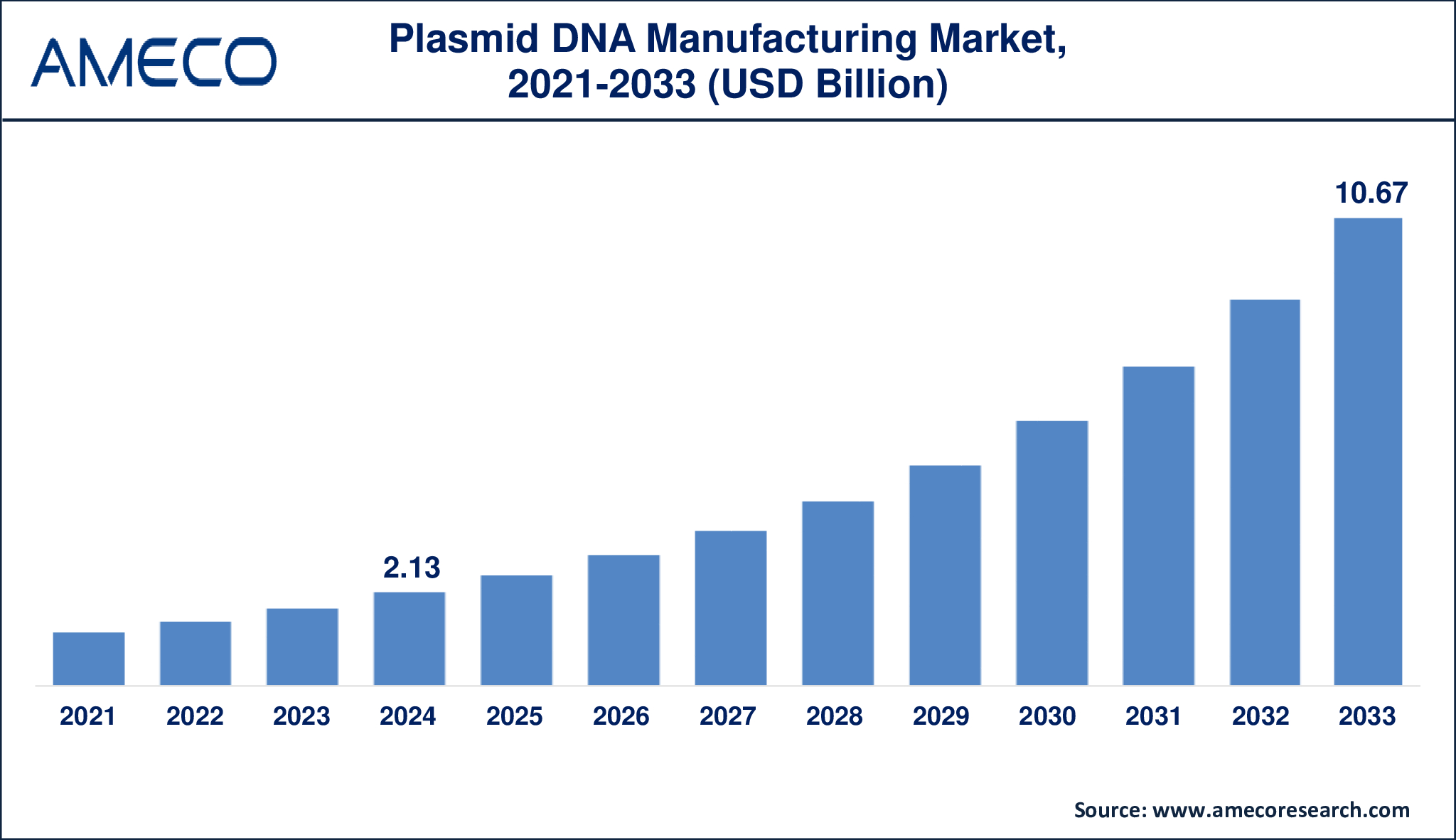

The Global Plasmid DNA Manufacturing Market Size was valued at USD 2.13 Billion in 2024 and is anticipated to reach USD 10.67 Billion by 2033 with a CAGR of 19.8% from 2025 to 2033.

The production of Plasmid DNA (pDNA) involves circular DNA molecular vector development which delivers genetic material into cells. Engineers design plasmids to contain essential genes and regulatory parts which activate expression inside host cells. The manufacturing process starts with bacterial cell transformation using E. coli cells and plasmids before growing the cells to produce high-quality plasmid DNA. The procedure stands crucial for generating genetic material at industrial levels with consistent and scalable yields.

Scientists use plasmid DNA for gene expression research and gene therapy and vaccine development while also producing proteins. Plasmid DNA acts as an essential delivery vehicle for CRISPR-Cas9 applications because it transports guide RNA and repair templates. The production of DNA-based vaccines and therapeutics through plasmid DNA represents a vital component of medical applications but the agricultural sector uses this genetic material to create enhanced genetically modified crops. Plasmid DNA manufacturing establishes itself as a fundamental technology in contemporary biotechnology research because of its reliable and scalable nature..

|

Parameter |

Plasmid DNA Manufacturing Market |

|

Plasmid DNA Manufacturing Market Size in 2024 |

US$ 2.13 Billion |

|

Plasmid DNA Manufacturing Market Forecast By 2033 |

US$ 10.67 Billion |

|

Plasmid DNA Manufacturing Market CAGR During 2025 – 2033 |

19.8% |

|

Plasmid DNA Manufacturing Market Analysis Period |

2021 - 2033 |

|

Plasmid DNA Manufacturing Market Base Year |

2024 |

|

Plasmid DNA Manufacturing Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Grade, By Disease, By Development Phase, By Application, and By Region |

|

Plasmid DNA Manufacturing Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Aldevron, Akron Biotech, Cobra Biologics & Pharmaceutical Services, Nature Technology Corporation, Vigene Biosciences, Luminous Biosciences, Plasmidfactory GmbH, JAFRAL Ltd., VGXI, Inc., and Delphi Genetics. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Plasmid DNA Manufacturing Market Dynamics

The plasmid DNA (pDNA) manufacturing sector grows quickly because scientists actively pursue the development of CRISPR-based gene editing and RNA therapeutics and advanced genetic engineering solutions. Academic institutions working in partnership with industry partners are speeding up therapeutic innovation and novel therapeutic development. Process optimization combined with strict adherence to modern global regulatory guidelines has improved both the scalability and safety features of pDNA manufacturing. BioNTech SE finalized the construction of its new plasmid DNA manufacturing facility in Marburg Germany during February 2023 to produce clinical and commercial-grade pDNA at competitive prices which demonstrates rising investments in this market sector. Major market participants are now using non-organic business growth methods to extend their product range. The September 2022 strategic partnership between Lonza and Touchlight enabled the company to obtain enzymatic DNA technology which strengthened its position in the mRNA therapeutics and vaccine market.

The plasmid DNA manufacturing market shows promising growth potential yet it confronts complex ethical issues as well as regulatory barriers. The genetic modification of DNA by using plasmid technology creates biosafety issues because genetically modified organisms (GMOs) may escape into natural environments. The implementation of strict regulatory standards at national and international levels requires substantial financial investment for containment measures and compliance as well as safety infrastructure. The implementation of regulatory requirements leads to operational delays and raises production expenses. The industry collaborators actively establish collaborative partnerships to break down these barriers while enhancing their technological capabilities. Recent industry partnerships established after 2021 focus primarily on manufacturing and supply agreements and process development and technology integration activities which total more than 55% of all new partnerships. Aldevron teamed up with Evanoa Bioscience in May 2023 to implement proprietary E. coli strains for fermentation improvement. Similarly, AcuraBio’s collaboration with Cytiva and BioCina’s agreement with GenomeFrontier in 2023 reflect the industry's ongoing commitment to innovation, cost-efficiency, and expanding therapeutic applications, including virus-free CAR-T therapies and cGMP-grade DNA manufacturing.

Global Plasmid DNA Manufacturing Market Segment Analysis

Plasmid DNA Manufacturing Market By Grade

· R&D Grade

o Antibody Development

o mRNA Development

o DNA Vaccine Development

o Others

o Viral Vector Development

§ Lentivirus

§ AAV

§ Retrovirus

§ Adenovirus

§ Others

· GMP Grade

The plasmid DNA manufacturing market showed its highest share through the GMP grade segment in 2024. The plasmid DNA manufacturing market shows dominance because of increasing demands for high-quality plasmid DNA that meets regulatory requirements for clinical testing and commercial manufacturing of gene therapies as well as DNA vaccines and mRNA-based therapeutics. Cell and gene therapy adoption rates for oncology care and rare diseases treatment has created an urgent need for GMP-grade plasmids. The combination of improved biomanufacturing facilities with strict regulatory standards has increased the demand for GMP-grade production because it ensures product safety and provides both trackability and consistent results. The GMP segment dominates the market because of rising numbers of gene therapy products progressing through clinical trials and securing regulatory approvals.

Plasmid DNA Manufacturing Market By Disease

· Cancer

· Infectious Disease

· Genetic Disorder

As per the plasmid DNA manufacturing market analysis, the cancer segment has gathered utmost market share in 2024. The rise of gene-based cancer treatments such as DNA vaccines and CAR-T cell therapies has resulted in substantial growth for high-quality plasmid DNA requirements. Plasmids serve as critical tools for creating customized cancer therapies by performing exact genetic transformations while providing therapeutic genetic material. The segment's growth receives additional support from increasing cancer incidence worldwide and expanding clinical trials for new cancer treatments. The strong commitment to oncology-focused research through strategic partnerships drives cancer to maintain its position as the main application sector in this market.

Plasmid DNA Manufacturing Market By Disease

· Clinical Therapeutics

· Pre-Clinical Therapeutics

· Marketed Therapeutics

The manufacturing sector of pre-clinical therapeutics experiences rapid growth in the plasmid DNA market. The market expansion stems from increasing numbers of gene therapy and nucleic acid-based therapeutic candidates that start their developmental phases. The biotech industry together with research institutions now devotes more resources into pre-clinical research that evaluates pDNA's potential therapeutic applications for cancer treatment and genetic disorders and infectious diseases. The segment operates under reduced regulatory requirements compared to clinical and market stages which speeds up innovation and experimental practices. As the pipeline for gene-based therapies expands, demand for high-quality research-grade and GMP-like plasmid DNA in pre-clinical applications continues to accelerate.

Plasmid DNA Manufacturing Market By Application

· DNA Vaccines

· Cell & Gene Therapy

· Others

The cell and gene therapy sector represents the dominant application segment in plasmid DNA manufacturing because researchers increasingly use advanced therapeutic approaches for genetic disorder and chronic illness treatment. Plasmid DNA functions as an essential component for both CRISPR-Cas9 gene editing technologies and viral vector production needed for delivering genetic material. The segment grows because genetic conditions increase while research funding into cell and gene therapy receives increased investment. The dominance of Plasmid DNA in the evolving market landscape becomes stronger because of its expanding use in personalized treatment strategies and regenerative medicine applications.

Plasmid DNA Manufacturing Market Regional Analysis

The North American region will keep its status as the dominant market for plasmid DNA manufacturing from 2021 to 2028. The growing number of contract development and manufacturing organizations (CDMOs) represents the main factor behind this market dominance because of rising investments in biopharmaceutical research. Intellectual property rights for newly developed therapies in the United States strengthen its market position because of its leadership in this area. Plasmid DNA manufacturing in the region gains strength due to the widespread implementation of advanced healthcare solutions and increased preference for gene and cell-based medical treatments.

The Asia Pacific region demonstrates the most rapid market expansion in plasmid DNA manufacturing. The biotechnology sector's growth in this region continues to advance at a rapid pace because both governments and private organizations provide substantial financial support. The surge in plasmid DNA manufacturing is led by China and India along with Japan because these nations have substantial populations that need vaccines and gene-based therapies for improving healthcare outcomes. China faces growing healthcare solution demands from its accelerating urbanization efforts and its fast-growing elderly population which will become 400 million by 2030. Plasmid DNA manufacturing capabilities in the region receive additional support through government initiatives combined with strategic healthcare infrastructure investments.

Plasmid DNA Manufacturing Market Leading Companies

The Plasmid DNA Manufacturing players profiled in the report is Aldevron, Akron Biotech, Cobra Biologics & Pharmaceutical Services, Nature Technology Corporation, Vigene Biosciences, Luminous Biosciences, Plasmidfactory GmbH, JAFRAL Ltd., VGXI, Inc., and Delphi Genetics.

Plasmid DNA Manufacturing Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa