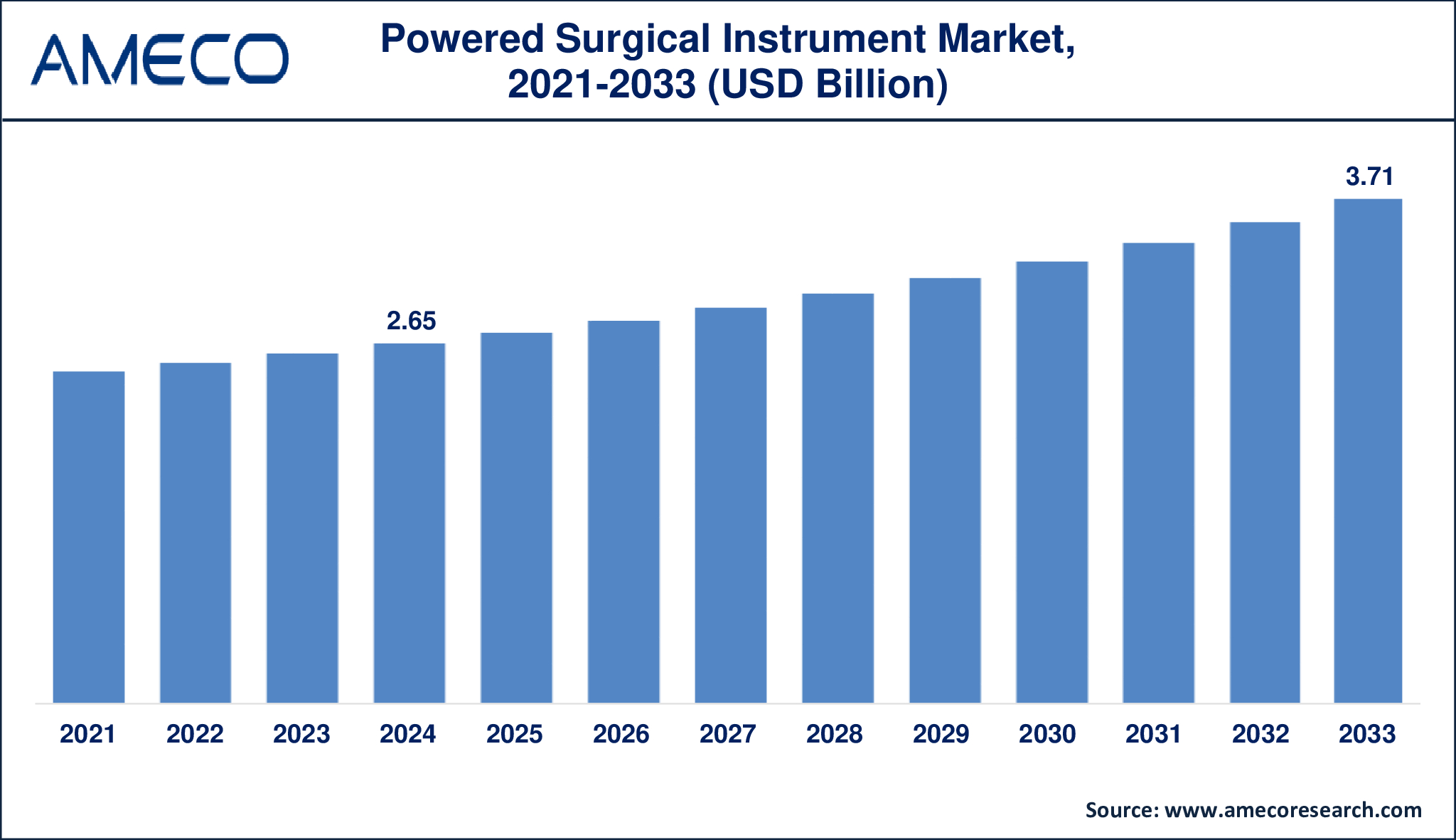

Powered Surgical Instrument Market Growth Opportunities and Forecast till 2033

The Global Powered Surgical Instrument Market Size was valued at USD 2.65 Billion in 2024 and is anticipated to reach USD 3.71 Billion by 2033 with a CAGR of 3.9% from 2025 to 2033.

Medical tools with powered functionality operate through external power sources that include electric and pneumatic pressure and battery power to deliver precise surgical procedures with expedited results. Such surgical tools find wide application in orthopedic surgery as well as cardiovascular surgery and neurological surgery and ENT (ear, nose, and throat) surgical procedures. The surgical tools include bone saws together with drills and reamers and dermatome devices that enhance surgical performance and reduce operator exhaustion when compared to manual equipment.

Powered surgical tools shorten procedure durations while permitting exact surgical interventions particularly during intricate or minimally invasive procedures. The adoption of powered surgical instruments expands because surgical technology advances and global surgical procedure numbers grow together with requirements for better patient results and quicker recovery times. Outpatient surgeries along with robotic-assisted procedures push this segment toward innovative integration.

|

Parameter |

Powered Surgical Instrument Market |

|

Powered Surgical Instrument Market Size in 2024 |

US$ 2.65 Billion |

|

Powered Surgical Instrument Market Forecast By 2033 |

US$ 3.71 Billion |

|

Powered Surgical Instrument Market CAGR During 2025 – 2033 |

3.9% |

|

Powered Surgical Instrument Market Analysis Period |

2021 - 2033 |

|

Powered Surgical Instrument Market Base Year |

2024 |

|

Powered Surgical Instrument Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product, By Power Source, By Application, and By Region |

|

Powered Surgical Instrument Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

adeor medical AG, B. Braun Medical Inc., CONMED Corporation, DePuy Synthes, De Soutter Medical, Smith+Nephew, Stryker, Medtronic, MicroAire, and Zimmer Biomet. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Powered Surgical Instrument Market Dynamics

The powered surgical instruments market shows strong growth because of the increasing prevalence of lifestyle disorders together with expanding healthcare service availability and increased medical exposure. The market requires advanced surgical solutions because of these multiple factors that have increased the demand. The government's healthcare awareness campaigns including medical tourism promotion has substantially fueled this market growth. The positive impact of medical tourism on market dynamics becomes evident through International Organization for Standardization (ISO) data which shows that the industry generated $44.8 billion in 2019.

The surgical world has benefited tremendously from electric-powered devices particularly through the implementation of electrosurgical systems. The tools facilitate exact procedures in ambulatory surgical centers (ASCs) alongside hospitals without necessitating specialized operating areas thus expanding their adoption potential. The Ambulatory Surgery Center Association reports that outpatient surgeries performed in ASCs reached more than 60% of all operations in the U.S. during 2023.

The worldwide market shows substantial growth potential throughout the forecast period due to the increasing incidence of diabetes alongside cancer and cardiovascular diseases and musculoskeletal disorders. Surgical requirements will increase because the International Diabetes Federation predicts that adult diabetes cases will reach 643 million by 2030 from 537 million in 2021. The World Health Organization reports that annual cardiovascular disease deaths reach 17.9 million while noting that many of these procedures require powered instruments for execution.

High prices for powered surgical instruments act as a major obstacle to market growth expansion. A wide range of sophisticated surgical instruments including electrosurgical systems and robotic-assisted devices need major upfront purchases and ongoing operational expenses. A robotic surgical system by Intuitive Surgical costs between $1.5 million and $2.5 million during purchase while annual maintenance fees amount to $100,000 to $200,000 based on a 2023 report. Small healthcare facilities across developing areas face exceptional difficulties because of these high financial expenses.

The availability of modern healthcare facilities is not uniform across regions because rural areas and underserved communities in various countries are missing out on powered surgical equipment use. According to the 2022 Lancet study on global surgery, 36% of surgical facilities in low- and middle-income nations lack advanced technologies. The population in sub-Saharan Africa faces a dramatic gap since basic surgical care remains out of reach for 80 percent of residents who lack access to powered surgical facilities (World Bank, 2023).

The market stands to benefit from revolutionary changes because robotics and automation now enhance powered surgical instruments. These technological advancements provide surgeons with enhanced accuracy during operations while minimizing human mistakes through minimally invasive surgical approaches which deliver better patient results. The da Vinci Surgical System among other robotic systems has enabled surgeons to conduct complex operations through small incisions since 2022 (Intuitive Surgical) and has resulted in recovery times that are fifty percent shorter than standard procedures (Mayo Clinic, 2023). A 2023 Surgical Endoscopy study shows automated tools shorten laparoscopic surgery durations by up to 20%. The same research confirms these tools improve workflow efficiency. The growing market need for advanced technological surgical solutions will transform present medical practices while fueling innovation that will expand the market for powered surgical instruments throughout the upcoming years.

Global Powered Surgical Instrument Market Segment Analysis

Powered Surgical Instrument Market By Product

· Hand Piece

o Drill Systems

o Reamer Systems

o Saw Systems

o Shavers

o Stapler

o Others

· Power Source & Controls

o Batteries

o Electric Consoles

o Pneumatic Regulators

· Accessories

o Surgical Accessories

o Electrical Accessories

As per the powered surgical instruments market analysis, the hand piece technology dominates the market with a 50% share in 2024 because ongoing design innovation creates instruments which offer better precision and control for surgeons during medical procedures. Modern handpieces incorporate state-of-the-art motion-sensing technology and vibration dampening and torque feedback systems which provide surgeons with precise tool manipulation. The precise control capabilities of these instruments make them suitable for complex operations which need gentle manipulation. The tools become more versatile through modular features and their specialized attachments enable drilling and sawing along with shaping operations. The National Institutes of Health (NIH) recognizes these innovations to be fundamental for better surgical results.

Powered Surgical Instrument Market By Power Source

· Battery-Powered Instruments

· Pneumatic Instruments

· Electric Instruments

As per the powered surgical instrument market analysis, the battery-powered instrument segment leads all other market segments with its dominant market share in 2024 while demonstrating substantial growth potential through 2033. The combination of cordless operation with lightweight design and reliability and rechargeability functions makes these instruments ideal for surgical procedures because they offer comfort and flexibility to surgeons. Due to their portable design the World Health Organization (WHO) observes these tools becoming more popular among resource-limited medical facilities. Electric instruments show growing popularity because they use high-frequency currents to perform both cutting and coagulation functions which produce significant blood loss reduction that benefits high-bleed surgical procedures.

Powered Surgical Instrument Market By Application

· Cardiovascular Surgery

· Cardiothoracic Surgery

· Orthopedic Surgery

· ENT Surgery

· Neurosurgery

· Plastic Surgery

· Others

According to the powered surgical instruments market forecast, the orthopedic surgery segment is expected to dominate the market revenue throughout 2025 to 2033 because of increasing cases of musculoskeletal disorders and injuries among patients. WHO projects that more than 1.7 billion people worldwide experience these conditions which creates high demand for surgical procedures. Sports-related injuries and accidents have increased by 12% each year based on data from the American Academy of Orthopaedic Surgeons (AAOS) which shows the need for these procedures to grow. These devices enable minimally invasive surgical techniques which lead to reduced recovery duration and lower postoperative complications. The combination of increasing patient awareness and broader health insurance coverage that covers 65% of surgeries under the Centers for Medicare & Medicaid Services (CMS) makes patients more likely to choose surgical procedures thus supporting segment growth.

Powered Surgical Instrument Market Regional Analysis

The powered surgical instruments market segment in North America captures the largest market share amounting to approximately 43% in 2024 because of its well-developed healthcare infrastructure and high number of surgical procedures. Chronic diseases throughout the United States at a high rate require surgical intervention to treat them. Heart disease stands as the primary cause of deaths in the U.S. based on data from the Centers for Disease Control and Prevention (CDC) where coronary artery disease affects approximately 18.2 million adults aged 20 and older who need procedures that require powered surgical instruments. The National Institutes of Health (NIH) documents that medical procedures take place over 15 million times per year in the U.S. while the aging population contributes to this number since 16.8% of Americans reached the age of 65 in 2020 according to U.S. Census Bureau statistics. The combination of population changes with Medicare/Medicaid insurance coverage reaching 65% of procedures (per CMS) creates enduring demand for precise surgical instruments which maintains North America's leadership position.

Asia-Pacific (APAC) region experience fastest powered surgical instruments market growth throughout the forecast period of 2025 to 2033 because of healthcare sector expansion and increasing surgical requirements. The World Health Organization (WHO) reports chronic diseases such as cancer and diabetes affect more than 1.5 billion people throughout the region and India identified 1.4 million new cancer cases during 2022 which drives surgical requirements. India’s Ministry of Health reports 30 million surgical procedures each year while government programs such as Ayushman Bharat have covered 50 million beneficiaries by 2023. Statistical data from the World Bank shows that Hong Kong performed 1,735 surgeries per 100,000 people in 2023 as APAC countries expand their healthcare systems. APAC demonstrates potential for rapid market growth in the upcoming years because of its combination of aging population demographics and government-backed healthcare policies.

Powered Surgical Instrument Market Leading Companies

The powered surgical instrument players profiled in the report is adeor medical AG, B. Braun Medical Inc., CONMED Corporation, DePuy Synthes, De Soutter Medical, Smith+Nephew, Stryker, Medtronic, MicroAire, and Zimmer Biomet.

Powered Surgical Instrument Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa