Car Rental Market Growth Opportunities and Forecast till 2033

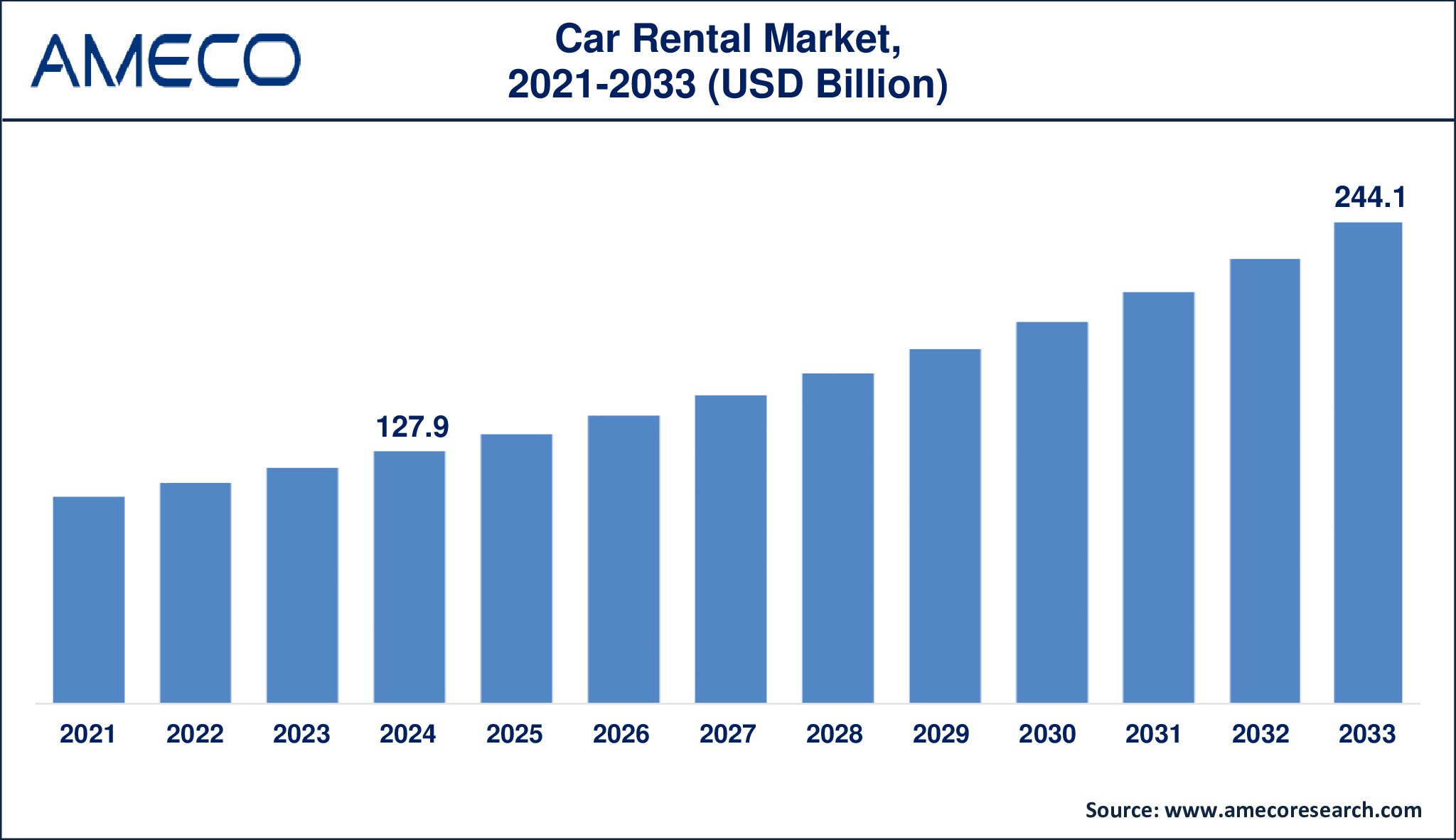

The Global Car Rental Market Size was valued at USD 127.9 Billion in 2024 and is anticipated to reach USD 244.1 Billion by 2033 with a CAGR of 7.5% from 2025 to 2033.

A rental car is a vehicle offered by a rental company for short-term use, usually priced on a daily or weekly basis. It provides flexibility and convenience for travelers, corporations, and individuals who require short-term mobility without owning a vehicle. Rental care industry is on tremendous rise due to a number of causes, including rising demand for flexible mobility options, the expansion of the travel and tourism industry, and the growing adoption of digital technology that simplify the rental process. The market is also being shaped by a growing preference for online booking platforms that provide convenience, price comparisons, and customer reviews, hence increasing user involvement.

Furthermore, the growth of digital platforms and mobile applications has fundamentally altered how customers interact with rental service providers. From real-time vehicle tracking to seamless app-based reservations and digital payments, today's automobile rental experience is more user-friendly and accessible than ever before. Market participants use data analytics, telematics, and artificial intelligence to improve fleet management and customer interaction. The global rise of electric mobility is also having an impact on the automobile rental industry, with many companies aggressively converting to electric and hybrid fleets to satisfy environmental targets and government laws. As travel restrictions ease and cross-border movement returns following the epidemic, both the leisure and corporate categories are likely to contribute significantly to market growth. Overall, the car rental sector is at a crossroads of innovation and opportunity, fueled by shifting lifestyles and the growing acceptance of shared mobility options.

|

Parameter |

Car Rental Market |

|

Car Rental Market Size in 2024 |

US$ 127.9 Billion |

|

Car Rental Market Forecast By 2033 |

US$ 244.1 Billion |

|

Car Rental Market CAGR During 2025 – 2033 |

7.5% |

|

Car Rental Market Analysis Period |

2021 - 2033 |

|

Car Rental Market Base Year |

2024 |

|

Car Rental Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Booking Type, By Vehicle Type, By Rental Length, By Application, By End User, and By Region |

|

Car Rental Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

SIXT, Eco Rent A Car, Localiza, Avis Budget Group, Inc., Europcar, Toyota Rent-a-Car, Enterprise Holdings, Inc., Carzonrent India Pvt. Ltd., The Hertz Corporation, and AVR Qatar, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Car Rental Market Dynamics

The steady recovery in global tourism and business travel following the COVID-19 epidemic is a major element driving industry growth. As international borders reopen and travel restrictions ease, the demand for rental automobiles, particularly in famous tourist areas, is rapidly increasing. Tourists choose rental cars because of the freedom and flexibility they provide when exploring unusual or inaccessible regions. Similarly, business travelers frequently use rental cars for airport transfers, attending events, and traveling on multi-city business trips.

Governments all over the world are enacting regulations and investing in infrastructure to increase tourism, such as airport expansions, road construction, and digital tourism promotion. These measures indirectly benefit the automobile rental industry by making traveling more convenient and appealing. Furthermore, many multinational corporations are implementing travel policies that favor rentals over company-owned fleets due to their cost-effectiveness and reduced administrative load. The rise of hybrid work arrangements and a surge in distant business events are generating new use cases for automobile rentals, such as employees flying between cities for in-person meetings. This mix of leisure and corporate demand establishes a solid platform for long-term market stability and growth.

Despite the bright outlook, the market faces some hurdles. Regulatory compliance in several countries frequently requires businesses to manage a complex collection of local laws, insurance policies, and environmental requirements, which can impede smooth operations. Furthermore, maintaining a well-functioning and diverse fleet necessitates ongoing investments in vehicle purchase, maintenance, and fleet management technology, which may be costly and logistically challenging, especially for small and medium-sized businesses.

Global Car Rental Market Segment Analysis

Car Rental Market By Booking Type

· Offline

· Online

In terms of booking type, the market is segmented into online and offline categories. Online bookings accounted for more than 69% of overall market share in 2024, driven by rising smartphone usage, internet accessibility, and the popularity of applications and aggregator platforms that provide rapid bookings. On the other hand, the offline booking channel remains relevant in some parts of the world where internet penetration is limited or consumers prefer direct interaction with suppliers. Offline bookings are also popular for last-minute rentals and bespoke chauffeur services.

Car Rental Market By Vehicle Type

· Executive

· Economy

· Luxury

· SUVs

· MUVs

When segmented by vehicle type, economy cars emerged as the leading category, capturing approximately 34% of the market share in 2024. These vehicles are favored for their cost-effectiveness, fuel efficiency, and suitability for city travel. The executive car segment is anticipated to grow at a considerable CAGR between 2025 and 2033, driven by increasing demand from business travelers in emerging economies. In parallel, the demand for SUVs is also witnessing a steady rise, particularly in electric variants. Companies such as Sixt SE have incorporated models like the Tesla Model Y and Volvo XC60 into their fleets, responding to rising consumer interest in premium, eco-friendly travel.

Car Rental Market By Rental Length

· Short term

· Long term

The market is divided into two segments based on rental duration: short-term and long-term. Short-term rentals continue to dominate the market, fueled primarily by leisure tourists and corporate personnel who need automobiles for short periods of time. This category benefits from flexible rental terms and convenient access in tourist-friendly areas. However, long-term rentals are gaining popularity, particularly among businesses searching for cost-effective alternatives to company-owned fleets and individuals seeking to avoid the financial burden of car ownership. This move is consistent with broader changes in consumer behavior toward subscription and usage-based models.

Car Rental Market By Application

· Business

· Leisure/Tourism

The car rental market is broadly divided into two categories: leisure/tourism and business use. The leisure category makes a major contribution to overall revenue, thanks to increased international and domestic tourism and visitors' preference for self-driven mobility. Simultaneously, the business market remains important, with corporations frequently renting automobiles for official travel, event logistics, and employee transportation. Many businesses choose premium or executive-class automobiles to project a professional image while offering comfortable commutes for their employees.

Car Rental Market By End User

· Self-Driven

· Chauffeur-Driven

According to the car rental industry analysis, end-users divide the market into two segments: self-driven and chauffeur-driven. Self-driven rentals are especially popular among younger consumers and tech-savvy individuals who appreciate independence and the freedom to explore areas at their leisure. In contrast, chauffeur-driven services are more popular in areas with difficult local driving regulations or among high-income consumers wanting convenience and elegance, such as corporate executives or tourists who prefer guided tours.

Car Rental Market Regional Analysis

North America led the global vehicle rental industry in 2024, accounting for approximately 37% of the total market share. The existence of established players, a well-developed infrastructure, and high domestic travel demand all contribute to the region's leadership position. From 2025 to 2033, the Asia-Pacific area is expected to develop at a CAGR of 8.7% in the car rental market. This expansion is being driven mostly by increased disposable incomes, expanding urban populations, and an increase in foreign and domestic tourism. Government measures to promote tourism and infrastructure development in nations such as India, China, and Thailand are also boosting the use of rental services. Europe continues to have a substantial portion of the worldwide market, thanks to a thriving tourism industry and efficient transit infrastructure. Meanwhile, Latin America, the Middle East, and Africa are rising markets with high growth potential, driven by increasing urbanization, economic reforms, and increased awareness of mobility-as-a-service (MaaS) possibilities.

Car Rental Market Leading Companies

The car rental market players profiled in the report is SIXT, Eco Rent A Car, Localiza, Avis Budget Group, Inc., Europcar, Toyota Rent-a-Car, Enterprise Holdings, Inc., Carzonrent India Pvt. Ltd., The Hertz Corporation, and AVR Qatar, Inc.

Car Rental Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East And Africa