Animal Feed Enzymes Market Growth Opportunities and Forecast till 2032

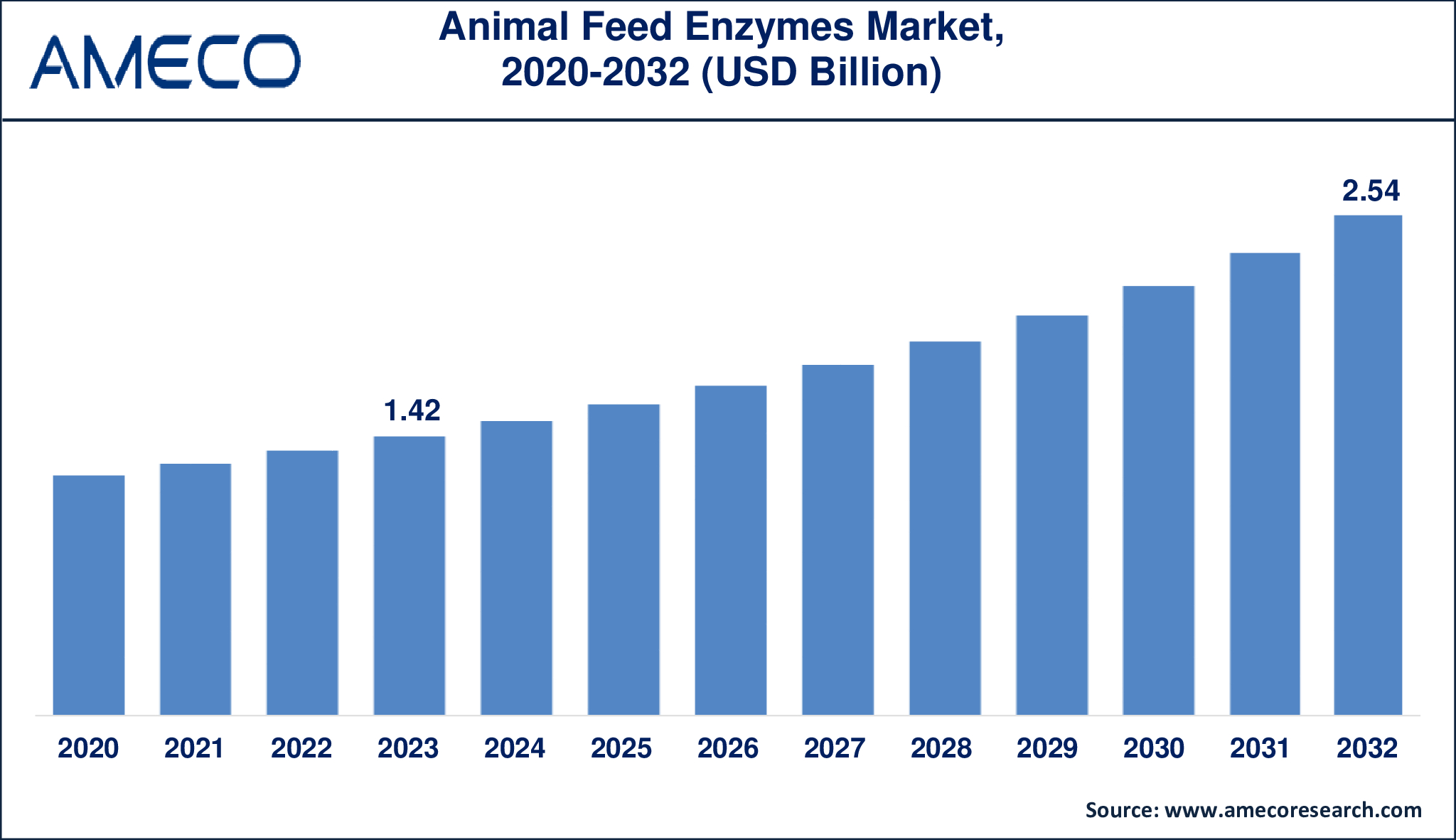

The Global Animal Feed Enzymes Market Size was valued at USD 1.42 Billion in 2023 and is anticipated to reach USD 2.54 Billion by 2032 with a CAGR of 6.8% from 2024 to 2032.

Animal feed enzymes are nutritional supplements that help animals digest and absorb nutrients from their feed. These enzymes assist break down feed components that would otherwise be difficult for animals to digest, such as fibers, proteins, and starches. Feed enzymes can boost growth rates, feed conversion ratios, and lower feed costs by increasing nutrient use efficiency. Animal feed enzymes include phytases, proteases, carbohydrases, and lipases. Enzymes in animal feed help animals break down and absorb fats and minerals faster. This implies the animal may develop quicker while using fewer nutritional supplements and producing less waste. Phytase, which assists in phosphorus absorption, is especially crucial for lowering phosphorus contamination. Phosphorus contamination is a widespread, undesirable side effect of modern agriculture, contaminating streams and causing marine dead zones.

|

Parameter |

Animal Feed Enzymes Market |

|

Animal Feed Enzymes Market Size in 2023 |

US$ 1.42 Billion |

|

Animal Feed Enzymes Market Forecast By 2032 |

US$ 2.54 Billion |

|

Animal Feed Enzymes Market CAGR During 2024 – 2032 |

6.8% |

|

Animal Feed Enzymes Market Analysis Period |

2020 - 2032 |

|

Animal Feed Enzymes Market Base Year |

2023 |

|

Animal Feed Enzymes Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Formulation, By Livestock, and By Region |

|

Animal Feed Enzymes Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

AB Enzymes, Adisseo France SAS (France), Advanced Enzymes Technologies, Associated British Foods plc, Azelis Holdings SA, BASF SE, BIO-CAT, Biocatalyst, E. I. du Pont de Nemours and Company, Koninklijke DSM N.V, and Rossari Biotech Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Animal Feed Enzymes Market Dynamics

The animal feed enzymes market is being pushed by rising demand for high-quality meat and dairy products, which has resulted in a focus on improving the efficiency and sustainability of animal feeding. As global meat consumption grows, particularly in emerging countries, there is a greater need to maximize feed usage to maintain increasing livestock populations. Feed enzymes serve an important function in enhancing the digestibility of feed materials, allowing animals to absorb nutrients more efficiently and develop faster. This, in turn, stimulates demand for enzymes as livestock producers strive to increase output while lowering feed costs.

Another important aspect impacting the industry is the growing awareness of environmental problems surrounding animal agriculture. The use of feed enzymes can lessen the environmental effect of cattle production by reducing nutrient excretion and greenhouse gas emissions. For example, enzymes such as phytases reduce the quantity of undigested phosphorus in animal excrement, lowering the danger of water contamination. This environmental advantage is becoming increasingly relevant as regulatory agencies in various locations tighten regulations on agricultural emissions and waste management, promoting the use of feed enzymes.

However, the market confronts several hurdles, such as the high cost of enzyme production and the demand for specialized enzyme formulations that match specific feed compositions. Furthermore, differences in regulatory frameworks among areas might hinder the approval and commercialization of novel enzyme products. Despite these challenges, improvements in biotechnology and enzyme engineering are likely to reduce manufacturing costs and improve feed enzyme performance, opening up new market prospects. As the global livestock sector evolves, feed enzymes' significance is anticipated to grow, aided by continued innovation and a greater emphasis on sustainable animal husbandry techniques.

Global Animal Feed Enzymes Market Segment Analysis

Animal Feed Enzymes Market By Product

· Phytase

· Carbohydrase

· Proteases

· Other Products

According to the animal feed enzymes industry analysis, carbohydrase led the market, accounting for 45 % of total revenue. One distinguishing feature of carbohydrases is their selectivity for various kinds of carbohydrates. Amylases, for example, specialize in starch breakdown, whereas cellulases focus on plant cell wall components. This distinguishing element allows for focused enzymatic activity based on the feed's composition. Furthermore, carbohydrases can be produced from microbial or fungal sources, expanding the possibilities for varied manufacturing and formulation techniques.

Animal Feed Enzymes Market By Formulation

· Dry

· Liquid

The dry formulation category generally accounts for the biggest market share in the animal feed enzymes industry. This dominance stems from the advantages that dry enzymes provide, such as ease of handling, extended shelf life, and improved stability during storage and transit. Dry formulations are frequently favored in feed production procedures because they may be easily blended with other feed components while maintaining the quality and uniformity of the final product. Furthermore, the low cost and simplicity of employing dry enzymes contribute to their widespread acceptance in a variety of countries, cementing their market leadership.

Animal Feed Enzymes Market By Livestock

· Ruminants

· Swine

· Aquatic Animals

· Others

The poultry sector is predicted to have the highest market share in the animal feed enzymes market from 2024 to 2032. Poultry production is quickly expanding, particularly in emerging economies, because to rising demand for chicken meat and eggs, which are low-cost sources of protein. Feed enzymes are widely employed in poultry diets to improve nutrient absorption, increase feed conversion ratios, and promote overall bird health. As a result, the poultry industry continues to be the greatest user of feed enzymes, a trend that is expected to continue as global poultry farming expands.

Animal Feed Enzymes Market Regional Analysis

The Asia-Pacific industry is expected to provide considerable growth prospects for marketers throughout the forecast period. With additional purchasing power, consumers can buy more protein-rich foods. Furthermore, the increased frequency of chronic diseases encourages people to focus more on nutritional intake, resulting in an overall rise in dairy and meat consumption. India, for example, has the world's highest annual milk consumption rate.

The animal feed enzymes market in Europe is predicted to increase considerably over the forecast period. According to the European Feed Manufacturers Federation (EFMF), Europe's feed output has been steadily declining since 2022, notably in the cattle industry. Over the last two years, this region has had the most substantial fall in output. Europe is dealing with continuing political and commercial problems, as well as an increased demand for sustainable feed solutions to help manage these market dynamics.

Animal Feed Enzymes Market Leading Companies

The animal feed enzymes market players profiled in the report is AB Enzymes, Adisseo France SAS (France), Advanced Enzymes Technologies, Associated British Foods plc, Azelis Holdings SA, BASF SE, BIO-CAT, Biocatalyst, E. I. du Pont de Nemours and Company, Koninklijke DSM N.V, and Rossari Biotech Ltd.

Animal Feed Enzymes Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa