Anti-Drone Market Growth Opportunities and Forecast till 2032

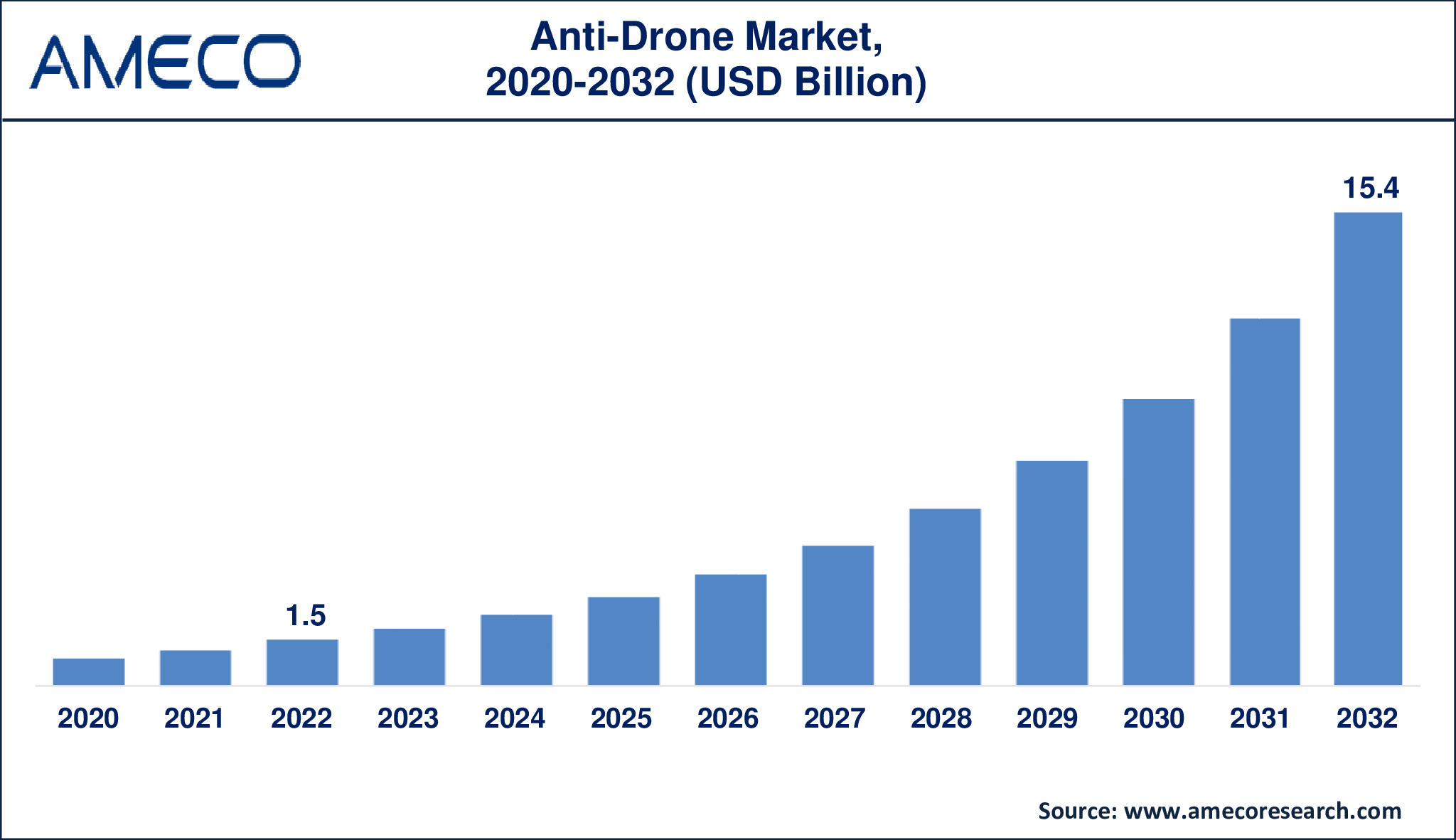

The Global Anti-Drone Market Size was valued at USD 1.5 Billion in 2022 and is anticipated to reach USD 15.4 Billion by 2032 with a CAGR of 26.5% from 2023 to 2032.

Anti-drone technology, also known as counter-drone (C-UAS), detects, tracks, and neutralizes unmanned aerial vehicles (UAVs) or drones that endanger national security, public safety, or personal property. The proliferation of drones has raised concerns about their possible use for harmful purposes such as surveillance, hacking, and even terrorist attacks. Anti-drone systems are intended to detect and locate drones in real time, utilizing sophisticated sensors and algorithms to track their movement and trajectory.

Anti-drone systems can take several forms, such as drone-detecting radar systems, acoustic sensors, and video analytics software. Some systems can also jam or stop the drone's control signals, causing it to lose altitude and crash. Others might employ physical barriers or netting to trap or disorient the drone. Anti-drone technology is employed in a variety of industries, including the military, law enforcement, and private security organizations. It's also being linked into existing infrastructure, such as airports and sporting arenas, to improve security and prevent unlawful drone use.

|

Parameter |

Anti-Drone Market |

|

Anti-Drone Market Size in 2022 |

US$ 1.5 Billion |

|

Anti-Drone Market Forecast By 2032 |

US$ 15.4 Billion |

|

Anti-Drone Market CAGR During 2023 – 2032 |

26.5% |

|

Anti-Drone Market Analysis Period |

2020 - 2032 |

|

Anti-Drone Market Base Year |

2022 |

|

Anti-Drone Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Component, By Technology, By Type, By End-Use, and By Region |

|

Anti-Drone Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Advanced Radar Technologies S.A., Airbus Group SE, Blighter Surveillance Systems, Boeing Company, DeTech Inc., Dedrone, Droneshield LLC, Enterprise Control Systems, Israel Aerospace Industries Ltd. (IAI), Liteye Systems, Inc., Lockheed Martin Corporation, Orelia, Prime Consulting and technologies, Raytheon Company, Saab Ab, Selex Es Inc., and Thales Group.. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Anti-Drone Market Dynamics

The anti-drone business is expanding rapidly as people become more concerned about drone-related risks like terrorism, surveillance, and disruption of essential infrastructure. Governments and organizations are heavily investing in anti-drone technology to identify and eliminate drones that endanger national security, public safety, and private property. This has resulted in an increase in demand for anti-drone solutions such as drone detection radar systems, acoustic sensors, and video analytics software.

The anti-drone market is also fueled by the expanding use of drones in a variety of industries, including the military, law enforcement, and commercial sectors. As drones grow more popular, there is a greater demand for effective anti-drone technologies to prevent unauthorized drone use and mitigate possible dangers. This has opened up a big potential for anti-drone technology suppliers to produce and market innovative solutions that match their clients' changing needs.

Geographically, the anti-drone market is predicted to develop significantly in North America, Europe, and Asia Pacific. These areas are home to several major drone manufacturers and users, and governments are substantially investing in anti-drone technologies to improve national security and public safety. The Middle East and Africa are also likely to see considerable development, driven by the growing usage of drones in a variety of industries and the need for effective anti-drone solutions to prevent illicit drone use.

The anti-drone business is fiercely competitive, with both established players and start-ups battling for market dominance. Dedrone, DroneShield, and Senzatac are some of the market's key participants. The market is characterized by continual innovation and R&D activities, with players developing new and more effective anti-drone solutions to remain competitive. The increasing demand for anti-drone technology is projected to fuel market innovation and growth in the coming years.

Global Anti-Drone Market Segment Analysis

Anti-Drone Market By Component

· Hardware

o Radars

o Acoustic Sensors

o Infrared and video surveillance systems

o RF Detectors

o Jammers

o Others

· Software

The hardware component led the anti-drone industry, accounting for the majority of market revenue in 2022. The key hardware components employed in anti-drone solutions were radar systems, acoustic sensors, infrared and video surveillance systems, radio frequency detectors, and jammers. Radar systems emerged as the dominant component, thanks to their capacity to identify and track drones from a distance, making them an essential component of anti-drone systems. Radar systems are widely employed in a variety of End-Uses, including the military, law enforcement, and commercial sectors, to identify and disable drones that threaten national security and public safety.

Anti-Drone Market By Technology

· Anti-Drone Radar

· RF Scan

· Thermal Image

· Others

The anti-drone radar technology dominated the Anti-Drone Market, accounting for the majority of market revenue in 2022. Anti-Drone Radar technology detects and tracks drones, delivering real-time data on their location, speed, and altitude. This technology is widely employed in a variety of End-Uses, including the military, law enforcement, and commercial sectors, to detect and disable drones that threaten national security and public safety. Radar technology is regarded as the most effective and dependable technique of detecting drones, particularly in locations with low visibility or in settings where other technologies may be useless.

Anti-Drone Market By Type

· Ground-Based

o Fixed

o Mobile

· Handheld

· UAV Based

Ground-based anti-drone systems dominated the anti-drone market, accounting for the majority of revenue in 2022. Fixed ground-based systems were the most popular in the category because they are simple to install and maintain and may provide effective coverage over a vast region. These systems are widely utilized in a variety of end-uses, including the military, law enforcement, and commercial sectors, to detect and disable drones that endanger national security and public safety. Fixed ground-based systems are regarded as the most effective and reliable technique of detecting drones, particularly in locations with little visibility or in circumstances where other technologies may be useless.

Anti-Drone Market By End-Use

· Military & Defense

· Commercial

o Public Spaces

o Critical Infrastructures

§ Energy & Utilities

§ Sports Stadiums

§ Airport

§ Data Centers

§ Others

· Government

· Others

The commercial end-use dominated the anti-drone market, accounting for the largest share of the market revenue in 2020. Within the commercial end-use category, the public spaces segment was the most significant, as there is a growing concern about drone-related security threats in public spaces such as airports, stadiums, and other areas where large crowds gather. The demand for anti-drone systems is increasing in these areas to prevent unauthorized drone operations and ensure public safety.

The commercial end-use segment includes various applications such as public spaces, critical infrastructures, and energy & utilities, among others. The growing demand for anti-drone systems in commercial sectors is driven by the increasing need for effective drone detection and neutralization solutions to prevent security threats and ensure public safety.

Anti-Drone Market Regional Analysis

The anti-drone industry is predicted to grow significantly across multiple regions, with North America ruling the industry by 2022. The region's strong military presence, along with growing national security concerns, has fueled demand for anti-drone equipment. The United States is a major contributor to this expansion, with the Federal Aviation Administration (FAA) enforcing rigorous drone restrictions. This has resulted in a rise in the use of anti-drone devices by government agencies, military groups, and private companies.

Europe is the world's second-largest market for anti-drone systems, driven by rising worries about drone-related security threats and the necessity for effective counter-drone solutions. The region's military forces are also investing on anti-drone devices to improve surveillance capabilities. Furthermore, the European Union's legislative framework has created a favorable climate for the expansion of the anti-drone business, with numerous countries enacting laws and regulations governing drone use. The anti-drone market in the Middle East and Africa is also predicted to grow significantly, owing to the region's military modernization initiatives and rising national security concerns.

Asia-Pacific is predicted to emerge as a significant region for anti-drone market growth, owing to the increasing use of drones in industries such as surveillance, reconnaissance, and logistics. China is a prominent participant in this region, and the Chinese government is heavily investing in anti-drone technologies to improve national security. Japan and South Korea are also likely to contribute to the region's anti-drone market growth, owing to national security concerns and the necessity for effective counter-drone solutions.

Anti-Drone Market Leading Companies

The anti-drone market players profiled in the report are Advanced Radar Technologies S.A., Airbus Group SE, Blighter Surveillance Systems, Boeing Company, DeTech Inc., Dedrone, Droneshield LLC, Enterprise Control Systems, Israel Aerospace Industries Ltd. (IAI), Liteye Systems, Inc., Lockheed Martin Corporation, Orelia, Prime Consulting and technologies, Raytheon Company, Saab Ab, Selex Es Inc., and Thales Group.

Anti-Drone Market Regions

North America

· U.S.

· Canada,

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa