Anti-Money Laundering Software Market Growth Opportunities and Forecast till 2032

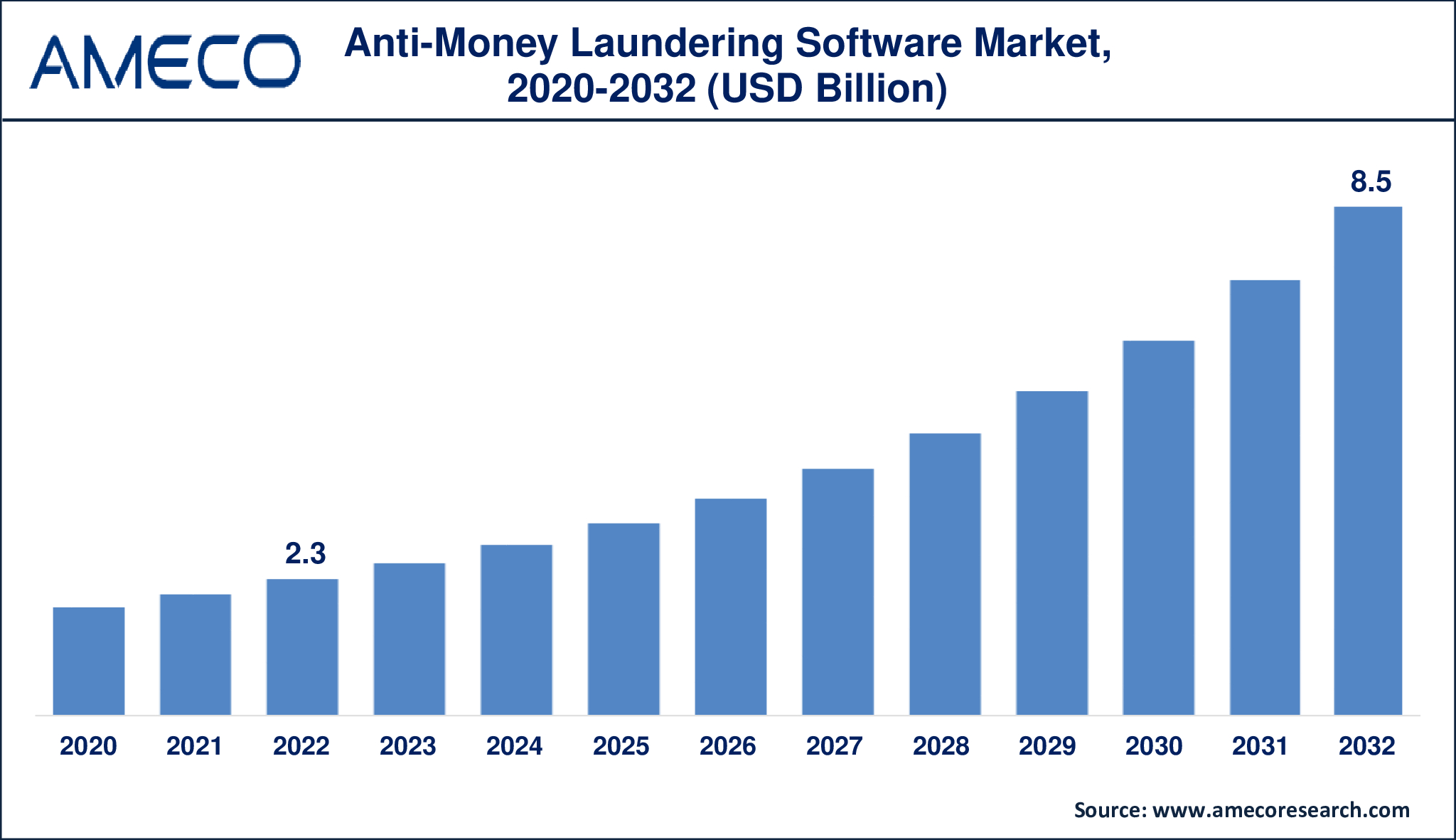

The Global Anti-Money Laundering Software Market Size was valued at USD 2.3 Billion in 2022 and is anticipated to reach USD 8.5 Billion by 2032 with a CAGR of 14.3% from 2023 to 2032.

Anti-money laundering (AML) software is a cutting-edge technology solution that enables financial institutions and regulated entities to effectively detect and prevent money laundering activities. Money laundering is a complex process where illegal funds are concealed to make them appear legitimate, but AML software streamlines the detection and prevention process by automating transaction monitoring, identifying suspicious activities, and ensuring compliance with regulatory requirements. The software typically incorporates a range of features, including transaction monitoring, customer due diligence, watchlist screening, and reporting tools that promptly alert institutions to potential money laundering activities.

AML software is a critical tool for financial institutions to maintain regulatory compliance and avoid severe penalties for non-compliance. By adhering to guidelines set by regulatory bodies, such as the Financial Action Task Force (FATF), institutions must implement rigorous monitoring and reporting of suspicious financial activities. Leveraging advanced technologies like algorithms, machine learning, and artificial intelligence, AML software can rapidly analyze vast amounts of transaction data in real-time, identifying unusual patterns that may indicate money laundering. This proactive approach not only detects and prevents financial crimes but also strengthens the overall security and integrity of the financial system, ensuring a safer and more trustworthy environment for transactions.

|

Parameter |

Anti-Money Laundering Software Market |

|

Anti-Money Laundering Software Market Size in 2022 |

US$ 2.3 Billion |

|

Anti-Money Laundering Software Market Forecast By 2032 |

US$ 8.5 Billion |

|

Anti-Money Laundering Software Market CAGR During 2023 – 2032 |

14.3% |

|

Anti-Money Laundering Software Market Analysis Period |

2020 - 2032 |

|

Anti-Money Laundering Software Market Base Year |

2022 |

|

Anti-Money Laundering Software Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Component, By Deployment Type, By Product, By End-Use Industry, and By Region |

|

Anti-Money Laundering Software Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Accuity Birst Inc., 3i Infotech Ltd., Fiserv Inc., Infosys, IBM, NICE Actimize Inc., Oracle Corporation, Norkom Technologies Ltd, SAS Institute Inc., and TCS. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Anti-Money Laundering Software Market Dynamics

The anti-money laundering (AML) software market is fueled by a combination of factors, as the need for robust financial crime prevention measures continues to intensify. A primary driver is the increasingly stringent regulatory environment. Governments and regulatory bodies worldwide have significantly enhanced their focus on combating money laundering and terrorist financing, imposing strict compliance requirements on financial institutions. As a result, there is a substantial demand for advanced AML software solutions capable of ensuring compliance and avoiding heavy fines. Financial institutions are compelled to adopt these technologies to monitor transactions, conduct customer due diligence, and report suspicious activities, thereby driving the market's growth.

Technological advancements are significantly influencing the AML software market dynamics, transforming the way financial institutions detect and respond to potential money laundering activities. The integration of artificial intelligence (AI) and machine learning (ML) into AML solutions has significantly enhanced the accuracy and efficiency of these processes, allowing for real-time analysis of vast amounts of data, identification of patterns, and prediction of suspicious behavior. Additionally, the adoption of cloud-based solutions provides scalability and flexibility, making it easier for institutions of all sizes to implement and upgrade their AML systems. As these technological innovations continue to evolve, they are driving further investment and adoption in the market, propelling growth and expansion in the AML software landscape.

Despite its growth potential, the AML software market faces several challenges that could hinder its progress. One significant obstacle is the high cost of implementing and maintaining advanced AML systems, which can be particularly challenging for smaller financial institutions with limited resources. Another challenge is the complexity of integrating AML software with existing legacy systems, requiring substantial investments in IT infrastructure and posing technical hurdles. Furthermore, the ever-evolving nature of financial crimes means that AML software must constantly adapt to new threats, necessitating ongoing updates and improvements to remain effective. However, despite these challenges, opportunities exist as emerging markets continue to develop their financial infrastructure and regulatory frameworks, presenting a growth potential for AML software providers.

Global Anti-Money Laundering Software Market Segment Analysis

Anti-Money Laundering Software Market By Component

· Service

· Software

The software component has emerged as the dominant force in the anti-money laundering (AML) market, comprising various applications and platforms designed to monitor transactions, conduct customer due diligence, screen against watchlists, and generate regulatory reports. The software component's supremacy can be attributed to its ability to provide automated, efficient, and scalable solutions that can handle the complex and vast amounts of data involved in AML processes.

Financial institutions and regulated entities heavily rely on sophisticated software solutions to ensure compliance with stringent regulatory requirements and effectively detect suspicious activities. The continuous advancements in software technology, including the integration of artificial intelligence and machine learning, have further enhanced the capability of these solutions to identify and mitigate risks in real-time. As a result, the increasing reliance on software solutions for AML purposes has solidified the software component's position as the market leader.

Anti-Money Laundering Software Market By Deployment Type

· Cloud

· On-Premise

The on-premise product has traditionally held the majority share in the anti-money laundering (AML) software market, as financial institutions have favored these solutions due to their perceived control, security, and customization capabilities. On-premise AML solutions allow organizations to maintain direct oversight over their data and IT infrastructure, which is crucial given the sensitive nature of financial data and the stringent regulatory requirements surrounding data privacy and security.

Despite this dominance, there is a notable shift towards cloud-based AML solutions, driven by the advantages of scalability, flexibility, lower upfront costs, and seamless integration with other cloud-based services and technologies. Cloud-based solutions also offer the benefit of regular updates and enhancements provided by the vendor, enabling financial institutions to stay current with evolving regulatory requirements and emerging threats.

Anti-Money Laundering Software Market By Product

· Transaction Monitoring

· Currency Transaction Reporting

· Customer Identity Management

· Compliance Management

· Others (Sanction Screening Software and Case Management Software)

The transaction monitoring product has emerged as the leading player in the anti-money laundering (AML) software market, driven by its crucial role in detecting and reporting suspicious financial activities in real-time or near-real-time. This is essential for preventing money laundering and ensuring compliance with regulatory requirements. Transaction monitoring systems analyze transactions across accounts, customers, and various financial activities to identify patterns that may indicate money laundering or other financial crimes.

The dominance of transaction monitoring software can be attributed to the growing complexity and volume of financial transactions, which requires advanced and automated monitoring solutions. Financial institutions prioritize transaction monitoring as it serves as the foundation of their AML compliance efforts, enabling them to detect anomalies, flag suspicious transactions, and generate reports for regulatory authorities. The ability of these systems to seamlessly integrate with other AML components, such as customer identity management and compliance management, further reinforces their critical role and widespread adoption in the market.

Anti-Money Laundering Software Market By End-Use Industry

· IT and Telecommunications

· Healthcare

· BFSI

· Transportation and Logistics

· Manufacturing

· Defense and Government

· Retail

· Energy and Utilities

· Others

The banking, financial services, and insurance (BFSI) industry holds a dominant position in the Anti-Money Laundering (AML) software market due to the intense regulatory scrutiny faced by financial institutions to prevent money laundering and terrorist financing activities. The sheer volume of daily transactions handled by banks and financial institutions demands sophisticated monitoring systems to detect and report suspicious activities. Regulatory bodies such as the Financial Action Task Force (FATF) and Financial Crimes Enforcement Network (FinCEN) enforce stringent AML regulations, making compliance a critical aspect for these institutions. As a result, the BFSI sector invests heavily in AML software to ensure compliance, minimize risks, and maintain its reputation and integrity.

Anti-Money Laundering Software Market Regional Analysis

The anti-money laundering (AML) software market exhibits distinct regional differences in terms of adoption and growth. North America stands out, driven by its stringent regulatory frameworks and high concentration of financial institutions. The United States, in particular, plays a significant role due to the rigorous AML compliance requirements imposed by agencies such as FinCEN, prompting banks and financial services firms to heavily invest in advanced AML software solutions. Europe follows closely, with countries like the UK, Germany, and France contributing to market growth through the implementation of EU directives and increased enforcement measures. The region benefits from its robust financial services sector and ongoing advancements in AML technologies.

The Asia-Pacific region is poised for rapid growth, driven by the expanding financial sectors in countries like China, India, and Singapore. Rising regulatory pressures and increasing instances of financial crime prompt financial institutions in these markets to adopt sophisticated AML software solutions. Additionally, government initiatives aimed at enhancing financial transparency and combating corruption are contributing to the region's growth trajectory. Latin America and the Middle East & Africa are also experiencing steady growth, driven by efforts to strengthen financial regulations and improve compliance standards among banks and financial institutions.

Anti-Money Laundering Software Market Leading Companies

The anti-money laundering software market players profiled in the report is Accuity Birst Inc., 3i Infotech Ltd., Fiserv Inc., Infosys, IBM, NICE Actimize Inc., Oracle Corporation, Norkom Technologies Ltd, SAS Institute Inc., and TCS.

Anti-Money Laundering Software Market Regions

North America

· U.S.

· Canada,

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa