Artificial Intelligence in Drug Discovery Market Growth Opportunities and Forecast till 2032

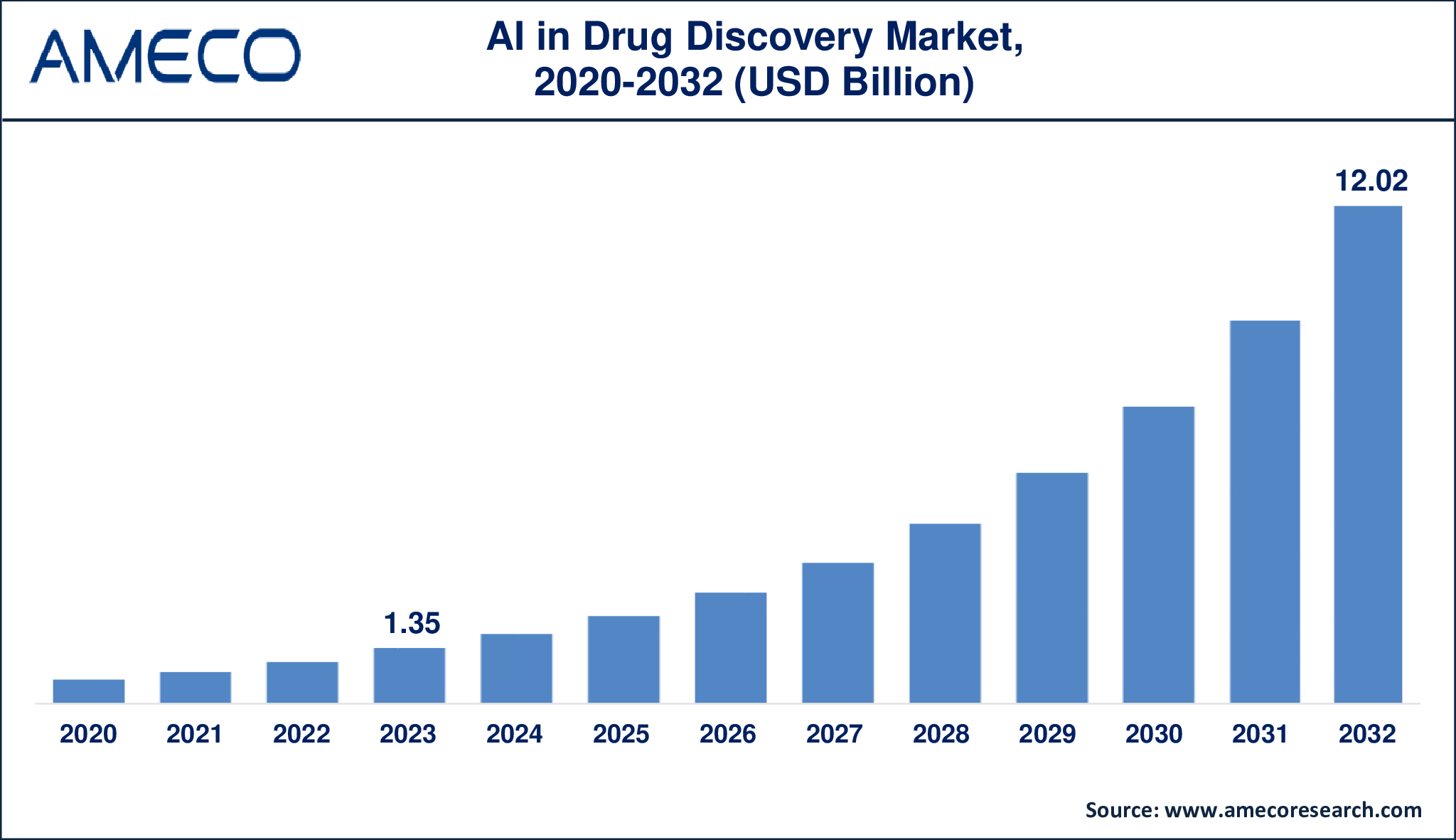

The Global Artificial Intelligence in Drug Discovery Market Size was valued at USD 1.35 Billion in 2023 and is anticipated to reach USD 12.02 Billion by 2032 with a CAGR of 27.8% from 2024 to 2032.

Artificial intelligence (AI) has changed the pharmaceutical industry by merging modern computational technology with classical medicine to solve long time problems. AI uses processed algorithms to study large batches of data and come up with its decision on drug approvals independently, therefore increasing efficiency. Specifically, it improves important tasks, such as protein-ligand docking, molecular dynamics simulations, virtual screening, and de novo drug design to an extent that has not been achieved before. AI is revolutionizing the pharma industry and opportunities for the discovery of innovative treatments as the identification of hopeful drug targets is significantly advanced.

AI does not simply apply in initial phases of drug discovery alone but is also involved in enhancing clinical trial setup and finding favorable patients and constant patient response measurement. This enables ways to alter protocol in a bid to enhance trial, success and effectiveness. Since drug discovery is a costly and lengthy process, AI brings value to the pricing and approximating solutions to the industry’s low efficacy. Some of the most frequently used applications are machine learning classifications such as virtual screening and drug-target interaction prediction works, and generative applications like retrosynthetic analysis and de novo protein design. These improvements are indicating a new generation of drugs discovery with enhanced accuracy and creativity.

|

Parameter |

Artificial Intelligence in Drug Discovery Market |

|

Artificial Intelligence in Drug Discovery Market Size in 2023 |

US$ 1.35 Billion |

|

Artificial Intelligence in Drug Discovery Market Forecast By 2032 |

US$ 12.02 Billion |

|

Artificial Intelligence in Drug Discovery Market CAGR During 2024 – 2032 |

27.8% |

|

Artificial Intelligence in Drug Discovery Market Analysis Period |

2020 - 2032 |

|

Artificial Intelligence in Drug Discovery Market Base Year |

2023 |

|

Artificial Intelligence in Drug Discovery Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Therapeutic Area, By Technology, By End-User, and By Region |

|

Artificial Intelligence in Drug Discovery Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Aitia (formerly GNS Healthcare), Atomwise, Inc., BenevolentAI, BPGbio, Inc. (acquired Berg Health), BioSymetrics, Inc., Cloud Pharmaceuticals, DeepMind (Google), Exscientia, IBM, Insilico Medicine, Inc., insitro, Microsoft Corporation, NVIDIA Corporation, Schrödinger, and Tempus, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Artificial Intelligence in Drug Discovery Market Dynamics

The notable increase in the number of chronic diseases globally depicts a rather scary scenario akin to a storm gathering momentum. The Centers for Disease Control and Prevention (CDC) have pointed out that a sixty percent of all the adults in the United States are dealing with chronic conditions, with heart disease and diabetes being the leading causes of death. The above statistics bring out-and-shining that have barbed the mortality rate connected with chronic diseases and thus called for innovative measures. AI-powered drug discovery platforms are recognized as a ray of light and with latest approaches promising to find treatment options and curtail the effects of these diseases the growth path of the market is fuelled.

AI is the motor of a high-speed train in drug discovery that analyzes large amounts of data, determines the likelihood of given molecules to interact, and suggests possible molecules to use as a drug in a significantly shorter time than employing conventional approaches. For example, Atomwise’s artificial intelligence system then planed virtual show, which identified a prospect cure for Ebola within several days that would have taken months through usual methods. This speed not only helps create new life-saving products but also attributes AI as one of the tools to address relevant medical emergent situations.

However, the addition of AI as an integrated part in drug discovery systems poses a great barrier that more resembles a mountain in terms of cost for small players in the market. Although the big pharma has the financial muscle to invest in such technologies, SMEs are significantly locked out by the high costs. In addition, the lack of sound fundamentals in the developing and underdeveloped parts of the globe corresponds to an unpaved road, through which people cannot travel to make AI-related advancements come true and extend the market.

To fill these gaps, the stakeholders of the industry are investing in AI, similar to building the base to be used in the future. In the last five years alone, both the public and private sectors have spent over one hundred and twenty five billion US dollars in this sector. Recent examples include Accenture’s investment in Turbine in May 2024 to boost the AI cell simulation capabilities of the firm; BenchSci’s 70 million USD Series D funding in 2023 to extend the ASCEND platform. While more than 40% of these investments occurred in the last two years, it is evident that the market leaders are keenly exploring the possibility of using AI to transform drug discovery.

Global Artificial Intelligence in Drug Discovery Market Segment Analysis

AI In Drug Discovery Market By Type

· Target Identification

· Molecule Screening

· De Novo Drug Design and Drug Optimization

· Preclinical and Clinical Testing

According to the report, the target identification segment was the largest segment in the artificial intelligence (AI) in drug discovery market in 2023. This dominance can be attributed to the fact that AI algorithms are able to process large dataset in the early stage of drug development to look for drug targets linked to certain diseases. AI cuts down time and costs for this process in a big way compared to conventional procedures that have to be followed. The increasing incidence of chronic and complicated diseases also increases the need for artificial intelligence in target identification because it helps to search for new drug targets in areas that were not considered before. Therefore, this segment is expected to remain the largest one within the market during the forecast period as well.

AI In Drug Discovery Market By Therapeutic Area

· Oncology

· Neurodegenerative Diseases

· Cardiovascular Disease

· Metabolic Diseases

· Infectious Disease

· Others

As per the artificial intelligence (AI) in drug discovery industry analysis, the oncology segment emerged as the largest revenue shareholder in 2023 with a share of 22% due to the escalating need for treatment of cancer across the world. As cancer is still one of the most significant threats to global human health, the stakes in the development of new treatments have risen significantly. Pursuant to the WHO analysis, there were 20 million new cancer cases and 9.7 million cancer-related deaths in the world in 2022. Artificial intelligence technologies have emerged as the game-changers in oncology due to their ability to handle large datasets, recognize new targets for drugs and estimate patient outcomes. This integration has helped in the fast identification of new cancer treatments, improved individual treatment plans, and enhanced clinical trial models making the segment crucial.

AI In Drug Discovery Market By Technology

· Machine Learning

o Deep Learning

o Supervised Learning

o Reinforcement Learning

o Unsupervised Learning

o Other Machine Learning Technologies

· Other Technologies

The machine learning segment, especially deep learning, accounted for the highest market share in the near past within the artificial intelligence (AI) in drug discovery market. This is because it has a unique feature of handling and analyzing large and complex biological data in order to identify drug targets, molecular interactions, and optimization of drug candidates. Neural networks, as a type of deep learning models, are particularly good at pattern recognition, which is beneficial for protein structure prediction, virtual screening, and other de novo drug design. Furthermore, its use by most of the top pharma companies and research labs for high accuracy uses has boosted it even further. Solid growth on this segment is attributed to the fact that deep learning is widely used to optimize and enhance drug development procedures.

AI In Drug Discovery Market By End-User

· Pharmaceutical and Biotechnology Companies

· Contract Research Organizations

· Academics and Research

As per the AI in drug discovery market forecast, the pharmaceutical and biotechnology companies are expected to dominate the industry throughout 2024 to 2032. This share is due to the increasing need for AI use in personalized medicine, allowing companies to optimize their drug discovery with fewer costs and more effective, safe products. The use of AI models enables these companies to derive a lot of information from large volumes of research data during the initial phases of drug development. AI shortens the time needed for forecasting both efficacy and safety of new compounds to a level that has taken over a decade and billions of dollars in the past. Tempus and Foundation Medicine (both American) are good examples of such companies that use AI platforms to enhance the efficiency of cancer treatment and rare diseases and improve the process of drug discovery innovation for patients.

Artificial Intelligence in Drug Discovery Market Regional Analysis

The North America region generated over 55% of the total market revenue in 2023 and is set to be a dominant market in the global AI in Drug Discovery market throughout the forecast period. This growth is attributed to the increasing numbers of pharmaceutical firms and key collaborations with AI solution firms. Another factor has been the increasing need for effective and efficient approaches to drug discovery and development in a relatively cost-sensitive region. Also, the rising incidence of chronic diseases and the large amount of funds being spent on drug development also contribute to the growth in this market. As highlighted in the Cushman & Wakefield’s report released in January 2023, drug discovery and biotechnology alone accounted for 72% of the funding recorded in the United States in 2022, which points to the region’s importance for the growth of AI pharmaceuticals.

Among the countries, China and India are the fastest-growing in the AI in drug discovery market, and they belong to the Asia-Pacific region. China’s government has placed much emphasis in the development of AI and biotechnology industries to make China the global hub of AI health care. Likewise, the Indian pharma industry is expanding its AI application to improve the processes of drug development. The growth is further accelerated by the fact that the region has access to large amounts of data and there is a rising trend in technology firms partnering with pharmaceuticals firms. These are the factors that are driving the uptake of AI in the drug discovery process, making it more efficient and cheaper ways of solving some of the most challenging diseases and growing the field of precision medication.

Artificial Intelligence in Drug Discovery Market Leading Companies

The Artificial Intelligence in Drug Discovery market players profiled in the report is Aitia (formerly GNS Healthcare), Atomwise, Inc., BenevolentAI, BPGbio, Inc. (acquired Berg Health), BioSymetrics, Inc., Cloud Pharmaceuticals, DeepMind (Google), Exscientia, IBM, Insilico Medicine, Inc., insitro, Microsoft Corporation, NVIDIA Corporation, Schrödinger, and Tempus, Inc.

Artificial Intelligence in Drug Discovery Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa