Biological Safety Testing Market Growth Opportunities and Forecast till 2032

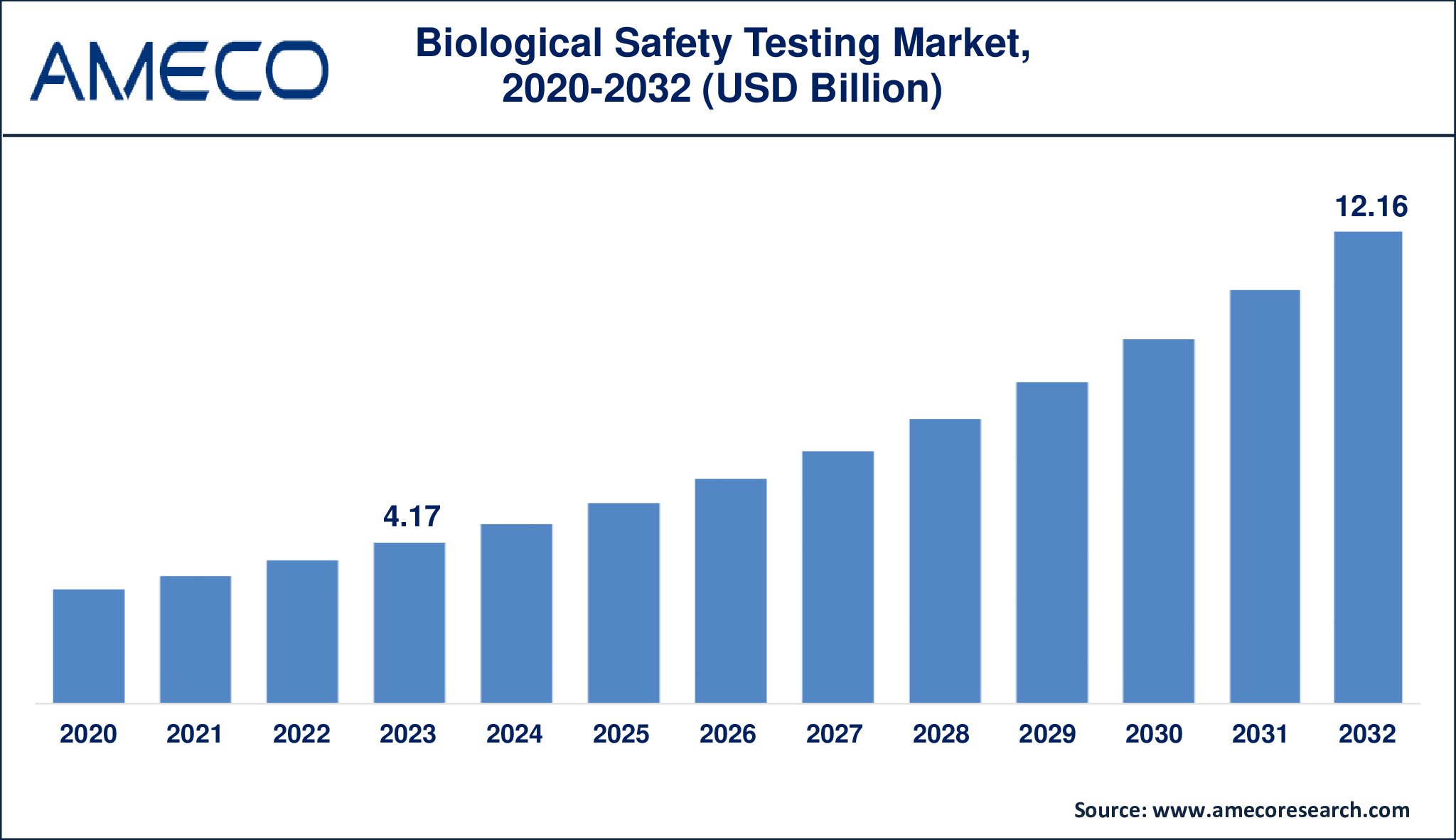

The Global Biological Safety Testing Market Size was valued at USD 4.17 Billion in 2023 and is anticipated to reach USD 12.16 Billion by 2032 with a CAGR of 12.8% from 2024 to 2032.

Biological safety testing can be defined as a series of assays used to determine biological hazards related to new biopharmaceutical products. This testing normally involves viral testing, microbial testing, cell testing, molecular testing and analytical testing to determine if there are any contaminants or risks in the food. The purpose is to help prevent introduction of unsafe products into the human environment or contamination of products like vaccines and biologics with hazardous pathogens or other contaminants.

These stringent testing measures are required by the regulatory bodies such as EMA and the FDA among others. Through these rigorous specifications, manufacturers can ensure that their products are safe from adverse impacts before they are sold in the market for human consumption.

|

Parameter |

Biological Safety Testing Market |

|

Biological Safety Testing Market Size in 2023 |

US$ 4.17 Billion |

|

Biological Safety Testing Market Forecast By 2032 |

US$ 12.16 Billion |

|

Biological Safety Testing Market CAGR During 2024 – 2032 |

12.8% |

|

Biological Safety Testing Market Analysis Period |

2020 - 2032 |

|

Biological Safety Testing Market Base Year |

2023 |

|

Biological Safety Testing Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Test Type, By Application, and By Region |

|

Biological Safety Testing Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

BIOMÉRIEUX, BSL Bioservice, Charles River Laboratories, Eurofins Scientific, Lonza, Merck KGaA (MilliporeSigma), Samsung Biologics, Sartorius AG, SGS Société Générale de Surveillance SA, and Thermo Fisher Scientific Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Biological Safety Testing Market Dynamics

The market for biological safety testing products and services is expected to grow rapidly because of the focus on the development of new drugs and therapies, as well as the need for the biological safety of these treatments for health problems. This market is projected to expand with the help of technological developments in the healthcare sector since innovations help in refining the test processes and increasing the safety assessment of the biopharmaceutical products.

The increase in the demand of biologics has also led to increase in the number of biopharmaceutical companies to develop therapeutic drugs and increase production to meet demand. This has led to the call for betterment of the industrial processes, where manufacturers have shifted towards bettering the cost and production aspect. For instance, in July 2023, Biocon Biologics, an India-based company, launched Humira, a biosimilar of AbbVie’s rheumatoid arthritis drug, in the U.S. at a cheaper price to enhance the accessibility of the product. The increasing use of advanced manufacturing practices that include comprehensive biological testing at different manufacturing phases is helping organizations to adopt the market. However, the requirement of sophisticated testing facilities, particularly for cell and gene therapies, as well as the scarcity of qualified personnel with experience in biopharmaceutical testing is issues that may act as constraints to the market growth path.

The growth rate of the market for safety testing of biologics is being driven by the rising R&D expenditure in the biopharmaceutical industry. The increasing global prevalence of diseases including diabetes, cancer, neurological and cardiovascular diseases has led to the need for new therapies. As the above diseases become more widespread, there is an increase in innovation for drugs, diagnostics, cell therapies, and other active biological products.

Also, there has been an increase in the number of biotechnology and pharmaceutical firms together with increased research and development expenditure by major players in the life science industry which has led to the discovery of new drugs. This trend is anticipated to continue to drive the biologics safety testing market in the future years.

Global Biological Safety Testing Market Segment Analysis

Biological Safety Testing Market By Product

· Reagents & Kits

· Instruments

· Services

The reagents & kits segment was the largest segment of the biological safety testing products market in 2023. This segment has been expanding due to increasing demand in biological safety testing in biopharmaceutical and biotechnological companies. The expanding use of biologics, vaccines, and biosimilar drugs has enhanced the utilization of these testing kits to screen products for safety and regulatory compliance. Reagents & Kits are highly reliable and can be used for several tests including endotoxin, bioburden and sterility tests.

Biological Safety Testing Market By Test Type

· Endotoxin Tests

· Sterility Tests

· Cell Line Authentication and Characterization Tests

· Residual Host Contamination Detection Tests

· Adventitious Agent Detection Tests

· Bioburden tests

· Other Tests

According to the biological safety testing industry analysis, the endotoxin tests segment held the largest share in the biological safety testing market. This test type is really important in the field of biologics, which may include therapeutic drugs and vaccines, because bacterial endotoxins in these products are undesirable. This segment has experienced growth due to the rising need for accurate methods of testing products that are used in biopharmaceutical applications. To further strengthen its market leadership, companies have also developed new and efficient endotoxin testing methods such as those of Lonza.

Biological Safety Testing Market By Application

· Blood and Blood-related Products Testing

· Vaccine and Therapeutics Development

· Cellular and Gene Therapy

· Tissue and Tissue-related Products Testing

· Stem Cell Research

Depending on the biological safety testing market size, the vaccine and therapeutic development application segment is expected to lead throughout 2024 to 2032. This growth is majorly attributed to the continuous research and development of vaccines, such as the COVID-19 mRNA vaccines and other emerging infectious diseases that need thorough safety assessments. Secondly, the constant emergence of new products and the growing need for safer biologics are the factors that support this segment’s stability. In addition, progress in biologics production and an emphasis on compliance provide the basis for the growth of vaccine and therapeutic safety testing..

Biological Safety Testing Market Regional Analysis

The largest market share of the biological safety testing was in the North American region primarily because of the well developed biopharmaceutical industry and the regulatory norms for new therapeutic entities. The existence of a strong healthcare industry coupled with the regulatory control by agencies such as the FDA has created high demand for biological safety testing products and services. This makes certain that all the biologics, vaccines, and other therapeutics are of high safety before they are released in the market. In addition, large scale biopharmaceutical companies based in North America remain focused on research and development thus increasing the demand for safety testing.

On the other hand, the Asia Pacific is expected to grow at a faster rate than the other regions in the forecast period. The Indian and Chinese governments, as well as private industries, are increasing pharmaceutical investments in their countries. For example, in June 2023, Worg Pharmaceuticals, a China-based company, raised $152 million in a Series C round to advance immunotherapies for autoimmune and allergic diseases. The growth in biological safety testing in the Asia Pacific region over the next few years will be supported by such huge investments, increasing manufacturing capacities, and favorable government policies.

Biological Safety Testing Market Leading Companies

The biological safety testing market players profiled in the report is BIOMÉRIEUX, BSL Bioservice, Charles River Laboratories, Eurofins Scientific, Lonza, Merck KGaA (MilliporeSigma), Samsung Biologics, Sartorius AG, SGS Société Générale de Surveillance SA, and Thermo Fisher Scientific Inc.

Biological Safety Testing Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa