Cancer Biomarkers Market Growth Opportunities and Forecast till 2032

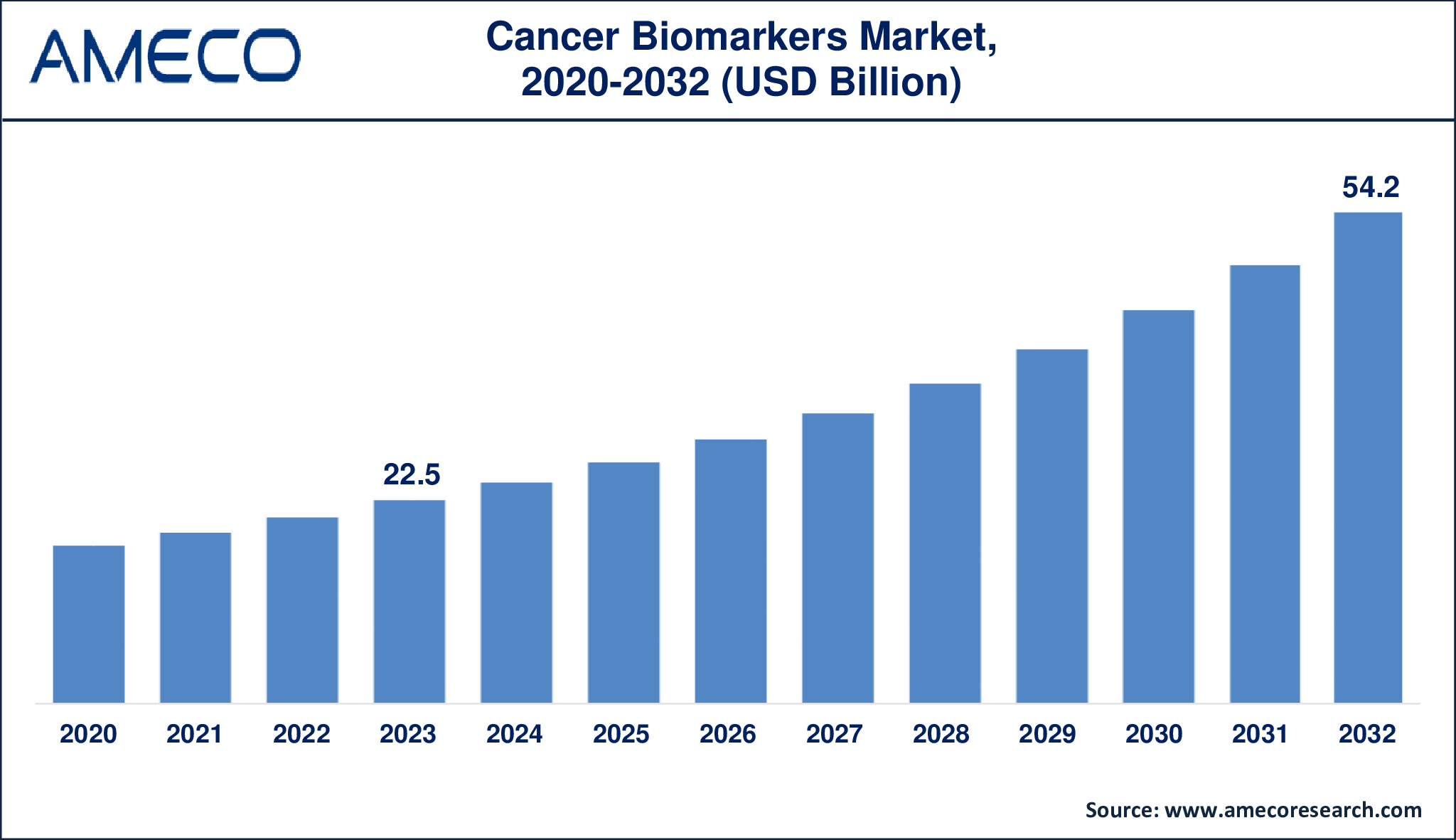

The Global Cancer Biomarkers Market Size was valued at USD 22.5 Billion in 2023 and is anticipated to reach USD 54.2 Billion by 2032 with a CAGR of 10.5% from 2024 to 2032.

Cancer biomarkers, also known as tumor markers, are genes, proteins, or other substances that provide crucial insights into cancer's presence, progression, and treatment. Cancer biomarkers that exist in blood, urine, tissue, and other bodily fluids show biological processes, including DNA mutations, cell growth changes, and metabolic alterations that point to cancer development. These biomarkers exist in different forms, such as DNA, mRNA, proteins, and metabolite, es as well as cellular activities, including apoptosis, angiogenesis, and proliferation. Biomarkers are either produced directly by tumors or generated by the body as responses to cancer or linked health conditions, including inflammation. Biomarkers now play a vital role in cancer detection, treatment evaluation, and therapy selection because they help doctors provide individualized care and track disease evolution. High-throughput screening enabled by genomics and proteomics technology allows researchers to detect multiple biomarkers at once, thus improving early detection and precise oncology treatments.

|

Parameter |

Cancer Biomarkers Market |

|

Cancer Biomarkers Market Size in 2023 |

US$ 22.5 Billion |

|

Cancer Biomarkers Market Forecast By 2032 |

US$ 54.2 Billion |

|

Cancer Biomarkers Market CAGR During 2024 – 2032 |

10.5% |

|

Cancer Biomarkers Market Analysis Period |

2020 - 2032 |

|

Cancer Biomarkers Market Base Year |

2023 |

|

Cancer Biomarkers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Cancer Type, By Technology, By Biomolecule, By Application, and By Region |

|

Cancer Biomarkers Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Abbott, Affymetrix Inc., Agilent Technologies, F. Hoffmann-La Roche AG, Hologic, Inc., Illumina, Inc., Merck & Co. Inc., QIAGEN, Sino Biological Inc., and Thermo Fisher Scientific Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Cancer Biomarkers Market Dynamics

The cancer biomarkers market is expanding rapidly owing to the escalating worldwide cancer cases. The American Cancer Society predicts that 1.9 million new cancer diagnoses have occurred in the United States during 2024 based on their "Cancer Facts & Figures 2024" report. This rising incidence underscores the critical need for early detection and personalized treatment strategies, where cancer biomarkers play a pivotal role. The cancer biomarker market continues to grow because of the technological advancements including liquid biopsies and genomic profiling that has developed better methods to monitor cancer through noninvasive procedures.

However, several challenges impede the widespread clinical implementation of cancer biomarkers. Tumor heterogeneity presents a major challenge to medical practice because genetic variations between tumors and within tumors result in irregular biomarker expression, which makes diagnosis and treatment planning difficult. Technical constraints such as demanding biomarker assay performance characteristics reduce their practical use in clinical settings. Biomarker development and validation processes create substantial financial barriers because of their expensive nature. According to the U.S. Department of Health and Human Services report, the biomarker development process requires four key stages that are identification followed by assay development, analytical validation, and clinical validation, which collectively drive total costs. The process of biomarker approval for clinical use becomes more complicated because regulatory requirements demand robust evidence showing both safety and efficacy before approval.

Despite these challenges, the market presents substantial opportunities. The integration of artificial intelligence (AI) and machine learning in biomarker research is revolutionizing data analysis, enabling the identification of novel biomarkers and the development of predictive models for treatment response. The rise of precision oncology has created more biomarker-based clinical trials which help researchers discover treatment options matching specific patient characteristics. The analysis of whole exome sequencing, whole genome sequencing and RNA sequencing provides detailed insights about cancer genetic and molecular foundations which enables accurate diagnostic procedures and individualized treatment strategies.

Global Cancer Biomarkers Market Segment Analysis

Cancer Biomarkers Market By Cancer Type

· Breast Cancer

· Lung Cancer

· Prostate Cancer

· Colorectal Cancer

· Cervical Cancer

· Thyroid Gland Cancer

· Kidney Cancer

· Liver Cancer

· Others

As per the cancer biomarkers industry analysis, the breast cancer consistently maintains its position as the largest segment because breast cancer affects many patients globally and increased early detection awareness. WHO reports breast cancer as the leading diagnosed cancer worldwide based on 2.3 million new cases and 670,000 deaths recorded in 2022. Breast cancer will affect 310,720 women in the United States during 2024 and will be responsible for 30% of new female cancer cases resulting in 42,250 anticipated deaths. The breast cancer biomarker segment leads the market due to ongoing research into biomarkers and screening technology development. Breast cancer biomarker validation research through major funding initiatives has enabled precision medicine by improving both early detection and treatment assessment and targeted therapeutic development.

Cancer Biomarkers Market By Technology

· Omics Technology

· Imaging Technology

· Cytogenetic Testing

Among the technology segment, omics technology sub-segment occupied the market because these technologies analyze biological molecules in a comprehensive manner to enhance cancer biology understanding. Genomics together with proteomics and transcriptomics and metabolomics functions as a single category to discover novel biomarkers which help advance personalized medicine. These technologies continue to gain widespread use in pharmaceutical research activities which has made them dominate market positions.

Cancer Biomarkers Market By Biomolecule

· Epigenetic Biomarkers

· Genetic Biomarkers

· Proteomic Biomarkers

· Metabolic Biomarkers

· Others

The genetic biomarkers segment stands as the leading market segment in the cancer biomarkers market. The leading position of genetic biomarkers in the market stems from their fundamental role in cancer molecular studies which supports both early-stage diagnosis and targeted therapy development. The capability to analyze genetic biomarkers in non-invasive biofluids including blood or serum promotes faster cancer detection which enhances their clinical adoption. The worldwide increase in cancer incidence emphasizes why genetic biomarkers are essential for personalized medicine. Medical treatment plans become more effective when healthcare providers use specific genetic mutations to identify individual cancer types which lead to better patient results and fewer negative side effects.

Cancer Biomarkers Market By Application

· Diagnostics

· Drug Discovery and Development

· Personalized Medicine

· Others

As per the cancer biomarkers market forecast, the diagnostics application segment is expected to lead the industry from 2024 through 2032. The rise of early cancer detection practices drives this market growth because it leads to better treatment results and extended patient survival durations. Advanced diagnostic procedures benefit from technological advancements which include liquid biopsies and genomic profiling to enhance biomarker adoption within clinical practice. Global cancer incidence rates have boosted the significance of diagnostic tools because they need efficient and accurate diagnostic tools. Biomarkers enable medical professionals to identify particular cancer types and stages as well as predict treatment responses which make them essential for personalized medicine. The market expansion of this segment gains momentum due to increased healthcare provider and patient understanding of early diagnosis and customized treatment approaches.

Cancer Biomarkers Market Regional Analysis

The North American cancer biomarkers market demonstrated strong growth in 2023 because of increasing cancer rates and the active participation of leading industry companies. Breast cancer cases have dramatically increased within the United States resulting in significant impact on women although breast cancer remains uncommon among male populations. The U.S. women are anticipated to receive diagnoses for 51,400 non-invasive (in situ) breast cancers and 287,850 invasive breast cancers as reported by Breastcancer.org during March 2022. Market growth in North America will be propelled by the increasing cancer prevalence because it enhances early diagnosis and treatment with cancer biomarkers.

The Asia-Pacific market will demonstrate notable compound annual growth rate between 2024 and 2032 because biomarker-based tests for cancer diagnosis gain popularity alongside laboratory implementation of technologically advanced instruments. The Asia-Pacific market expands because of growing public and private organization investment in biomarker research and development and their increasing application in both patient stratification and drug development processes. Market growth in Latin America and Middle East & Africa will significantly contribute to the forecast period through the combination of increasing cancer prevalence and growing awareness about biomarker diagnostic methods.

Cancer Biomarkers Market Leading Companies

The cancer biomarkers market players profiled in the report is Abbott, Affymetrix Inc., Agilent Technologies, F. Hoffmann-La Roche AG, Hologic, Inc., Illumina, Inc., Merck & Co. Inc., QIAGEN, Sino Biological Inc., and Thermo Fisher Scientific Inc.

Cancer Biomarkers Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa