Foam Packaging Market Growth Opportunities and Forecast till 2032

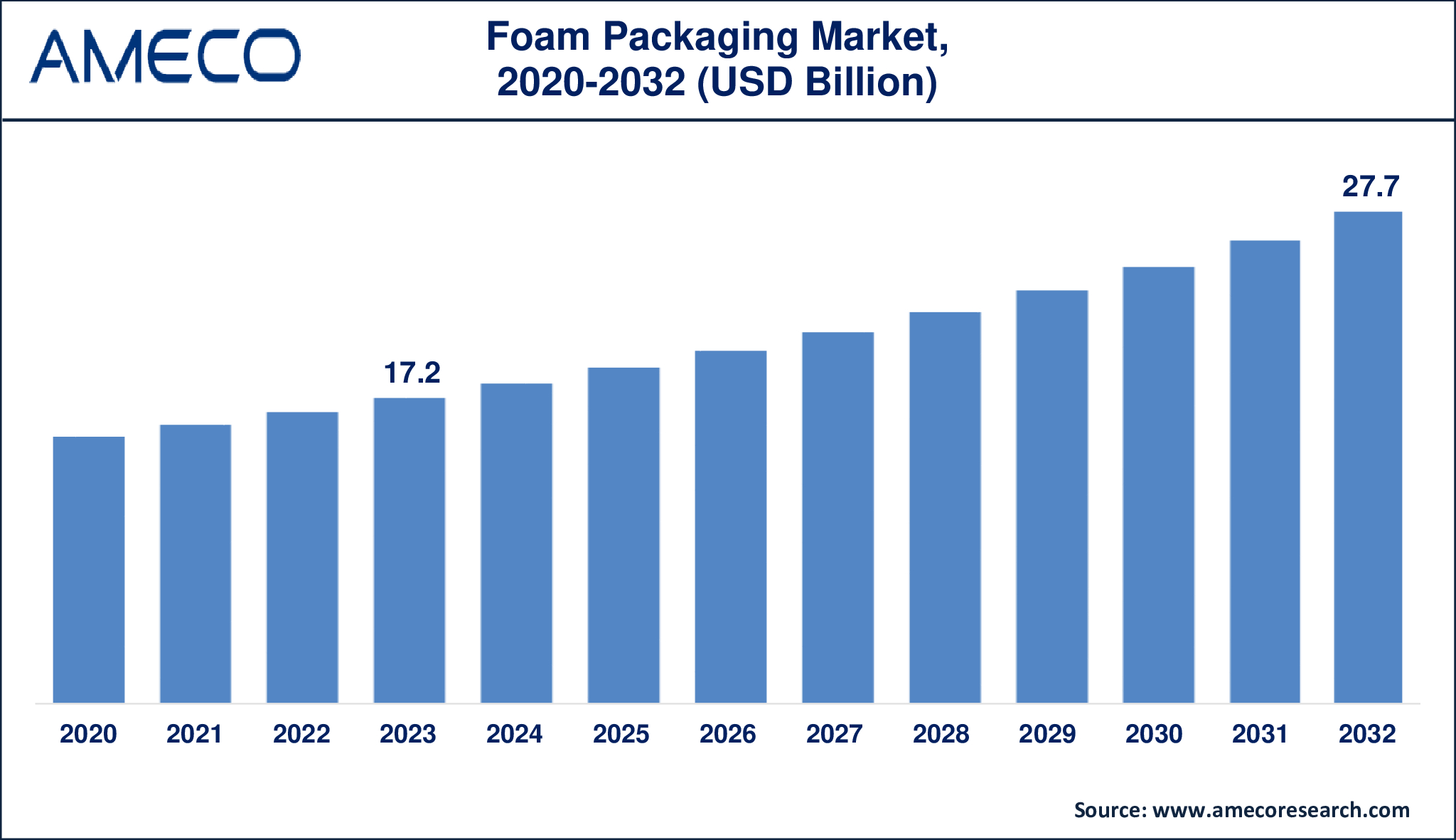

The Global Foam Packaging Market Size was valued at USD 17.2 Billion in 2023 and is anticipated to reach USD 27.7 Billion by 2032 with a CAGR of 5.5% from 2024 to 2032.

Foam packaging is the use of foam materials to protect, cushion, and insulate objects during transit and storage. It is widely used in many industries, including electronics, appliances, food, pharmaceuticals, and automobiles. Polyethylene (PE) foam, expanded polystyrene (EPS), and polyurethane (PU) foam are common packaging materials because they are lightweight, shock-absorbing, and versatile. These materials can be easily molded or cut into specified forms, offering personalized protection for fragile or sensitive products and ensuring they arrive in good condition.

Additionally, foam packaging provides advantages such as thermal insulation, moisture resistance, and reusability. It preserves the integrity of temperature-sensitive products and protects them from external variables such as humidity and temperature variations. Foam packaging is a popular choice among producers and merchants that want to prevent product damage and improve consumer happiness due to its simplicity of customization and ability to provide exceptional protection. With developments in recycling and eco-friendly foam materials, foam packaging is evolving to balance usefulness and environmental concerns.

|

Parameter |

Foam Packaging Market |

|

Foam Packaging Market Size in 2023 |

US$ 17.2 Billion |

|

Foam Packaging Market Forecast By 2032 |

US$ 27.7 Billion |

|

Foam Packaging Market CAGR During 2024 – 2032 |

5.5% |

|

Foam Packaging Market Analysis Period |

2020 - 2032 |

|

Foam Packaging Market Base Year |

2023 |

|

Foam Packaging Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material, By Structure, By End Use, and By Region |

|

Foam Packaging Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Arkema, Armacell, BASF SE, Dart Container Corporation, Foampartner Group, Genpak, JSP, Kaneka Corporation, Pactiv LLC, Pregis LLC, Rogers Corporation, Sealed Air Corporation, Sonoco Products Company, Synthos SA, WinCup, and Zotefoams Plc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Foam Packaging Market Dynamics

Several important variables drive the foam packaging market, including increased need for protective packaging in industries such as electronics, food and beverage, pharmaceuticals, and automotive. As e-commerce grows, there is a greater demand for dependable packaging solutions that assure product safety during transit. Foam packaging materials, known for their lightweight, shock-absorbing, and insulating features, are suitable for meeting these requirements, since they provide effective protection against damage and contaminants. The expansion of e-commerce, combined with increased customer expectations for product quality, is considerably driving demand for foam packing solutions.

Technological improvements and innovation in foam packing materials are also important factors in driving market dynamics. Companies are investing in R&D to develop more sustainable and eco-friendly foam products, addressing growing environmental concerns about traditional foam materials. Biodegradable foams, recyclable materials, and manufacturing process innovations are gaining acceptance, allowing businesses to provide environmentally friendly packaging solutions while maintaining performance. This shift toward sustainability is being driven not only by legislative forces, but also by customer preferences for greener products, which in turn influence market patterns.

However, the foam packaging market confronts hurdles, including the environmental impact of non-biodegradable foam waste and tight laws aimed at reducing plastic consumption. The industry's reliance on petroleum-based raw materials exposes it to price volatility, which affects manufacturing costs. To address these issues, businesses are looking into alternate raw materials and implementing recycling programs to lessen their environmental impact. Collaboration with regulatory agencies and the implementation of circular economy ideas are also becoming critical tactics for sustaining market competitiveness. Despite these obstacles, the foam packaging market is likely to grow further, fueled by continued innovation and increased demand for protective and sustainable packaging solutions.

Global Foam Packaging Market Segment Analysis

Foam Packaging Market By Material

· Polystyrene

· Polyethylene

· EPS

· Polyurethane

· Others

According to the foam packaging industry analysis, the polystyrene has long dominated the foam packaging market because of its vast availability, low cost, and versatility. Expanded polystyrene (EPS), a form of polystyrene, is especially popular for packaging delicate objects like electronics and appliances due to its superior cushioning and insulating features. The lightweight nature of EPS minimizes shipping costs, and its flexibility to be molded into numerous shapes allows for customized protection for a wide range of products. Furthermore, its use in food packaging, including as disposable containers and trays, reinforces its market dominance. Despite growing environmental concerns and a push for more sustainable alternatives, polystyrene is still a popular material in the foam packaging business due to its proven performance and cost benefits.

Foam Packaging Market By Structure

· Flexible

· Rigid

Flexible foam packaging is expected to achieve substantial market share by 2023. This rise is being driven by its versatility, adaptability, and great cushioning capabilities, which make it perfect for protecting a wide range of products, including electronics and fragile consumer goods. Flexible foam materials such as polyethylene and polyurethane provide superior shock absorption, insulation, and moisture resistance, ensuring product safety throughout transit and storage. Furthermore, the rise of e-commerce and the growing demand for lightweight, cost-effective packaging solutions help to boost the popularity of flexible foam. Its capacity to be easily customized and its compliance with sustainable practices, such as recyclability and the use of eco-friendly materials, further enhances its appeal in the present market environment.

Foam Packaging Market By End Use

· Food and Beverage

· Pharmaceutical

· Automotive

· Personal Care

· Industrial

· Electrical and Electronics

· Consumer Packaging

· Others

As per the foam packaging market forecast, the food and beverage end-use segment is expected to gather the largest market share from 2024 to 2032. This dominance stems from the growing demand for easy and safe food packaging solutions that maintain product freshness, increase shelf life, and provide protection during transit. The expanding popularity of online food delivery services, as well as the increased consumption of ready-to-eat meals, are driving up demand for foam packaging in this industry. Furthermore, the food and beverage industry's demanding hygiene and packaging standards make foam materials, particularly expanded polystyrene (EPS), an appealing option due to their outstanding insulating characteristics, lightweight nature, and cost-effectiveness.

Foam Packaging Market Regional Analysis

The foam packaging market has varying growth patterns across regions, with North America and Asia-Pacific leading the way. North America, notably the United States, is a prominent market because to strong demand in industries such as food and beverage, medicines, and e-commerce. The region's established infrastructure, strong consumer spending, and demanding packaging standards all contribute to a steady demand for foam packaging solutions. Furthermore, the push for sustainable packaging is driving innovation and the use of eco-friendly foam materials, which is fueling market expansion in North America.

Asia-Pacific is predicted to have the quickest growth in the foam packaging market, owing to growing industrialization, urbanization, and the expansion of e-commerce in countries such as China and India. The growing middle class, rising disposable incomes, and increased consumer awareness of product safety and quality are driving demand for effective packaging solutions. Furthermore, the presence of a significant manufacturing base and favorable government policies that promote industrial growth help to expand the region's market. As a result, Asia-Pacific is growing as a major hub for the production and consumption of foam packaging materials, establishing it as a vital player in global market dynamics.

Foam Packaging Market Leading Companies

The Foam Packaging market players profiled in the report is Arkema, Armacell, BASF SE, Dart Container Corporation, Foampartner Group, Genpak, JSP, Kaneka Corporation, Pactiv LLC, Pregis LLC, Rogers Corporation, Sealed Air Corporation, Sonoco Products Company, Synthos SA, WinCup, and Zotefoams Plc.

Foam Packaging Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa