Healthcare Staffing Market Growth Opportunities and Forecast till 2032

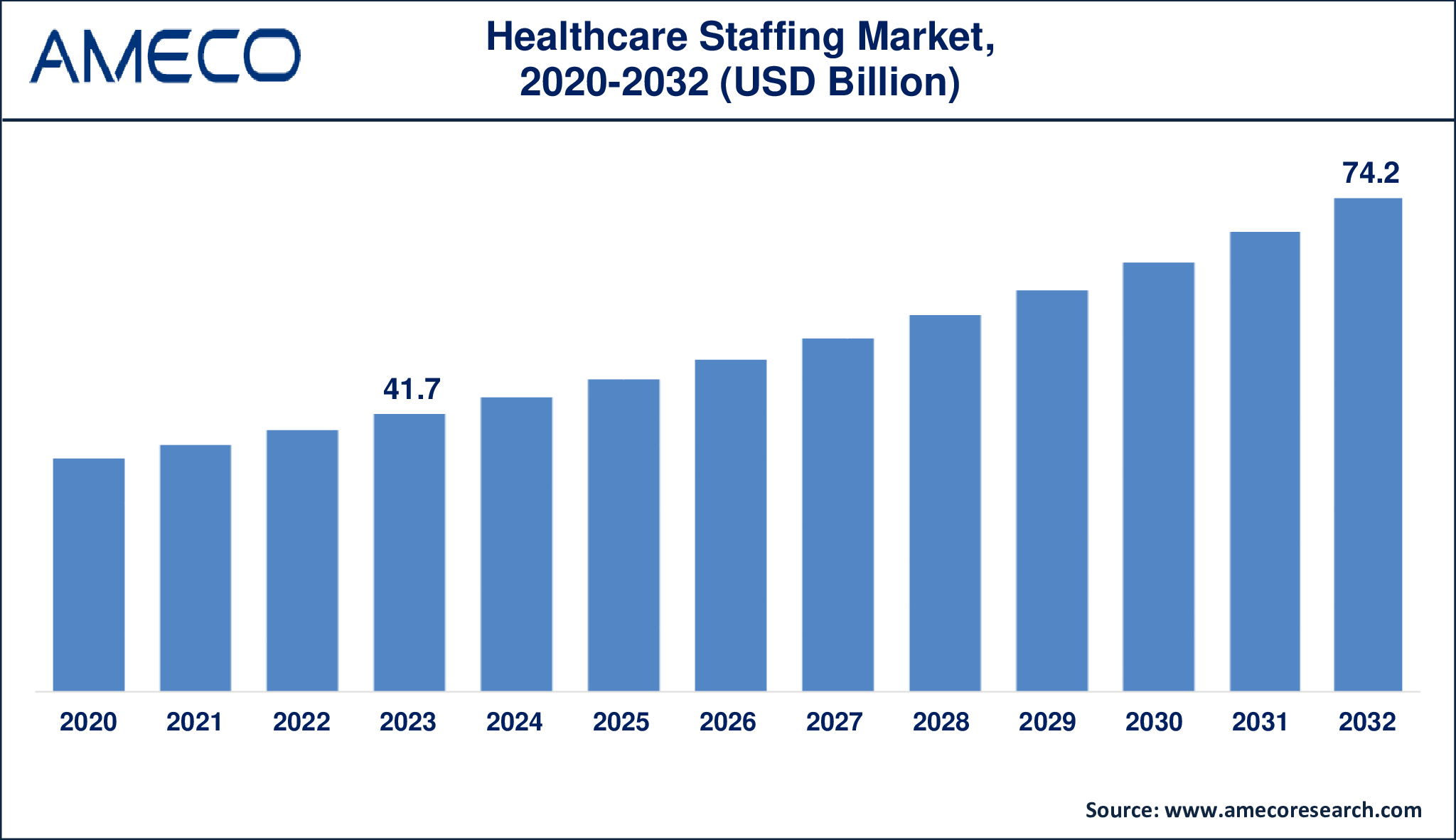

The Global Healthcare Staffing Market Size was valued at USD 41.7 Billion in 2023 and is anticipated to reach USD 74.2 Billion by 2032 with a CAGR of 6.7% from 2024 to 2032.

Healthcare staffing is the placement of temporary, permanent, or travel healthcare professionals at medical facilities such as hospitals, clinics, and long-term care facilities. This industry responds to labor shortages and shifting demand by providing competent nurses, physicians, allied health professionals, and other medical personnel. With technological improvements, healthcare staffing has expanded to encompass innovative platforms for better labor management and on-demand employment options.

According to the National Institute of Health (NIH), healthcare staffing needs are determined not only by calculating the optimal number of professionals, but also by describing how the professional workforce supports the development of healthcare organizations and meets the population's care demands. The NIH also emphasizes the expanding relevance of healthcare staffing, which is likely to propel market growth in the future.

|

Parameter |

Healthcare Staffing Market |

|

Healthcare Staffing Market Size in 2023 |

US$ 41.7 Billion |

|

Healthcare Staffing Market Forecast By 2032 |

US$ 74.2 Billion |

|

Healthcare Staffing Market CAGR During 2024 – 2032 |

6.7% |

|

Healthcare Staffing Market Analysis Period |

2020 - 2032 |

|

Healthcare Staffing Market Base Year |

2023 |

|

Healthcare Staffing Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Service Type, By End-use, and By Region |

|

Healthcare Staffing Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Trustaff, TeamHealth, Adecco Group, Maxim Healthcare Group, CHG Management, Inc., Cross Country Healthcare, Inc., Aya Healthcare, AMN Healthcare, Envision Healthcare Corporation, and LocumTenens.com. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Healthcare Staffing Market Dynamics

The aging population raises the need for healthcare services, as the elderly require more frequent medical treatment. For example, the Economic and Social Commission for Asia and the Pacific (ESCAP) estimates that 721 million individuals aged 60 and up would live in the region by 2024, accounting for about one out of every seven people. By 2050, it is expected that one out of every four people in this region will be of this age, totaling around 1.3 billion older individuals. This has resulted in an increase in demand for healthcare workers across a variety of professions. According to the India Brand Equity Foundation (IBEF), the health-tech sector is set to expand significantly, with hiring predicted to climb by 15-20% by 2024, reflecting increased demand for new healthcare solutions and the integration of technology into medical services. The scarcity of permanent personnel fuels the demand for temporary and flexible labor solutions.

Healthcare facilities are increasingly relying on temporary and travel workforce solutions to meet changing demand. These methods provide flexibility and allow companies to quickly fill critical staffing vacancies. This trend is especially visible during emergencies, such as pandemics, when a rapid staff expansion is required.

The healthcare staffing industry is subject to stringent regulations regarding licensing, working hours, and employee rights. These regulations may complicate operations and raise costs for staffing agencies. Noncompliance with the guidelines might result in fines or legal action, which slows market expansion.

The usage of AI-powered platforms and digital tools streamlines the employment process while increasing efficiency and applicant matching. AI-powered platforms, such as HireVue and Paradox, have gained popularity in the healthcare industry, facilitating hiring through virtual interviews and soft skills assessments while reducing time spent on initial candidate screening. These developments allow agencies to provide an on-demand workforce while also improving the user experience for businesses and healthcare providers. The digital transformation opens up enormous opportunities for growth in a competitive business.

Global Healthcare Staffing Market Segment Analysis

Healthcare Staffing Market By Service Type

· Travel Nurse

· Locum Tenens

· Per Diem Nurse

· Allied Healthcare

According to the healthcare staffing market, travel nurse service market focuses on supplying temporary nursing professionals to healthcare facilities experiencing short-term or regional staffing shortages. Travel nurses are hired for jobs that last anything from a few weeks to months, generally in high-demand locales. These services give healthcare professionals more freedom while also providing nurses with opportunity for various experiences and attractive remuneration. The segment has grown significantly, driven by rising demand for specialist care and the need to overcome regional staffing gaps, especially during pandemics.

Healthcare Staffing Market By End-use

· Hospitals

· Clinics

· Deep Learning

· Others

As per the healthcare staffing industry analysis, hospital segment is the largest end-user due to the continual demand for a diverse spectrum of medical personnel, including nurses, physicians, and allied health staff. Hospitals frequently encounter variable patient loads, staff turnover, and specialized care demands, necessitating temporary and travel personnel. Hospitals rely on staffing agencies to provide crucial care continuity, particularly during emergencies. This dominance is strengthened by the size and complexity of hospital operations, which necessitate professional worker assistance.

Healthcare Staffing Market Regional Analysis

North America dominates the healthcare staffing industry because of its advanced healthcare infrastructure, high demand for specialist professionals, and well-established temporary staffing model. For example, in November 2022, MedPro Healthcare Staffing launched MPX+, a new way to experience MedPro. MPX+ empowers travelers. Users have access to jobs, applications, credentials, assignment data, and other information at any time. The region's aging population and rising chronic disease cases increase the need for additional healthcare workers. The US Department of Health and Human Services estimates that 129 million Americans suffer from at least one significant chronic ailment, such as cancer, diabetes, heart disease, obesity, or hypertension. Furthermore, the use of digital staffing platforms and substantial investments in workforce solutions contribute to its leadership position.

The Asia-Pacific region's healthcare staffing market is rising rapidly, owing to increased healthcare infrastructure and medical service investments. The India Brand Equity Foundation believes that the Indian healthcare sector is seeing unprecedented growth, with private equity and venture capital investments exceeding US$ 1 billion in the first five months of 2024, a 220% increase over the previous year. Population expansion and government healthcare efforts are driving up demand for qualified experts in countries such as India and China.

Healthcare Staffing Market Leading Companies

The healthcare staffing market players profiled in the report is Trustaff, TeamHealth, Adecco Group, Maxim Healthcare Group, CHG Management, Inc., Cross Country Healthcare, Inc., Aya Healthcare, AMN Healthcare, Envision Healthcare Corporation, and LocumTenens.com

Healthcare Staffing Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa