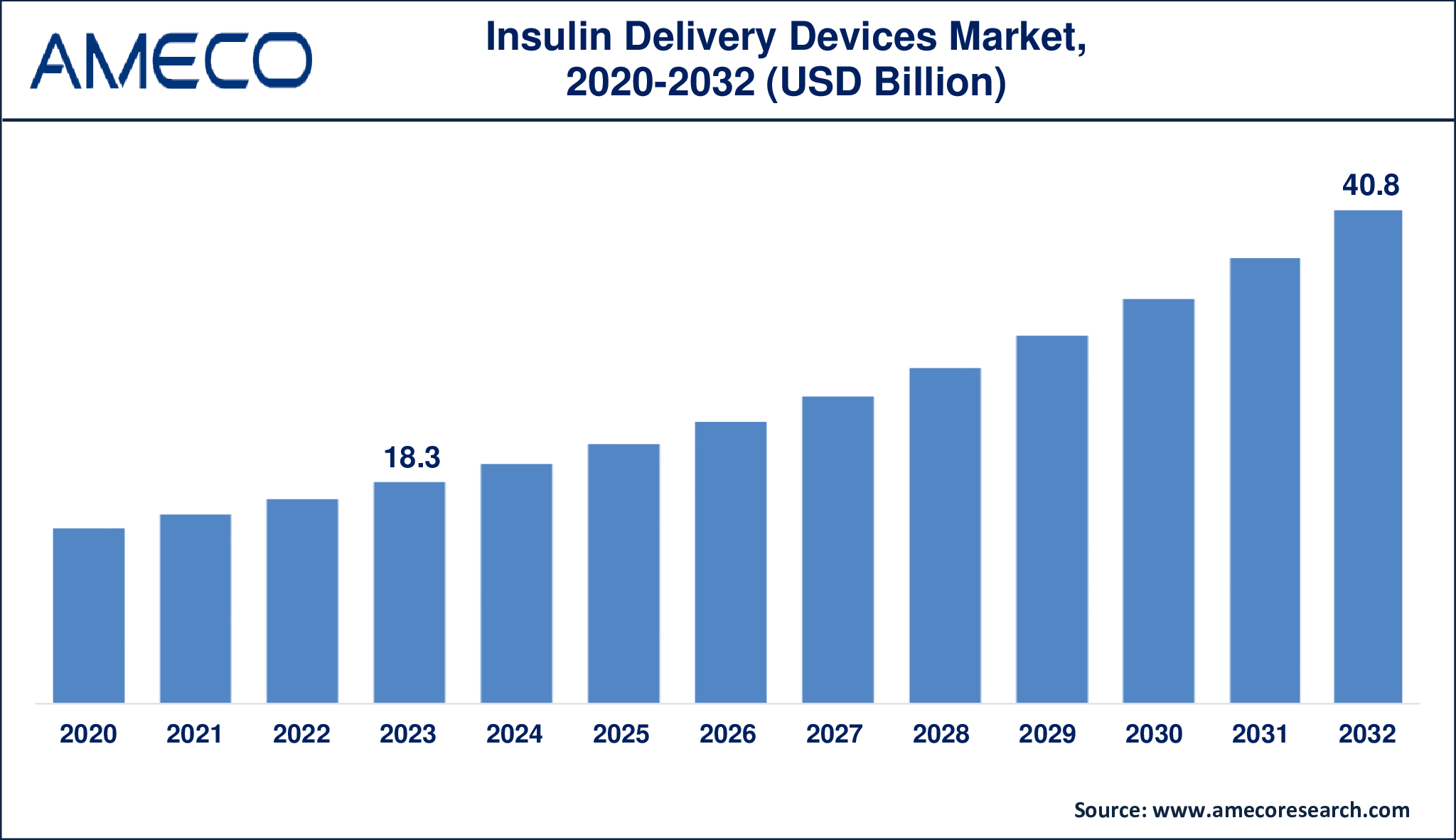

Insulin Delivery Devices Market Growth Opportunities and Forecast till 2032

The Global Insulin Delivery Devices Market Size was valued at USD 18.3 Billion in 2023 and is anticipated to reach USD 40.8 Billion by 2032 with a CAGR of 9.5% from 2024 to 2032.

Insulin delivery devices are medical instruments used to provide insulin to diabetics, hence regulating blood sugar levels. According to the National Institutes of Health (NIH), insulin delivery device systems have proven to be the most effective technology for enhancing metabolic control and may hold the key to achieving goal-level glycemic control for persons with type 1 diabetes.

Insulin delivery devices include insulin pens, pumps, syringes, and inhalers, which each provide a different manner of insulin administration. They play an important role in diabetes management by ensuring accurate and constant insulin administration. Applications include home care, hospitals, and clinics, which improve patient outcomes through better glucose control.

|

Parameter |

Insulin Delivery Devices Market |

|

Insulin Delivery Devices Market Size in 2023 |

US$ 18.3 Billion |

|

Insulin Delivery Devices Market Forecast By 2032 |

US$ 40.8 Billion |

|

Insulin Delivery Devices Market CAGR During 2024 – 2032 |

9.5% |

|

Insulin Delivery Devices Market Analysis Period |

2020 - 2032 |

|

Insulin Delivery Devices Market Base Year |

2023 |

|

Insulin Delivery Devices Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By End Use, By Distribution Channel, and By Region |

|

Insulin Delivery Devices Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Ypsomed AG, Novo Nordisk A/S, Tandem Diabetes Care, Inc., Eli Lilly and Company, BD (Becton, Dickinson and Company), Sanofi, Insulet Corporation, Owen Mumford Ltd., Medtronic, and B. Braun SE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Insulin Delivery Devices Market Dynamics

The increasing prevalence of diabetes globally is a major driver for the insulin delivery devices market. According to a report published in 2023 by the Indian Council of Medical Research, India Diabetes (ICMR INDIAB), and diabetes affects 10.1 crore people. Additionally, Centers for Disease Control and Prevention states that between August 2021 and August 2023, the prevalence of total diabetes was 15.8%, diagnosed diabetes was 11.3%, and undiagnosed diabetes was 4.5% among people in the United States. Men had a greater total and diagnosed diabetes prevalence (18.0% and 12.9%, respectively) than women (13.7 and 9.7%). As the number of diabetes cases rises, the demand for effective insulin management solutions grows. This trend is particularly prominent in aging populations and regions with rising healthcare access.

High costs associated with advanced insulin delivery devices, such as insulin pumps, can limit their adoption, especially in low-income regions. Despite technological advancements, affordability remains a barrier for many patients who require consistent insulin therapy. This challenge affects market growth, particularly in developing countries.

Technological innovations, such as smart insulin pens and connected insulin pumps, present a significant opportunity in the market. For instance, in April 2023, Medtronic gained FDA approval for their MiniMed 780G System, the world's first insulin pump incorporating metal detection technology.

Furthermore, collaborations between key players for automated technology further enhance industry growth. For instance, Diabeloop, a pioneer in Automated Insulin Delivery technology, announced cooperation with Novo Nordisk, a well-known healthcare firm, in March 2023. This cooperation focuses on the integration of Diabeloop's powerful self-learning algorithm, DBL-4pen, which is specifically built for Multiple Daily Injections (MDI) therapy, with Novo Nordisk's unique, connected, and reusable insulin pens, the NovoPen 6 and NovoPen Echo Plus. Diabeloop is planning a customized research for people with Type 2 diabetes to evaluate the effectiveness and clinical benefits of this integrated approach. As a result, these devices offer enhanced user convenience and better glucose monitoring, creating a growing demand for advanced, personalized solutions. As digital health technologies integrate into diabetes care, the market is poised for expansion.

Global Insulin Delivery Devices Market Segment Analysis

Insulin Delivery Devices Market By Type

· Insulin Syringe

· Insulin Pens

· Insulin Jet Injectors

· Insulin Pumps

· Insulin Needles

· Insulin Inhalers

According to the insulin delivery devices industry, insulin pens dominate market due to their convenience, portability, and ease of use, making them ideal for daily self-administration. According to NIH, The ADA's 2023 Standards of Care promote linked insulin pens as an option for people with diabetes on injectable insulin therapy, and the guidelines state that their use can be useful for diabetes control in those on injectable therapy. They offer precise dosing and are more discreet compared to syringes, enhancing patient compliance. With the growing preference for non-invasive and user-friendly options, insulin pens are widely adopted by both type 1 and type 2 diabetes patients.

Insulin Delivery Devices Market By End Use

· Hospitals

· Clinics

· Ambulatory Care Centers

· Homecare

According to the insulin delivery devices industry, homecare dominates the insulin delivery devices market due to the increasing shift toward self-management of diabetes. Patients prefer managing their condition at home with convenient devices like insulin pens and pumps, reducing the need for frequent hospital visits. According to the Diabetes Journals Organization, everyone with hypertension or diabetes should check their blood pressure at home. This trend is further supported by advancements in technology, providing easy-to-use and accurate tools for home-based diabetes care.

Insulin Delivery Devices Market By Distribution Channel

· Hospital Pharmacies

· Retail Pharmacies

· Online Sales

· Diabetes Clinics & Centers

According to the insulin delivery devices market forecast, hospital pharmacies dominate market because they have direct access to healthcare experts and patients who need quick or specialized care. Hospitals play an important role in delivering insulin delivery devices, particularly for new patients beginning diabetes therapy or those with severe medical demands. The presence of skilled personnel ensures correct guidance when selecting and operating the appropriate device. Furthermore, hospital pharmacies frequently provide a broader selection of products, such as modern insulin pumps and continuous glucose monitoring systems, thereby increasing their market domination.

Insulin Delivery Devices Market Regional Analysis

By the year 2032, North America holds the largest share in the insulin delivery devices market, driven by a high prevalence of diabetes and advanced healthcare infrastructure. The region benefits from widespread access to innovative devices, and strong healthcare policies. With continuous advancements in diabetes management technologies, North America remains a key market leader. For instance, in May 2023, Beta Bionics got FDA approval for its iLet ACE Insulin Pump and the iLet Dosing Decision Software for controlling type 1 diabetes.

The Asia-Pacific region is experiencing rapid growth in the insulin delivery devices market due to increasing diabetes cases, improving healthcare access, and rising awareness about diabetes management. For instance, Terumo Corporation introduced an insulin syringe to India in November 2023 for patients who require daily insulin injections to control their illness. Economic development and government initiatives in countries like India and China are boosting market demand for affordable and effective insulin delivery solutions. This region is poised for significant market expansion in the coming years.

Insulin Delivery Devices Market Leading Companies

The insulin delivery devices market players profiled in the report is Ypsomed AG, Novo Nordisk A/S, Tandem Diabetes Care, Inc., Eli Lilly and Company, BD (Becton, Dickinson and Company), Sanofi, Insulet Corporation, Owen Mumford Ltd., Medtronic, and B. Braun SE.

Insulin Delivery Devices Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa