Medical Laser Market Growth Opportunities and Forecast till 2032

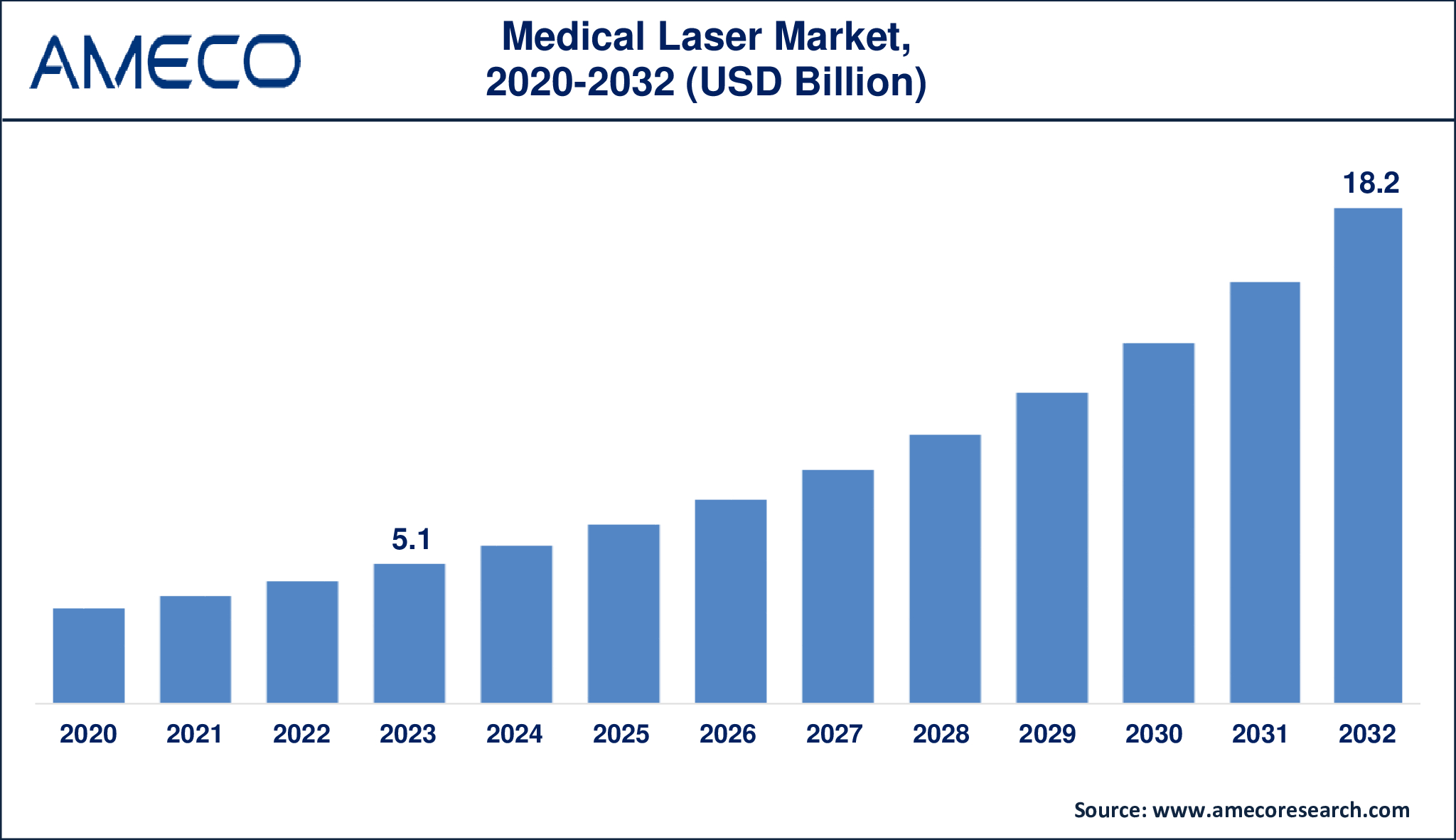

The Global Medical Laser Market Size was valued at USD 5.1 Billion in 2023 and is anticipated to reach USD 18.2 Billion by 2032 with a CAGR of 15.4% from 2024 to 2032.

A medical laser is powerful device that uses precise focused beams or light sources to treat or remove tissue. Lasers are in high demand in the medical sector as they can focus very accurately on tiny areas, thus used for precise surgical work or cutting through tissue. CO2 lasers, diode lasers, and erbium lasers are commonly used in surgical applications based on their ability to cut or coagulate tissues. Medical lasers are often used to treat varicose veins, remove tumors, remove kidney stones, improve vision during eye surgery, and remove parts of the prostate among others. The laser allows surgeons to accomplish critical tasks, decrease post-operative discomfort, reduce blood and the chance of wound infection, and at last, achieve better wound healing.

|

Parameter |

Medical Laser Market |

|

Medical Laser Market Size in 2023 |

US$ 5.1 Billion |

|

Medical Laser Market Forecast By 2032 |

US$ 18.2 Billion |

|

Medical Laser Market CAGR During 2024 – 2032 |

15.4% |

|

Medical Laser Market Analysis Period |

2020 - 2032 |

|

Medical Laser Market Base Year |

2023 |

|

Medical Laser Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Type, By End-Use, and By Region |

|

Medical Laser Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, Alcon, Inc., Alma Lasers, Ltd., Bausch Health Companies, Inc., BIOLASE Technology, Inc., Boston Scientific Corporation, Candela Corporation, Cynosure, Inc., Fotona do.o., Hologic, Inc., IPG Photonics Corporation, Lumenis, Ltd., IRIDEX Corporation, Novartis AG, Quanta System S.p.A., Philips Healthcare, Syneron Medical Ltd., Thermo Fisher Scientific, Inc., Topcon Corporation, and ZEISS International. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Medical Laser Market Dynamics

Increasing number of eye surgery Laser-assisted in situ keratomileusis (LASIK) that require laser is a leasing factor that is driving the medical laser market share. In 2007, about 1,396,000 operations were done in Europe, whereas doctors in the United States performed over 19 million surgeries. Each year, around 30 million individuals worldwide get laser eye surgery, demonstrating its universal acceptability as an effective vision correction therapy. Examining the development in LASIK procedures, the procedure's demand has steadily increased over the years, owing to its established efficiency and great patient satisfaction. In 2021, more than 833,000 LASIK, SMILE, and PRK treatments were performed in the United States alone. Over 100,000 LASIK operations are conducted in the United Kingdom each year, indicating that this vision correction technique is becoming increasingly popular. Countries such as Australia have experienced an increase in demand for LASIK operations over the previous decade.

The growing burden of chronic diseases such as cancer, cardiovascular disease, and various dental ailments has forced the use of new medical technology to address increased healthcare demand. For example, according to The Skin Cancer Foundation, over 9,500 persons are diagnosed with skin cancer in the United States each day. Furthermore, in the United States, more than two individuals die from the condition every hour. Furthermore, more than 5.4 million instances of nonmelanoma skin cancer were treated in over 3.3 million patients in the United States in 2012.

Lasers are also used in dentistry to cure gum disease, whiten teeth, and perform oral surgery. These technologies help patients have less post-operative discomfort, recover faster, and have better outcomes. According to the WHO Global Oral Health Status Report (2022), oral illnesses impact about 3.5 billion people globally, with middle-income nations accounting for three out of every four. An estimated 2 billion individuals worldwide suffer from permanent tooth decay, while 514 million children have primary tooth decay. As a result, this widespread of dental illness is expected to create significant opportunity for the medical laser industry.

On the other hand, tight safety standards and a high failure rate may stymie the market's expansion. The medical laser systems market will face challenges due to a shortage of experienced personnel and healthcare infrastructure in developing nations. The high expense of medical laser services has resulted in fewer clients preferring these facilities. People from moderate to lower socioeconomic levels cannot afford these services since they are so expensive. The market's expansion is also hampered by stringent safety regulations and a high failure rate in laser-based operations.

Global Medical Laser Market Segment Analysis

Medical Laser Market By Product

· Solid State Laser Systems

· Dye Laser Systems

· Diode Laser Systems

· Gas Laser Systems

According to the medical laser industry analysis, the solid-state laser systems sector usually leads the medical laser industry. Solid-state laser systems are an essential component of the medical laser business, noted for their great accuracy and adaptability. These lasers employ a solid gain medium, such as a crystal or glass doped with rare earth or transition metal ions, that is activated to generate laser light. One of the primary benefits of solid-state lasers is their ability to produce high-intensity beams with remarkable stability and efficiency. This makes them suitable for a variety of medical applications, including surgery, ophthalmology, and dermatology. Solid-state lasers offer precision cutting and coagulation during operations, minimizing tissue damage and shortening recovery time. In ophthalmology, they are utilized in operations such as LASIK and photocoagulation for retinal diseases.

Medical Laser Market By Type

· Surgical Laser

· Dental Lasers

· Aesthetic Lasers

· Others

In 2023, surgical laser type accounted for significant market share. On the other hand, aesthetic lasers are second largest share in the medical laser industry. Aesthetic lasers are widely employed in a variety of cosmetic and dermatological procedures, driven by rising demand for minimally invasive and non-invasive treatments to improve physical appearance. Aesthetic lasers are used for a variety of purposes, including hair removal, skin resurfacing, tattoo removal, wrinkle reduction, acne therapy, and pigmentation removal. The growing popularity of cosmetic operations among both men and women, along with advances in laser technology that provide safer and more effective treatments with less downtime, has greatly increased demand for aesthetic lasers.

Medical Laser Market By End-Use

· Hospitals

· Specialty Clinics

· Others

The hospitals sector is expected to have the largest share of the medical laser market from 2024 to 2032. Hospitals frequently have more complete facilities and resources to provide a wide range of laser-based medical treatments, including complicated surgical operations, dermatological and cosmetic treatments.

Hospitals often have the appropriate infrastructure and diverse staff to manage modern medical laser technology. They offer a concentrated environment for a wide range of treatments, including those that need extreme accuracy and experience, such as eye operations, cardiovascular procedures, and oncological therapies. Furthermore, the ability to include laser treatments within broader healthcare services and post-operative care makes hospitals the preferred choice for patients.

Medical Laser Market Regional Analysis

North America accounted for the greatest market share in 2023 and is likely to continue to do so in the future. The region's largest share is attributed to the presence of prominent businesses, government funding to support innovation in the healthcare sector, and technical breakthroughs in medical equipment. Furthermore, the growing senior population in the United States is necessitating significant geriatric procedures such as ocular surgery (including glaucoma, cataracts, cardiovascular surgeries, and urological surgeries), which is increasing demand for medical lasers in the area.

Asia-Pacific had the second greatest market share in 2023, followed by North America. Asia Pacific is expected to see the largest increase in the future years as a result of improved healthcare infrastructure and an expanding number of laser centers. Furthermore, rising demand for anti-aging treatments and an increase in the number of hair removal operations are expected to boost demand for aesthetic lasers, hence pushing market expansion.

Medical Laser Market Leading Companies

The Medical Laser market players profiled in the report is Abbott Laboratories, Alcon, Inc., Alma Lasers, Ltd., Bausch Health Companies, Inc., BIOLASE Technology, Inc., Boston Scientific Corporation, Candela Corporation, Cynosure, Inc., Fotona do.o., Hologic, Inc., IPG Photonics Corporation, Lumenis, Ltd., IRIDEX Corporation, Novartis AG, Quanta System S.p.A., Philips Healthcare, Syneron Medical Ltd., Thermo Fisher Scientific, Inc., Topcon Corporation, and ZEISS International.

Medical Laser Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa