Orthopedic Implants Market Growth Opportunities and Forecast till 2032

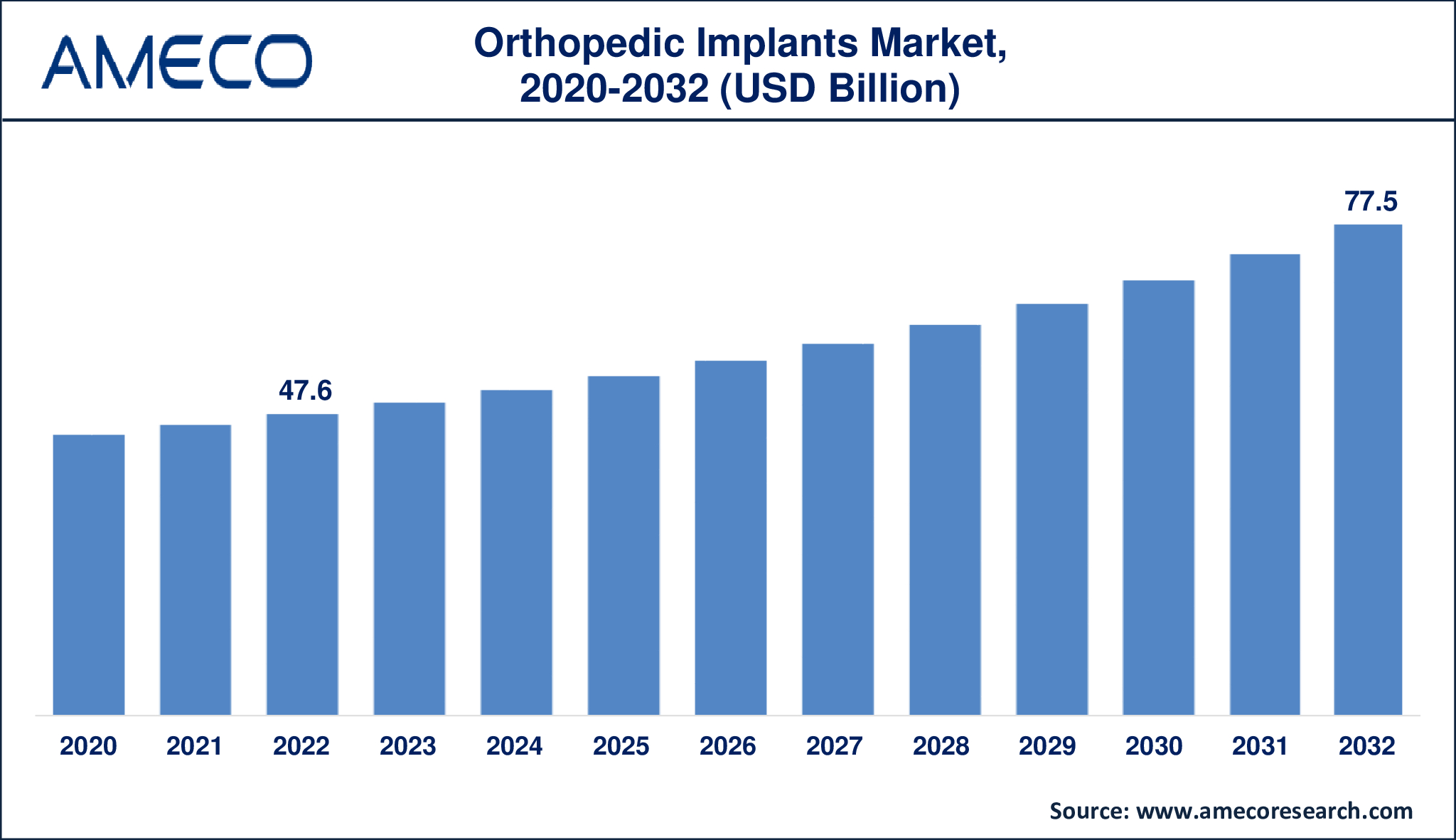

The Global Orthopedic Implants Market Size was valued at USD 47.6 Billion in 2022 and is anticipated to reach USD 77.5 Billion by 2032 with a CAGR of 5.1% from 2023 to 2032.

Orthopedic implants are surgically inserted medical devices that replace or support injured bones and joints, thereby promoting healing and restoring function. Screws, plates, rods, and prosthetic joints are examples of implants made from a variety of materials and designs to meet specific anatomical needs. Metals such as titanium and stainless steel, as well as ceramics and polymers, are commonly employed in these implants due to their biocompatibility, strength, and longevity. Orthopedic implants are used in a variety of treatments, including joint replacement (hip, knee, shoulder), fracture repair, spinal fusion, and bone restoration. Advances in biomedical engineering and material science have considerably enhanced the performance and durability of these devices, resulting in better patient outcomes.

The selection and implementation of orthopedic implants necessitate careful consideration of patient-specific parameters such as age, activity level, bone quality, and the type of the orthopedic disease. Surgeons must strike a balance between the implant's mechanical qualities and the patient's biological environment to guarantee optimal integration and functionality. Orthopedic implant innovations include bioactive coatings that encourage bone formation and lower infection risk, as well as individualized implants manufactured with 3D printing technology. As the population ages and need for orthopedic therapies rises, continuing research and development aim to improve the safety, efficacy, and durability of these vital medical devices.

|

Parameter |

Orthopedic Implants Market |

|

Orthopedic Implants Market Size in 2022 |

US$ 47.6 Billion |

|

Orthopedic Implants Market Forecast By 2032 |

US$ 77.5 Billion |

|

Orthopedic Implants Market CAGR During 2023 – 2032 |

5.1% |

|

Orthopedic Implants Market Analysis Period |

2020 - 2032 |

|

Orthopedic Implants Market Base Year |

2022 |

|

Orthopedic Implants Market Forecast Data |

2023 - 2032 |

|

Segments Covered |

By Type, By Biomaterial, By End-Use, and By Region |

|

Orthopedic Implants Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Arthrex, Inc., Colfax Corporation (DJO GLOBAL LLC), CONMED Corporation, Globus Medical, Inc., Johnson & Johnson, Medtronic plc, NuVasive Inc., Smith & Nephew plc, Stryker Corporation, and Zimmer Biomet Holdings Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Orthopedic Implants Market Dynamics

Several important reasons drive the orthopedic implants market, including the increasing frequency of orthopedic problems, an aging global population, and advances in surgical Biomaterials and implant materials. Conditions including osteoarthritis, rheumatoid arthritis, and osteoporosis, which frequently require surgical intervention, are growing increasingly common as people live longer lives. Furthermore, the increasing prevalence of sports injuries and severe fractures adds to the demand for orthopedic implants. Innovations in minimally invasive surgical techniques have made implant surgeries more accessible and risk-free, encouraging more patients to choose these Biomaterials.

Technological innovations have a significant impact on the dynamics of the orthopedic implants market. The discovery of novel materials, such as strongly cross-linked polyethylene, bioceramics, and bioresorbable polymers, has improved implant function and durability. 3D printing technology enables the development of personalized implants matched to each patient's anatomy, increasing outcomes and shortening recovery times. Furthermore, the incorporation of smart technology and sensors into implants is a growing trend, providing real-time data on implant performance and patient recovery, perhaps leading to more tailored and successful treatment programs.

Economic and regulatory issues have a significant impact on market dynamics. The high cost of orthopedic implants and surgical Biomaterials can be a barrier to access, especially in poor countries with inadequate healthcare resources. However, increased healthcare spending and favorable reimbursement systems in many nations are helping to alleviate these issues. Regulatory frameworks assure the safety and efficacy of orthopedic implants, with bodies such as the FDA and EMA establishing strict requirements for approval. Companies in the orthopedic implants market are investing extensively in R&D to satisfy these criteria and differentiate their goods in a competitive environment. Companies frequently engage in strategic collaborations, mergers, and acquisitions in order to increase their market share and capitalize on emerging technologies. Overall, the orthopedic implants market is expected to increase steadily, fueled by demographic trends, technological innovation, and changing healthcare legislation.

Global Orthopedic Implants Market Segment Analysis

Orthopedic Implants Market By Type

· Reconstructive Joint Replacements

· Spinal Implants

· Dental Implants

· Trauma

· Orthobiologics

· Others

Reconstructive joint replacements have long dominated the orthopedic implant market. This division comprises implants for hip, knee, and shoulder replacements, which are among the most prevalent and well-established Biomaterials in orthopedic surgery. The high frequency of joint-related disorders such as osteoarthritis, the growing aging population, and considerable advancements in the longevity and functionality of these implants have all contributed to their popularity.

Hip and knee replacements, in particular, make up a significant share of this industry. The need for these Biomaterials continues to climb as the number of senior patients grows, as does the prevalence of lifestyle-related disorders that influence joint health. Furthermore, developments in implant materials, such as highly cross-linked polyethylene and ceramic-on-ceramic bearings, have increased the endurance and performance of joint replacement implants, resulting in their continued market domination.

Orthopedic Implants Market By Biomaterial

· Metallic Biomaterials

· Ceramic Biomaterials

· Polymeric Biomaterials

· Others

Metallic biomaterials have long dominated the orthopedic implant market. These materials, which include stainless steel, cobalt-chromium alloys, and titanium alloys, are popular due to their superior mechanical qualities, such as high strength, durability, and biocompatibility. Titanium and its alloys, in particular, are highly prized for their superior corrosion resistance and ability to merge effectively with bone, hence encouraging osseointegration. This makes them appropriate for load-bearing implants such joint replacements, fracture fixation devices, and spinal implants.

The dominance of metallic biomaterials is further underscored by their extended history of effective usage in orthopedic procedures, as well as their ability to tolerate the considerable mechanical forces that these implants face. For example, in reconstructive joint replacements, metallic components are frequently used as the implants' core structural elements, giving the strength and stability required to restore function and motion. Metallic biomaterials are versatile enough to be used in a variety of orthopedic applications, which contributes to their market leadership.

Orthopedic Implants Market By End-Use

· Hospitals & Ambulatory Surgery Centers

· Orthopedic Clinics & Others

End-users of orthopedic implants are mostly hospitals and ambulatory surgery centers (ASCs). This dominance is due to a number of factors, including the wide range of services they provide, their advanced surgical capabilities, and the availability of specialist medical professionals and equipment required for major orthopedic procedures.

Hospitals are frequently the principal sites for orthopedic surgery, particularly major joint replacements, spinal surgeries, and trauma situations that necessitate immediate and intensive medical care. They have the required infrastructure, such as modern imaging technologies and surgical suites, to carry out these high-demand surgeries safely and efficiently. Furthermore, hospitals often see a higher volume of patients, particularly those with severe and difficult illnesses requiring the use of orthopedic implants.

Orthopedic Implants Market Regional Analysis

North America, specifically the United States, has the greatest share of the orthopedic implants market. This supremacy is fueled by a well-developed healthcare system, substantial healthcare spending, and a sizable elderly population. The existence of top orthopedic device makers, as well as continuing improvements in implant technology, all contribute to the region's strong market position. Furthermore, the high frequency of orthopedic disorders such as osteoarthritis, as well as rising demand for minimally invasive surgical techniques, is driving growth in this region.

Europe is another large market for orthopedic implants, with significant contributions from Germany, France, and the United Kingdom. Europe's market growth is fueled by a strong healthcare infrastructure, an aging population, and advantageous reimbursement rules. The region also houses numerous major orthopedic implant manufacturers and research organizations that fuel innovation and development. Initiatives to increase healthcare access, as well as the rising prevalence of orthopedic illnesses, all contribute to the market's steady rise in Europe.

The Asia-Pacific region is predicted to have the greatest growth in the orthopedic implant market. This rapid expansion is driven by rising healthcare spending, improved healthcare infrastructure, and increased knowledge of modern orthopedic treatments. Countries such as China, India, and Japan are in the forefront of this expansion due to their enormous populations, rising prevalence of orthopedic disorders, and increased adoption of advanced medical technologies. Economic development and government attempts to improve healthcare accessible are also important factors driving market expansion in this region.

Orthopedic Implants Market Leading Companies

The orthopedic implants market players profiled in the report are Arthrex, Inc., Colfax Corporation (DJO GLOBAL LLC), CONMED Corporation, Globus Medical, Inc., Johnson & Johnson, Medtronic plc, NuVasive Inc., Smith & Nephew plc, Stryker Corporation, and Zimmer Biomet Holdings Inc.

Orthopedic Implants Market Regions

North America

· U.S.

· Canada,

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa