Residual Gas Analyzers Market Growth Opportunities and Forecast till 2032

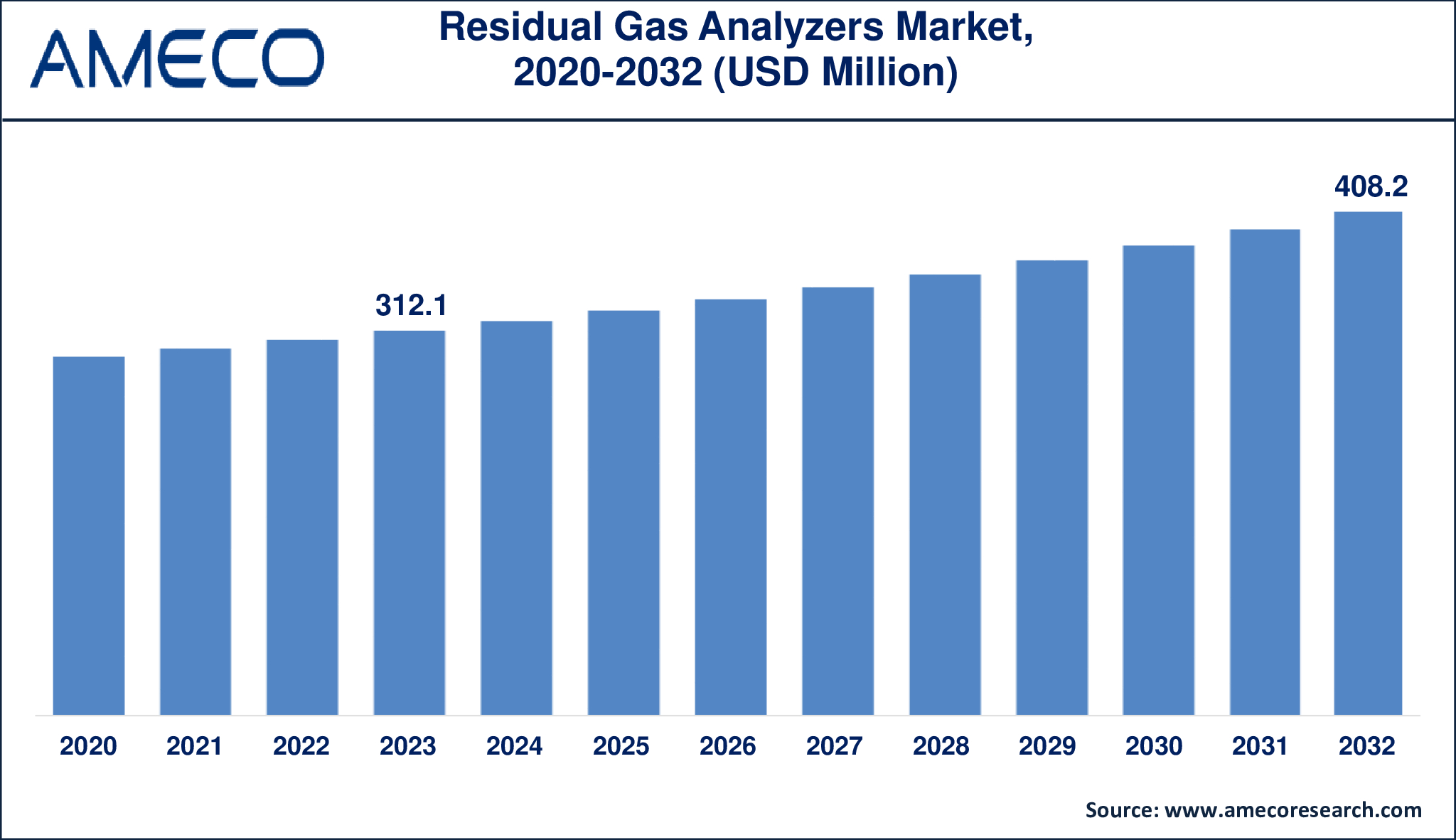

The Global Residual Gas Analyzers Market Size was valued at USD 312.1 Million in 2023 and is anticipated to reach USD 408.2 Million by 2032 with a CAGR of 3.1% from 2024 to 2032.

Residual gas analyzers (RGAs) are highly advanced devices employed in measuring and identifying gases present in vacuum systems. These devices operate through the principles of mass spectrometry in which gaseous samples are ionized and the mass to charge ratio is determined to determine the type and concentration of the gases present. RGAs play an important role in keeping the vacuum system free from contaminants such as water vapor, hydrocarbons or other gases which may interfere with the performance of the system especially in applications such as semiconductor manufacturing, space research, and materials science.

The data collected from RGAs assist engineers and researchers to observe the vacuum conditions, identify problems, and enhance the performance. They are essential in maintaining vacuum systems including those used in particle accelerators or deposition chambers from contaminants that may affect the functionality or produce defects in high value added products. Due to the fact that RGAs can measure gas concentrations at the parts per billion (ppb) level, they are accurate and sensitive; thus, they are essential in industries that require ultra-high purity.

|

Parameter |

Residual Gas Analyzers Market |

|

Residual Gas Analyzers Market Size in 2023 |

US$ 312.1 Million |

|

Residual Gas Analyzers Market Forecast By 2032 |

US$ 408.2 Million |

|

Residual Gas Analyzers Market CAGR During 2024 – 2032 |

3.1% |

|

Residual Gas Analyzers Market Analysis Period |

2020 - 2032 |

|

Residual Gas Analyzers Market Base Year |

2023 |

|

Residual Gas Analyzers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Application, and By Region |

|

Residual Gas Analyzers Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

SENTECH Instruments GmbH, Ametek, Inc., Pfeiffer Vacuum Technology AG, Stanford Research Systems, Inc., ULVAC-PHI, Inc., Hiden Analytical Ltd., AMKS Instruments, Inc., Thermo Fisher Scientific Inc., SRS Vacuum LLC, Extorr Inc., Semicore Equipment, Inc., and Inficon Holding AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Residual Gas Analyzers Market Dynamics

The residual gas analyzers (RGA) market is growing due to its rising application across the high-tech industries like semiconductors, aerospace, and pharmaceuticals. These industries depend on vacuum environments for the accuracy and sterility that is necessary for high technology applications. As the semiconductor industry expands with trends such as AI, 5G, and IoT, the requirement for effective vacuum monitoring systems is critical. RGAs are used in detecting contaminants in these processes and therefore the market for RGAs is expected to grow with these sectors. Also, the employment of RGAs in space exploration and nuclear industries increases the demand for the same.

Technological improvements are increasing the market prospects of RGAs. The current generation of RGAs is being developed to be more portable, more sensitive and capable of providing real time analysis. These enhancements enable the product to be more easily integrated into current manufacturing environments and provide higher accuracy of gas analysis at lower concentrations. This has also been occasioned by the need to have more efficient vacuum systems in research institutions and industries that require stringent environmental control. However, advancements like wireless connection and automatic data acquisition make RGAs applicable to different industrial uses.

Nevertheless, the RGA market has some issues. The major disadvantage of these analyzers is the high cost of purchasing them and also the fact that their use may be a bit complicated especially for the small business entities. Furthermore, the management and calibration of RGAs can also be costly especially for industries that may not afford to employ technical personnel. Nevertheless, the increasing need for high-quality vacuum systems, as well as the development of the RGA technology, should ensure that the market stays in a state of steady growth in the next few years.

Global Residual Gas Analyzers Market Segment Analysis

Residual Gas Analyzers Market By Type

· Open Ion Source RGAs

· Closed Ion Source RGAs

According to the residual gas analyzers industry research, it is found that the open ion source RGAs dominate the market. These RGAs are preferred because of its design, cost, and versatility for use in many industries such as semiconductor manufacturing, research, and vacuum systems. Open Ion Source RGAs are more sensitive in detecting the gas species in clean vacuum environment which makes them suitable for real-time monitoring and analysis. They are used in various types of vacuum systems and have lower costs of production and maintenance hence dominating the market. However, Closed Ion Source RGAs are emerging in more specific application areas that demand better protection from contamination and stability in worse conditions.

Residual Gas Analyzers Market By Application

· Industrial Applications

· Laboratory Research

· Others

As per the residual gas analyzers (RGA) market forecast, the industrial applications segment is anticipated to gain the highest market share from 2024 to 2032. This growth is due to the expansion of the application of RGAs in industries like semiconductors, aerospace, pharmaceuticals, and vacuum coating industries where cleanliness is paramount in production and quality of the end product. The development of new technologies including artificial intelligence, internet of things, and fifth generation communication technologies has made it necessary to have better control of vacuum systems in industrial production lines. The fact that these industries require real-time monitoring of gases and their contaminants to enhance operations and minimize defects further cements the industrial application segment’s control of the RGA market.

Residual Gas Analyzers Market Regional Analysis

The residual gas analyzers (RGA) market has a large regional growth with North American market dominating the market due to the presence of advanced semiconductor, aerospace, and pharmaceutical industries. The U. S. has a large number of key players and research institutions that are the main consumers of RGAs. Besides, the government spending on space exploration and high-tech manufacturing sectors also contribute to the market growth in the region. The use of innovative technologies and high quality requirements in such sectors as vacuum coating and biotechnology also play a significant role.

The Asia-Pacific region is expected to exhibit the highest growth rate in the coming years of the forecast period. The electronics and semiconductor industries in the region, especially China, Japan, South Korea, and Taiwan, drive the demand for RGAs due to their growth. Due to the development of the new industrial base and the growth of R&D processes, the demand for precise gas analysis in vacuum systems is growing. Moreover, the expanding pharmaceutical and chemical sectors in Asia-Pacific also help to enhance the RGAs’ demand because these industries need strict environmental management for production procedures.

Residual Gas Analyzers Market Leading Companies

The residual gas analyzers market players profiled in the report is SENTECH Instruments GmbH, Ametek, Inc., Pfeiffer Vacuum Technology AG, Stanford Research Systems, Inc., ULVAC-PHI, Inc., Hiden Analytical Ltd., AMKS Instruments, Inc., Thermo Fisher Scientific Inc., SRS Vacuum LLC, Extorr Inc., Semicore Equipment, Inc., and Inficon Holding AG.

Residual Gas Analyzers Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa