Sheet Metal Market Growth Opportunities and Forecast till 2032

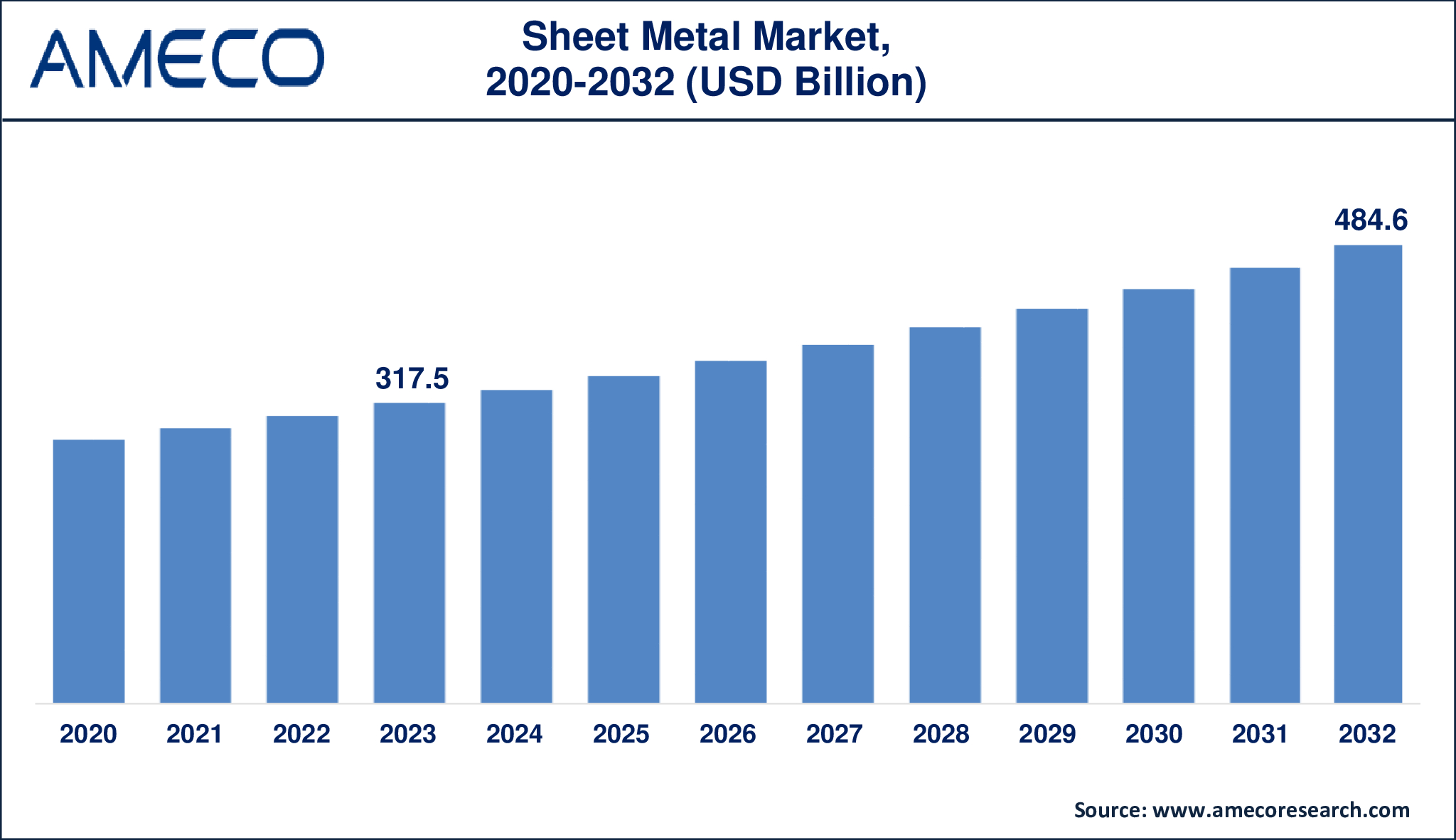

The Global Sheet Metal Market Size was valued at USD 317.5 Billion in 2023 and is anticipated to reach USD 484.6 Billion by 2032 with a CAGR of 4.9% from 2024 to 2032.

Sheet metal functions as a basic raw material in metalworking which results in flat thin pieces that remain below 6 mm (0.24 inches) thickness during industrial production. Sheet metal exists in multiple forms with steel, aluminum, copper, brass, stainless steel and additional materials among them. The term “foil” or “leaf” applies to extremely thin sheet metal while “plate” designates pieces exceeding one-quarter inch in thickness. Sheet metal achieves its essential role in manufacturing and fabrication because it offers versatility and durability while allowing formability which lets workers cut, bend, weld, stamp and fasten it into multiple shape designs. The material serves various industrial sectors including automotive and aerospace and construction alongside healthcare for applications spanning from automobile bodies to airplane wings and roofing materials and medical equipment.

|

Parameter |

Sheet Metal Market |

|

Sheet Metal Market Size in 2023 |

US$ 317.5 Billion |

|

Sheet Metal Market Forecast By 2032 |

US$ 484.6 Billion |

|

Sheet Metal Market CAGR During 2024 – 2032 |

4.9% |

|

Sheet Metal Market Analysis Period |

2020 - 2032 |

|

Sheet Metal Market Base Year |

2023 |

|

Sheet Metal Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Material, By End User, and By Region |

|

Sheet Metal Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Baosteel Group, Hindalco Industries Limited, Howmet Aerospace, Inc., JFE Steel, JSW Steel Ltd, Kaiser Aluminum Corporation, Ma’aden, Nippon Steel Corporation, POSCO, Tata BlueScope Steel Private Limited, United States Steel Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Sheet Metal Market Dynamics

The rapid expansion of the manufacturing industry is primarily driving the demand for sheet metal. According to a NIST study, manufacturing accounted for 17.5% of global GDP in 2022. Additionally, IBEF statistics indicate that India's manufacturing sector has the potential to reach USD 1 trillion by 2025-2026. The combination of rapid industrialization and urbanization has led to increased sheet metal usage across various manufacturing processes. This material stands out due to its durability, ease of use, and high-quality finished surfaces, making it a preferred choice for manufacturing a wide range of products. The growing number of manufacturing businesses is expected to further boost sheet metal demand, creating profitable opportunities in the coming years. A recent industry report also revealed that the number of manufacturing businesses in the U.S. rose to 720,000 in 2022, marking an increase from 2021 levels.

The construction sector, alongside the manufacturing industry, is also contributing significantly to the sheet metal market. The construction industry grows because of three main factors such as population expansion, urbanization trends and low interest rates in building projects. The construction sector chooses sheet metal for its strong and durable and light-weight properties to support market expansion. The United States Census Bureau reports that construction spending across the U.S. rose from $1,768.2 billion in March 2022 to $1,834.7 billion during March 2023 resulting in a 3.8% increase. Construction growth remains persistent which creates an increased need for sheet metal products.

High production expenses act as a barrier to sheet metal market expansion because labor costs and equipment and tooling expenses reduce profit potential. The production speed decreases when forming times extend beyond certain thresholds in specific applications. The sheet metal industry faces expansion limitations because manufacturers now use alternative processes such as additive manufacturing and casting and forging to achieve lower costs together with complex geometries and faster production speeds and better quality.

Advanced manufacturing technologies serve as essential factors which help develop the sheet metal market. The sheet metal production process has become more precise and cost-effective through the growing implementation of automation robotics and artificial intelligence (AI) technologies during cutting and bending operations and forming and finishing stages. The sheet metal fabrication sector utilizes robotics and automation for laser cutting operations and bending operations as well as forming procedures. AI predictive maintenance functions in combination with optimized production schedules enhance the overall operational efficiency of the manufacturing process. The sheet metal industry experiences a transformation because of advanced manufacturing which produces complex components with increased speed and precision and enhanced versatility.

Global Sheet Metal Market Segment Analysis

Sheet Metal Market By Material

· Steel

· Aluminum

· Others

Based on all the materials, the steel segment experienced a dominance of more than 80% in 2023. The market experienced robust demand from automotive industries and construction sectors as well as oil & gas players and the food processing sector and chemical manufacturers. Steel sheet products have become essential components in household appliances including washing machines as well as refrigerators and dishwashers and countertops. The market experiences continuous expansion because steel continues to find increasing applications in construction and infrastructure projects across developed and developing economies.

Sheet Metal Market By End User

· Automotive & Transportation

· Building & Construction

· Industrial Machinery

· Others

The building and construction segment represented 56% of the sheet metal market revenue during 2023. The building and construction sector uses sheet metal primarily for roofing along with walling and cladding functions. Stainless steel sheets used for both curtain walls and roofing have boosted the market because they offer durability alongside functionality and attractive appearance. The market demand for aluminum roofing sheets continues to grow because they resist rust while providing insulation and maintaining high resale value and durability while being lightweight in nature. Stadiums along with parking bays and airports use these sheets for cladding purposes while residential and commercial buildings and industrial warehouses and sheds and halls also employ them for roofing applications.

Sheet Metal Market Regional Analysis

The Asia-Pacific sheet metal market maintained a 65% share of the complete market volume in 2023 while demonstrating substantial forecasted CAGR development throughout the period. The automotive market drives market expansion because vehicle manufacturers require substantial quantities of sheet metal and because it provides benefits for automotive applications. The market expansion in this region is being accelerated by fast-paced industrialization and urbanization processes that drive manufacturers to adopt sheet metal for their diverse manufacturing needs.

The European market demonstrated the second-largest market dominance because of its innovative and eco-friendly sheet metal product introduction. The market finds new opportunities because sheet metal usage continues to expand across multiple different industries. Germany controlled the sheet metal market throughout Europe but the United Kingdom demonstrated the most rapid market growth.

Sheet Metal Market Leading Companies

The sheet metal market players profiled in the report is Baosteel Group, Hindalco Industries Limited, Howmet Aerospace, Inc., JFE Steel, JSW Steel Ltd, Kaiser Aluminum Corporation, Ma’aden, Nippon Steel Corporation, POSCO, Tata BlueScope Steel Private Limited, United States Steel Corporation.

Sheet Metal Market Regional Segments

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa