Small Hydropower Market Growth Opportunities and Forecast till 2032

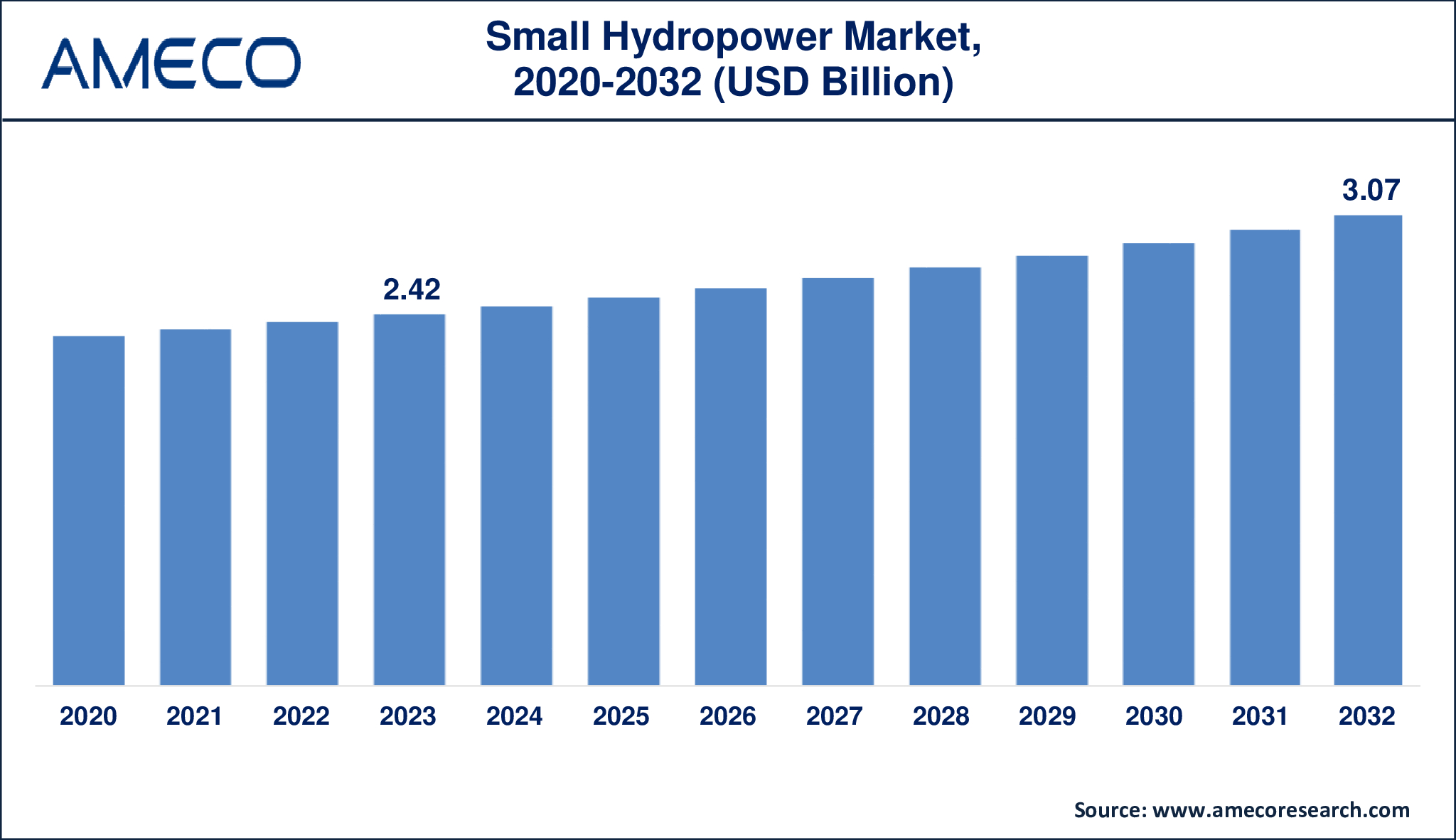

The Global Small Hydropower Market Size was valued at USD 2.42 Billion in 2023 and is anticipated to reach USD 3.07 Billion by 2032 with a CAGR of 2.7% from 2024 to 2032.

Small hydropower is the generation of electricity from small-scale water resources such streams, rivers, and canals. These power plants typically have an installed capacity of less than 10 megawatts (MW), which is significantly less than large-scale hydroelectric power facilities that produce thousands of MWs. Small hydropower plants are frequently used to provide electricity to remote communities, villages, and rural areas with limited or no connectivity to the main grid. They can also be utilized to power small industrial applications such as agricultural processing or manufacturing plants.

Small hydropower has a lower environmental impact than other forms of power generation, and it can provide a reliable and sustainable source of electricity. Small hydropower facilities usually use run-of-river technology, which means that the water flow is not kept behind a dam, lowering the risk of flooding and environmental damage. Furthermore, tiny hydropower plants can be constructed to be modular and expandable, making them appropriate for a variety of purposes and sites. Overall, tiny hydropower plays a vital role in bringing clean and dependable energy to rural and underserved communities around the world.

|

Parameter |

Small Hydropower Market |

|

Small Hydropower Market Size in 2023 |

US$ 2.42 Billion |

|

Small Hydropower Market Forecast By 2032 |

US$ 3.07 Billion |

|

Small Hydropower Market CAGR During 2024 – 2032 |

2.7% |

|

Small Hydropower Market Analysis Period |

2020 - 2032 |

|

Small Hydropower Market Base Year |

2023 |

|

Small Hydropower Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Capacity, By Component, and By Region |

|

Small Hydropower Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Brammer PLC, Harbin Small Hydropower Manufacturing Co., Ltd., HKT Small Hydropower Ltd., JTEKT Corporation, NBI Small Hydropower Europe, NSK Global, NTN Corporation, RBC Small Hydropower Inc., Rexnord Corporation, RHP Small Hydropower, Schaeffler Group, SKF, and The Timken Company. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Small Hydropower Market Dynamics

The small hydropower (SHP) industry is driven by a number of reasons, including rising demand for renewable energy, government regulations and incentives, and the need for energy access in distant and underserved regions. The global SHP market has grown steadily over the last decade, owing to increased awareness of the value of renewable energy and the need to reduce greenhouse gas emissions. Tax credits, grants, and feed-in tariffs are examples of policies and incentives established by governments around the world to encourage the development of solar-heating plants.

The SHP industry is also being driven by the demand for energy access in remote and underserved areas. Many rural areas lack access to dependable and sustainable energy sources, which can stymie economic growth and quality of life. SHP projects can provide a consistent source of electricity for these communities, powering homes, businesses, and infrastructure. Furthermore, SHP projects can create job opportunities and boost local economies.

The SHP market is characterized by a combination of existing and new competitors. Large corporations with experience in traditional hydroelectric power generating are progressively entering the SHP sector, as are new enterprises specializing in SHP development and construction. Private equity firms and impact investors are also showing an increased interest in SHP projects, drawn by the possibility for high returns on investment. However, the SHP market confronts several problems, including high initial prices, regulatory barriers, and environmental concerns. Despite these limitations, the SHP market is likely to expand as governments and investors understand its potential to deliver clean, reliable, and sustainable energy to communities all over the world.

Global Small Hydropower Market Segment Analysis

Small Hydropower Market By Type

· Micro Hydropower

· Mini Hydropower

· Pico Hydropower

According to the small hydropower industry analysis, the micro hydropower segment led the small hydropower market in terms of installed capacity and income. Micro hydropower plants, with a capacity of less than 100 kW, are commonly utilized to power local communities, villages, or individual residences. They are frequently less expensive and easier to install than bigger hydroelectric plants, making them an attractive option for distant or off-grid places. According to a recent market research estimate, micro hydropower was responsible for around 60% of total small hydropower installed capacity in 2020, followed by mini hydropower (30%) and pico hydropower (10%). Micro hydropower's dominance is projected to continue due to its simplicity, scalability, and low upfront costs.

Small Hydropower Market By Capacity

· Up to 1 MW

· 1-10 MW

· Others

In 2023, the up to 1 MW segment dominated the small hydropower market. This segment accounts for approximately 55% of all small hydropower capacity installed globally. The demand for small-scale hydropower plants with capacities of up to 1 MW stems from the need for decentralized and off-grid power generation, particularly in rural areas. These facilities are frequently used to power individual residences, villages, or small companies, and they are less expensive and easier to establish than bigger hydroelectric plants. The "Up to 1 MW" sector is projected to remain dominant in the market because to its adaptability and widespread adoption.

Small Hydropower Market By Component

· Electromechanical Equipment

o Turbine

o Generator

o Other Equipment (includes inlet valves gates, penstock, governors, and auxiliaries)

· Electric infrastructure

· Civil Works

· Others (includes engineering, structural, management, environmental mitigation, and project development)

As per the small hydropower market forecast, electromechanical equipment is predicted to lead the market from 2024 to 2032. This segment is expected to increase at a CAGR of roughly 6% over the forecast period, driven by rising demand for efficient and dependable power generation equipment. The turbine and generator sectors of the Electromechanical Equipment category are predicted to increase significantly because they are important components of small hydropower projects. The demand for electromechanical equipment stems from the need for efficient and cost-effective power generation, as well as the expanding use of renewable energy sources.

Small Hydropower Market Regional Analysis

The Asia-Pacific small hydropower market is predicted to grow significantly as energy demand rises and governments promote renewable energy. Countries like China, India, and Indonesia are likely to be significant markets for small hydropower due to their enormous populations, rapid economic expansion, and rising energy demand. By 2032, the Asia-Pacific region is estimated to account for almost 40% of the worldwide small hydropower market, with China leading the way.

In contrast, the Americas' modest hydropower industry is predicted to grow at a slower rate due to the region's reliance on fossil fuels and nuclear power. However, Brazil and Chile are likely to lead regional growth due to their substantial renewable energy resources and government initiatives to encourage sustainable energy. Europe and Africa are also likely to have moderate development in the small hydropower market, driven by rising demand for renewable energy and government assistance for clean energy programs.

Small Hydropower Market Leading Companies

The small hydropower market players profiled in the report is ANDRITZ AG, BHEL, Siemens, Toshiba, GE Renewable Energy, Gilbert Gilkes & Gordon Ltd., Mavel,a.s., Voith, Canyon Hydro, HNAC Technology Co, and SNC-Lavalin.

Small Hydropower Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa