Structural Insulated Panels Market Growth Opportunities and Forecast till 2032

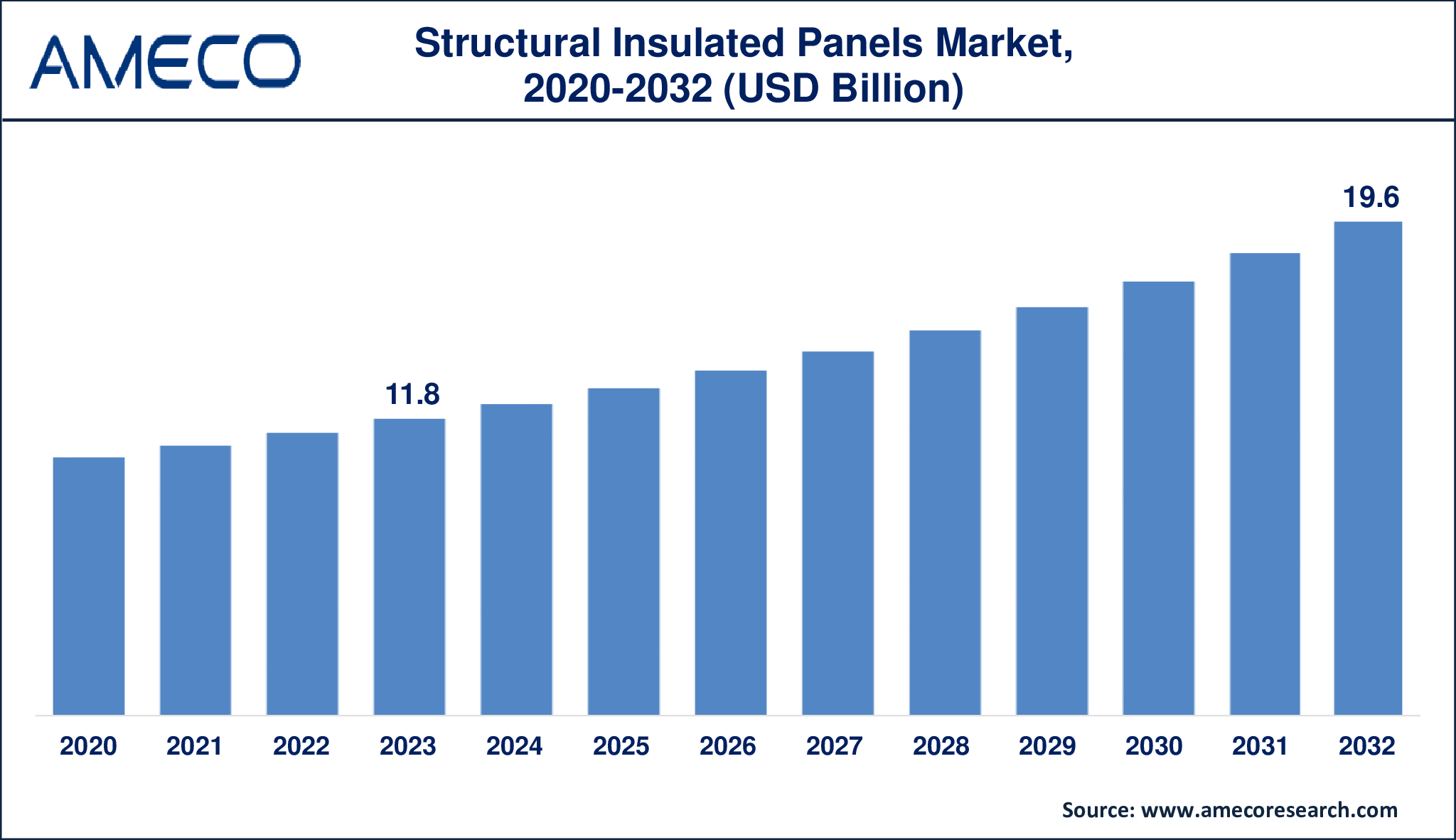

The Global Structural Insulated Panels Market Size was valued at USD 11.8 Billion in 2023 and is anticipated to reach USD 19.6 Billion by 2032 with a CAGR of 5.9% from 2024 to 2032.

Structural Insulated Panels (SIPs) are prefabricated construction materials made up of a core insulation layer (usually EPS, XPS, or polyurethane) sandwiched between two outer layers of structural sheathing (such as OSB). These panels offer high thermal insulation, strength, and energy efficiency, making them perfect for environmentally friendly construction. SIPs are commonly utilized in the construction of walls, roofs, and floors, resulting in faster construction times and lower energy usage in buildings. They are widely used in residential, commercial, and non-building applications, including modular homes and recreational vehicles. SIPs are gaining popularity for their exceptional efficiency in energy-efficient and ecologically friendly construction projects.

|

Parameter |

Structural Insulated Panels Market |

|

Structural Insulated Panels Market Size in 2023 |

US$ 11.8 Billion |

|

Structural Insulated Panels Market Forecast By 2032 |

US$ 19.6 Billion |

|

Structural Insulated Panels Market CAGR During 2024 – 2032 |

5.9% |

|

Structural Insulated Panels Market Analysis Period |

2020 - 2032 |

|

Structural Insulated Panels Market Base Year |

2023 |

|

Structural Insulated Panels Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Skin Type, By Application, By End-Use, and By Region |

|

Structural Insulated Panels Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Metecno Group, RAYCORE, Inc., Thermocore Systems, Kingspan Group plc, Premier SIPS, PFB Corporation, FischerSIPS, Insulspan, Foam Laminates of Vermont, Murus Company, Inc., and T. Clear Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Structural Insulated Panels Market Dynamics

The growing demand for energy-efficient and sustainable construction is a major driver for the structural insulated panels (SIPs) market. As building codes become stricter and energy conservation becomes a priority, SIPs offer superior insulation, reducing heating and cooling costs. This makes them an attractive option for residential, commercial, and industrial projects focused on reducing energy consumption and carbon footprints. According to a major report from the International Finance Corporation, switching to greener technologies in building construction and operation, combined with more climate-friendly capital markets, could reduce the carbon footprint of the construction value chain by 23% by 2035, while creating investment opportunities in emerging markets.

A significant restraint in the SIPs market is the higher initial cost compared to traditional construction materials. Although SIPs provide long-term savings through energy efficiency, the upfront investment can be a barrier for budget-conscious builders, especially in regions with lower demand for energy-efficient buildings or limited awareness of SIP advantages.

There is a growing opportunity for SIPs in the emerging markets, particularly in Asia-Pacific and Africa, where rapid urbanization and infrastructure development are underway. As these regions strive for sustainable and cost-effective building solutions, SIPs can play a crucial role in meeting the demand for efficient and environmentally friendly construction, opening new avenues for market expansion.

Global Structural Insulated Panels Market Segment Analysis

Structural Insulated Panels Market By Product

· Glass Wool

· Stone Wool

· EPS

· XPS

· Phenolics

· PU/PIR

· Flexible Insulation

According to the structural insulated panels industry, because of its low cost and dependable thermal insulation capabilities, EPS (expanded polystyrene) is the most commonly used core material. EPS is commonly used in residential and commercial construction due to its cost, simplicity of handling, and high insulation efficacy. Its lightweight characteristics and ease of manufacture make it popular in SIPs. While other materials, such as PU/PIR and XPS, provide superior insulation, EPS remains the favored option for most cost-sensitive applications.

Structural Insulated Panels Market By Skin Type

· OSB Two Sides

· OSB One Side

According to the structural insulated panels industry, OSB two sides (oriented strand board) is notably increasing because to its higher structural integrity and moisture resistance. This choice has strength on both sides of the panel, making it suitable for load-bearing applications in walls, roofs, and floors. It is commonly used in residential and commercial construction, particularly when durability and long-term performance are important. OSB Two Sides is very easy to install, which contributes to its popularity in SIPs.

Structural Insulated Panels Market By Application

· Walls

· Roofs

· Floors

Applications in walls are rapidly rising because of their vital role in providing thermal insulation and structural support in constructions. SIPs for walls provide improved energy efficiency by limiting heat loss, making them highly attractive in both residential and commercial construction. The desire for energy-efficient building envelopes is driving the expansion of this category, as SIP walls help to reduce heating and cooling costs. Furthermore, their ease of installation and robustness in load-bearing applications make them an excellent choice for exterior and interior walls.

Structural Insulated Panels Market By End-Use

· Residential

· Commercial

· Non-Building

According to the structural insulated panels market forecast, the residential sector expected to grow due to rising demand for energy-efficient dwellings and environmentally friendly construction procedures. SIPs provide high insulation and rapid construction periods, making them perfect for residential projects that want to cut energy expenses and environmental effect. This segment benefits from increased consumer awareness of energy efficiency and environmentally friendly building solutions. As a result, residential applications, such as single-family houses and low-rise structures, continue to drive the majority of the SIPs industry.

Structural Insulated Panels Market Regional Analysis

By the year 2032, North America dominates the structural insulated panels (SIPs) market, owing to the strong demand for energy-efficient and sustainable building in the United States and Canada. Nucor Corporation bought Cornerstone Building Brands' insulated metal panels (IMP) business in August 2021, allowing it to offer a wide range of solutions to customers for high-end architectural applications. The region has implemented building rules that encourage energy conservation, as well as increased consumer knowledge of the environmental benefits of SIPs. Furthermore, government incentives for green building techniques drive up SIP usage in residential and commercial development.

Asia-Pacific's structural insulated panels market is predicted to increase significantly due to fast urbanization and infrastructure development in countries like as China and India. For instance, the National Highway (NH) network has extended by 60%, from 91,287 km in 2014 to 1,46,145 km by 2023. As these countries strive to reach energy efficiency targets while combating rising energy costs, SIPs present an appealing choice for sustainable construction. The growing middle-class population and increased demand for eco-friendly structures help to drive market growth in this region.

Structural Insulated Panels Market Leading Companies

The structural insulated panels market players profiled in the report is Metecno Group, RAYCORE, Inc., Thermocore Systems, Kingspan Group plc, Premier SIPS, PFB Corporation, FischerSIPS, Insulspan, Foam Laminates of Vermont, Murus Company, Inc., and T. Clear Corporation.

Structural Insulated Panels Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa