Super Absorbent Polymer Market Growth Opportunities and Forecast till 2032

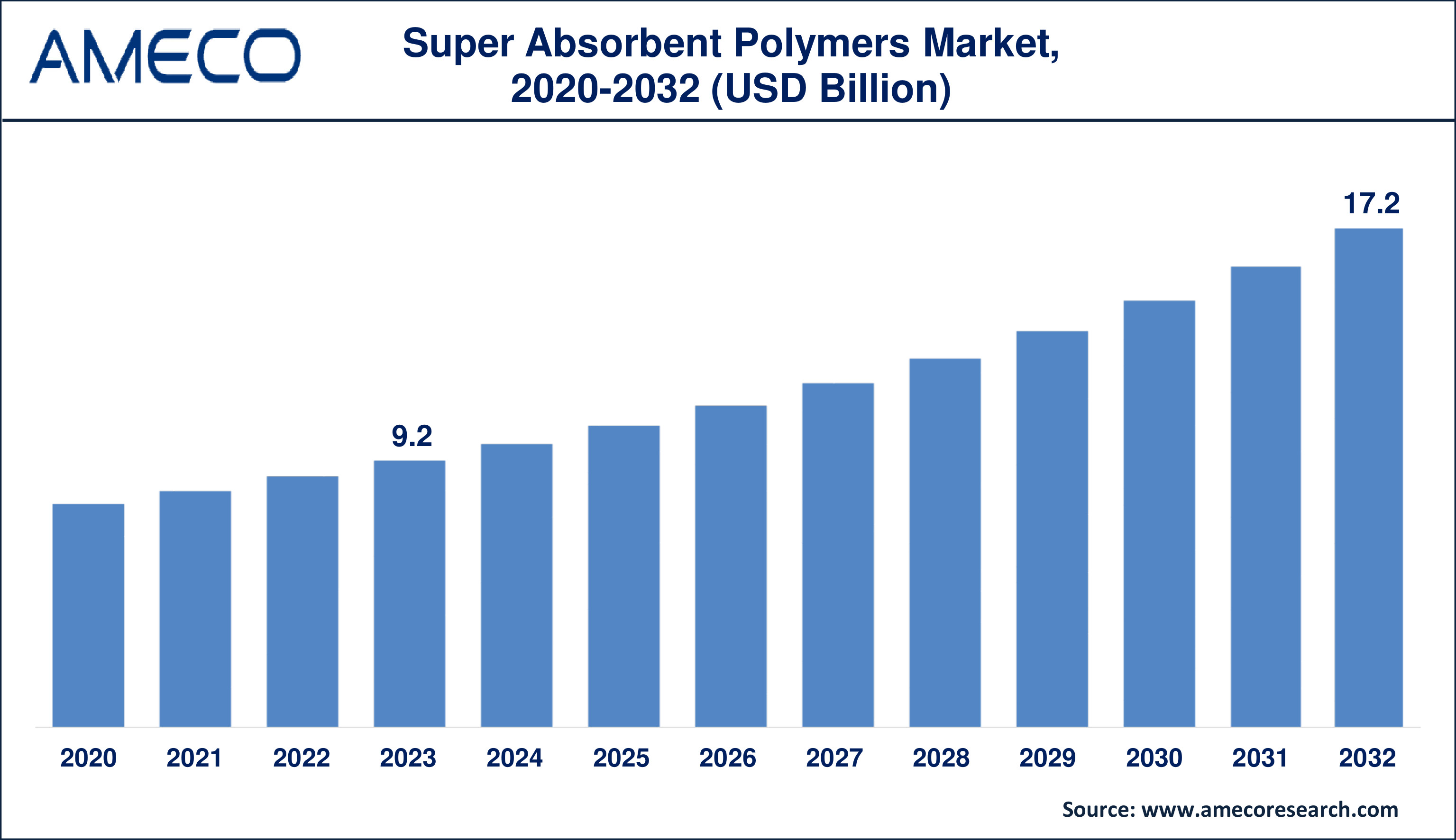

The Global Super Absorbent Polymer Market Size was valued at USD 9.2 Billion in 2023 and is anticipated to reach USD 17.2 Billion by 2032 with a CAGR of 7.3% from 2024 to 2032.

Super absorbent polymers (SAP) are water-absorbing hydrophilic copolymers or homopolymers that can absorb large quantities of liquid relative to their mass. This amount can reach 300 times its weight and retain it with almost zero leakage, even when compressed. Because of their unique cross-linked structure, SAPs are water-swellable rather than water-soluble. As a result, they are ideal materials for use in products that are designed to efficiently lock in moisture and prevent leakage such as baby diapers, feminine hygiene pads, and incontinence products. In addition to personal hygiene products, SAPs have a range of applications in medicine, agriculture, and environmental protection. Surging demand for super absorbent polymers across various sectors is creating an opportunity for the SAP market in the coming years.

|

Parameter |

Super Absorbent Polymer Market |

|

Super Absorbent Polymer Market Size in 2023 |

US$ 9.2 Billion |

|

Super Absorbent Polymer Market Forecast By 2032 |

US$ 17.2 Billion |

|

Super Absorbent Polymer Market CAGR During 2024 – 2032 |

7.3% |

|

Super Absorbent Polymer Market Analysis Period |

2020 - 2032 |

|

Super Absorbent Polymer Market Base Year |

2023 |

|

Super Absorbent Polymer Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Application, and By Region |

|

Super Absorbent Polymer Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

BASF SE, Formosa Plastic Corporation, LG Chem, SANYO CHEMICAL INDUSTRIES, LTD., Evonik Industries AG, SONGWON, KAO Corporation, Sumitomo Seika Chemicals Co. Ltd., Nippon Shokubai Co., Ltd., and Yixing Danson Technology. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Super Absorbent Polymer Market Dynamics

Rising demand for baby diapers, female hygiene products, and adult incontinence is the primary factor driving the demand for the super absorbent polymer market. This factor is backed by the growing number of births across the world coupled with rising awareness regarding the use of baby diapers. Similarly, the increasing elderly population with the growing occurrence of incontinence is another reason that has created the demand for adult incontinence products. According to the World Health Organization (WHO) statistics, there were 771 million people over 65 years old in 2022, reaching 10% population of the world. Furthermore, this number is estimated to increase to 1.6 billion by 2050. In addition, the surplus demand for female hygiene products is yet another reason that is significantly driving the SAP market growth. As a result, all these factors combined have been creating lucrative opportunities for the super absorbent polymer (SAP) market.

In addition, technological advancements in SAP, which reduce leaks, enhance absorbance, and improve comfort are also contributing to the SAP industry. SAP has also been implemented in the agriculture sector, as they are utilized for water conservation and soil moisture management, particularly in arid regions facing water scarcity challenges. Despite several drivers, the SAP industry faces challenges that can hamper market growth. One major factor that is hampering the market is conventional SAP materials are not biodegradable, thus it can cause environmental concerns associated with the disposal of SAP-containing products. Nevertheless, fluctuations in the raw material prices, especially petrochemicals used in SAP production are also impacting the growth of the SAP market.

On the other hand, the development of biodegradable and bio-based SAPs is likely to generate significant opportunities for the market. Rising strict regulatory protocols and consumer awareness for environmentally friendly products are creating demand for biodegradable SAP material. In the agriculture sector, the application of SAP to improve crop yields and drought mitigation further offers promising growth prospects throughout the forecast timeframe. Furthermore, the advent of smart SAPs, which will open up new possibilities for specialized applications in numerous end-use industries, is supporting the rapid market growth.

Global Super Absorbent Polymer Market Segment Analysis

Super Absorbent Polymer Market By Type

· Sodium Polyacrylate

· Polyacrylamide Copolymers

· Others

According to the super absorbent polymer industry analysis, sodium polyacrylate is the most often used SAP owing to its excellent absorbency, low cost, and widespread availability. Sodium polyacrylates are widely utilized in personal hygiene products such as diapers, sanitary napkins, and adult incontinence products, which are SAPs' main application categories. They are also used as a super-absorbent polymer as a binding agent, emulsion stabilizer, coatings, viscosity controlling agent, and film forming in a variety of industries, including consumer goods, building and construction, sanitation, electrical and electronics, and industrial items.

Super Absorbent Polymer Market By Application

· Personal Hygiene

o Adult Incontinence Products

o Baby Diapers

o Female Hygiene Products

· Agriculture

· Medical

· Industrial

· Others

As per the super absorbent polymer market forecast, the personal hygiene segment is expected to gather utmost market share throughout 2024 to 2032. SAPs are often used in baby diapers because of their great absorbency, which keeps newborns dry and comfortable. The rising worldwide birth rate, along with greater awareness of newborn cleanliness and disposable money in emerging nations, has greatly increased demand for baby diapers. Furthermore, adult incontinence and female hygiene products add to the personal hygiene segment's supremacy by relying largely on SAPs for excellent moisture control and leak protection.

Super Absorbent Polymer Market Regional Analysis

Asia-Pacific is the most promising market for superabsorbent polymers (SAP) materials, accounting for more than 40% of worldwide demand and expected to dominate the industry for the foreseeable future. This dominance stems from the region's growing need for personal hygiene and agricultural products. Countries such as China, India, and Japan make substantial contributions, with considerable demand for infant diapers and female hygiene products. The growing middle class and urbanization in these nations have resulted in increased use of hygiene products. Furthermore, the agriculture industry in Asia-Pacific, particularly in water-scarce countries, is increasingly using SAPs to increase soil water retention and crop productivity.

North America is a major market for the superabsorbent polymer sector. One of the primary drivers of market expansion is the region's aging population. Rising consumer knowledge and social acceptance of a variety of health conditions has resulted in a shift in the hygiene industry's demand. The region's superior healthcare infrastructure, as well as the presence of significant industry participants, helps to maintain its leadership position. Furthermore, the use of SAPs in agricultural applications for soil moisture retention and water management is increasing, boosting the market in North America.

Super Absorbent Polymer Market Leading Companies

The super absorbent polymer market players profiled in the report is BASF SE, Formosa Plastic Corporation, LG Chem, SANYO CHEMICAL INDUSTRIES, LTD., Evonik Industries AG, SONGWON, KAO Corporation, Sumitomo Seika Chemicals Co. Ltd., Nippon Shokubai Co., Ltd., and Yixing Danson Technology.

Super Absorbent Polymer Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa