Surgical Staplers Market Growth Opportunities and Forecast till 2032

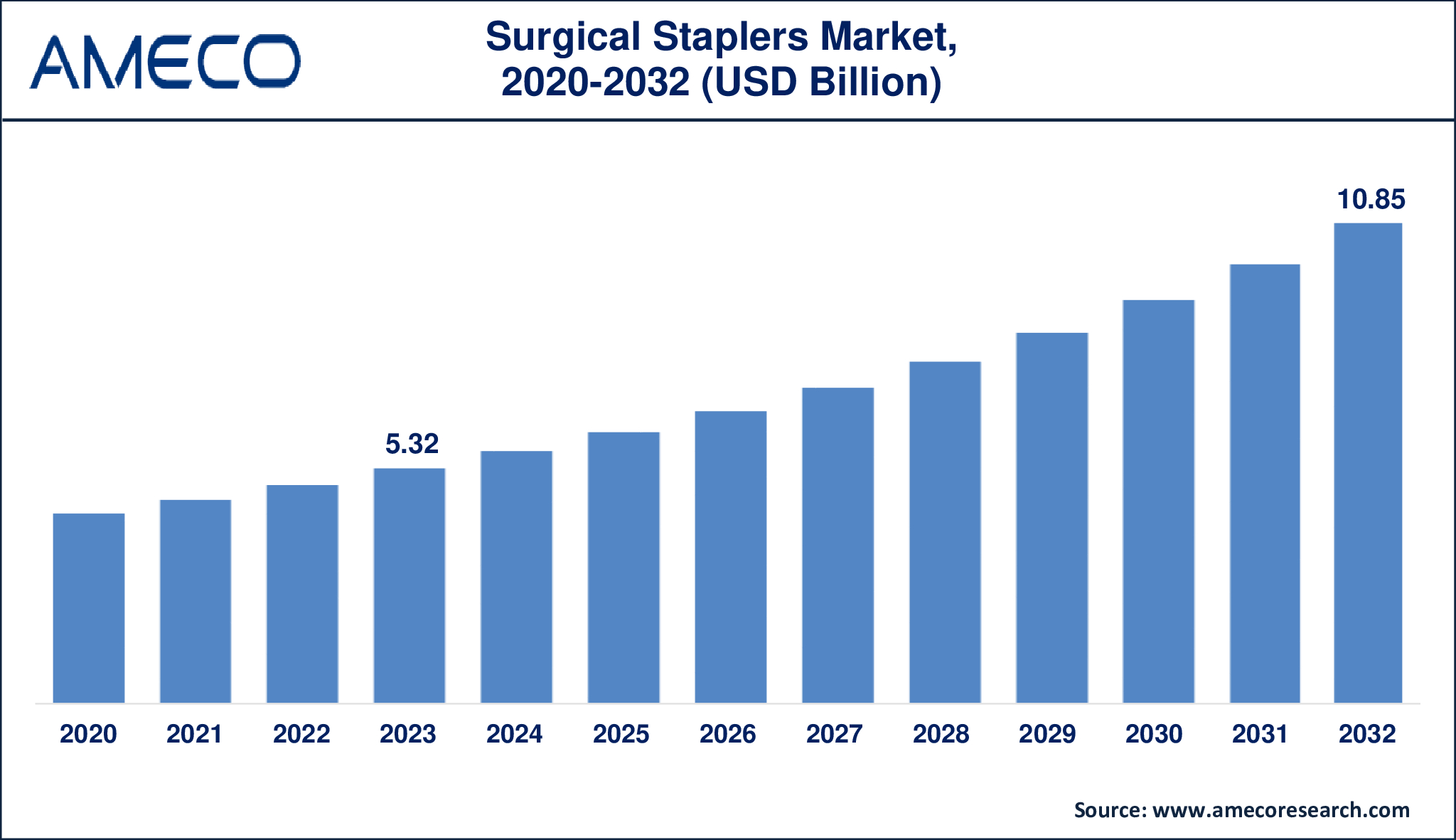

The Global Surgical Staplers Market Size was valued at USD 5.32 Billion in 2023 and is anticipated to reach USD 10.85 Billion by 2032 with a CAGR of 8.4% from 2024 to 2032.

Surgical staples are used to suture a wound after surgery has been conducted. It may be preferable in some cases to staples rather than stitches or sutures. They are convenient, require little preparation and are generally less likely to cause an infection. In most operations, a surgeon performs an incision on a person’s skin. They also have to suture this incision to avoid infections and help the wound to heal up after a surgery. After a surgery, surgeons may decide to stitch the incision using sutures or use surgical staples to do the same. Staples ensure that the wound is closed quickly and therefore the time taken to conduct the surgery is reduced. The cosmetic results are better with stapling than with intradermal sutures. But stapling leads to more complications and increases the length of stay in the hospital.

Staplers are classified into five categories: These include circular, linear, linear cutting, ligating and skin staplers. Moreover, there are modern modifications of these approaches to organize minimally invasive surgery. Each of the categories contains different commercial models and all of them are different from each other by some parameters. While all the staplers share some basic attributes such as having different names, color coded and different sizes and tissue thickness, they are designed for different uses in the surgical theatre. The nature of human tissues determines the choice of staples in that the different types of tissues have different properties. For optimum stapling outcomes in any type of tissue, adequate time must be provided for the tissue to be compressed in order to elongate the tissue undergoing compression, without the potential hazard of tearing.

|

Parameter |

Surgical Staplers Market |

|

Surgical Staplers Market Size in 2023 |

US$ 5.32 Billion |

|

Surgical Staplers Market Forecast By 2032 |

US$ 10.85 Billion |

|

Surgical Staplers Market CAGR During 2024 – 2032 |

8.4% |

|

Surgical Staplers Market Analysis Period |

2020 - 2032 |

|

Surgical Staplers Market Base Year |

2023 |

|

Surgical Staplers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Type, By Application, By End-User, and By Region |

|

Surgical Staplers Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Abbott, Boston Scientific Corporation, CryoLife, Inc., Edwards Lifesciences Corporation, enaValve Technology, Inc., Medtronic plc, Meril Life Sciences Pvt. Ltd., Neovasc Inc., Symetis SA, Terumo Corporation, Venus Medtech (Hangzhou) Inc., and W.L. Gore & Associates. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Surgical Staplers Market Dynamics

Increasing incidences of surgeries are one of the major factors that fuel the market growth of surgical stapling devices. It is believed that in emerging countries there are more than 1000 operations per year. Surgical staplers are more advantageous than sutures because they are cheaper, accurate, quicker, and contain less possibility of infection. They are also applied in procedures that were previously cumbersome to conduct mainly due to restricted access with older approaches. The fact that surgical staplers provide less post-operative complications than other methods is also contributing to market growth.

The increase in the number of different sorts of operations including gastrointestinal, thoracic and bariatric operations has been a major driver to the demand for surgical stapling devices. This growth is further supported by the increasing incidence of minimally invasive surgeries where the stapling devices are used to achieve the best results with short recovery time.

With the aging population across the globe, the number of surgeries being conducted also increases and this is the main reason why surgical stapling devices are in high demand. Secondly, the incidence of chronic diseases including obesity has risen, thereby increasing the demand for surgeries related to such diseases such as bariatric surgery and other obesity procedures, thus driving the market for surgical staplers..

Several challenges and restrictions will act as a barrier to the growth of the market in the coming years. The market growth is being slowed down by concerns such as the fact that these gadgets are considerably expensive than their traditional counterparts. Furthermore, other types of wound care which are not using staplers such as surgical sealants, fibrin sealants and other anti-inflammatory, anti-scarring methods which do not require removal of staples can also act as restrains for the global surgical stapler market.

Predicted threats include the expensive nature of the devices and the availability of other methods of wound care that may limit the demand for the devices. In the future, problems connected with the application of surgical staplers and the scarcity of qualified specialists is also expected to create problems for the market for surgical staplers.

Global Surgical Staplers Market Segment Analysis

Surgical Staplers Market By Product

· Manual

· Powered

According to the surgical staplers industry analysis, powered staplers have dominated in recent years. This is so because they have better features than the manual staplers in that they are accurate, uniform and easier to use. This tool is more appropriate in complex and lengthy operations because the powered staplers minimize the physical strain exerted by surgeons. Furthermore, the use of the powered staplers results in better staple formation and less chances of such mishaps as leakage or bleeding. Due to the growth in the use of minimally invasive surgeries, powered staplers are gaining preference especially in the large volume surgery markets, which already cements their position over manual staplers.

Surgical Staplers Market By Type

· Disposable

· Reuse

As per the analysis of surgical staplers industry, the disposable segment has received the highest market share. This is because there is increased preference of single use staplers because they reduce cross contamination and infections, which are very important in surgeries. Disposable staplers are also convenient since they do not require reprocessing after every use and thus, spare hospitals considerable expenses and minimize the likelihood of human mistakes. As patient safety and infection control becomes a major concern in the operating room and other care delivery areas, health care workers prefer single use staplers particularly in sensitive procedures. Also, the rising use of disposable surgical devices in the emerging economies has also helped this segment to be in the forefront of the market..

Surgical Staplers Market By Application

· Abdominal

· Pelvis

· General Surgery

· Cardiac

· Thoracic

· Orthopedic

· Hemorrhoids

· Cosmetic

· Pediatric

Currently in the surgical staplers market, the largest application being experienced is in the abdominal surgery segment. This growth is attributed to the growing prevalence of gastrointestinal and bariatric surgeries that are often carried out to treat obesity and other obesity related illnesses. With the increase in the obesity levels around the world, the need for bariatric surgery such as gastric bypass and other forms of surgery where surgical staplers are used in order to create precise and minimized post-operative surgical site infection rates.

Furthermore, the improvement of minimally invasive procedures especially in the abdominal area, has led to the widespread use of surgical staplers because of their effectiveness, safety and shorter recovery time than that of sutures. The increasing incidences of abdominal disorders and the increasing use of laparoscopic surgeries are adding to the market growth of this segment..

Surgical Staplers Market By End-User

· Hospital

· ASC & Clinic

As per the Surgical Staplers market forecast, the hospitals segment is expected to dominate the market from 2024 to 2032. This mainly because of the increased number of procedures that are complicated and varied, which are done in hospitals such as gastrointestinal, thoracic and cardiovascular surgeries. Hospitals tend to have a bigger surgical division, better equipment, and more varied specialists that make them an important buyer of surgical staplers.

Further, hospitals are inclined to spend on technologically superior stapling equipment like the powered and disposable staplers, because of the increasing concern for patient safety, infection control and better surgical outcomes. The constant increase in patient traffic for surgeries and the opportunity to provide full-spectrum postoperative care only enhance the position of hospitals in the market compared to ASCs and clinics.

Surgical Staplers Market Regional Analysis

North America is currently leading the market due to the increasing number of surgeries, the adoption of new technologies, and the growing preference for minimally invasive procedures. The high incidence of obesity, the presence of all major medical consumable companies, and regulatory approval for less invasive procedures also contribute to the region’s large market share in this industry. Additionally, dedicated devices for thoracoscopic and laparoscopic procedures, which involve surgical staplers, further boost the market.

Moreover, value-based care is emerging as the new industry model in the region, driving the rise of minimally invasive surgeries. These procedures are highly favored by patients as they involve less blood loss, smaller incisions, shorter hospital stays, fewer post-surgical complications, reduced pain and scarring, and, most importantly, greater affordability. The preference for staplers over sutures in minimally invasive surgeries is a key factor behind the market's growth, as the trend toward such surgeries continues to rise.

Surgical Staplers Market Leading Companies

The Surgical Staplers market players profiled in the report is Abbott, Boston Scientific Corporation, CryoLife, Inc., Edwards Lifesciences Corporation, enaValve Technology, Inc., Medtronic plc, Meril Life Sciences Pvt. Ltd., Neovasc Inc., Symetis SA, Terumo Corporation, Venus Medtech (Hangzhou) Inc., and W.L. Gore & Associates.

Surgical Staplers Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa