Ultrasound Equipment Market Growth Opportunities and Forecast till 2032

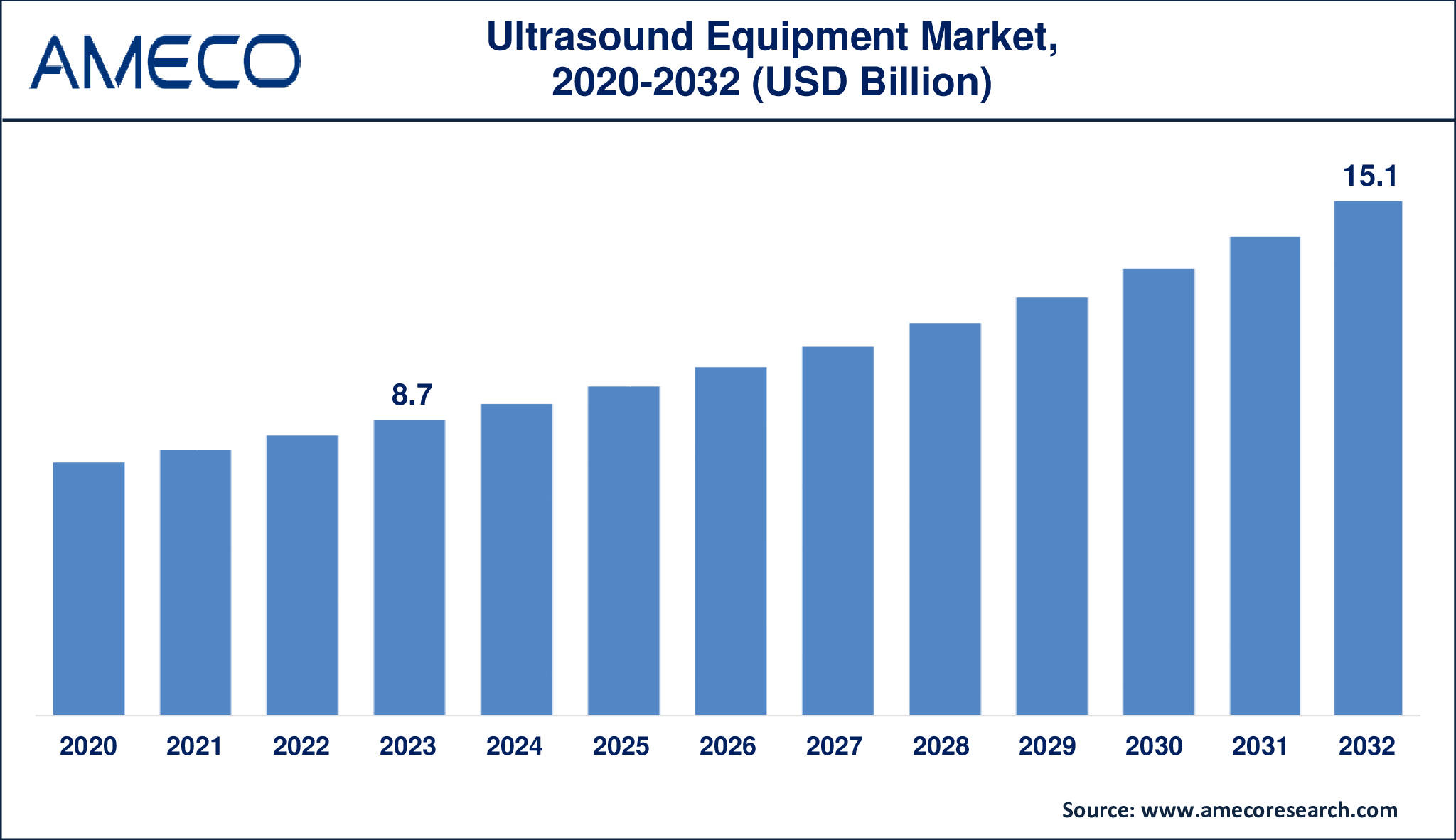

The Global Ultrasound Equipment Market Size was valued at USD 8.7 Billion in 2023 and is anticipated to reach USD 15.1 Billion by 2032 with a CAGR of 6.5% from 2024 to 2032.

Ultrasound is diagnostic imaging equipment that employs ultrasonic waves for the purpose of producing real time images of internal organs of the body. It allows imaging of tissues and organs without the need for invasive procedures and can be used for identification, tracking, and diagnosis of numerous diseases. Ultrasound images are created from the echo returned from the organ’s surfaces and scattering in tissue inhomogeneities for anatomy and function visualization. This medication is used in almost all the specialties such as obstetrics, cardiology, and radiology because it is safe and efficient.

Ultrasound scanning is mostly an interactive process where the operator, the patient and the ultrasound device are all involved. The operator has to direct sound waves into the body using a transducer and the echoes are then used by the equipment to form real time images. Today’s ultrasound machines contain features like Doppler imaging of blood flow, and 3D/4D imaging for enhanced visualization. The fact that ultrasound is noninvasive, does not use ionizing radiation, and is easily applicable in various clinical fields makes it one of the most significant tools in contemporary diagnostic and therapeutic approaches.

|

Parameter |

Ultrasound Equipment Market |

|

Ultrasound Equipment Market Size in 2023 |

US$ 8.7 Billion |

|

Ultrasound Equipment Market Forecast By 2032 |

US$ 15.1 Billion |

|

Ultrasound Equipment Market CAGR During 2024 – 2032 |

6.5% |

|

Ultrasound Equipment Market Analysis Period |

2020 - 2032 |

|

Ultrasound Equipment Market Base Year |

2023 |

|

Ultrasound Equipment Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Portability, By Application, By End-Use, and By Region |

|

Ultrasound Equipment Market Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Canon Inc., ESAOTE SPA, Fujifilm Corporation, General Electric Company, Hitachi, Ltd., Koninklijke Philips N.V., Mindray Medical International Limited, Samsung Healthcare, Siemens Healthineers AG, and Zimmer MedizinSysteme GmbH. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Ultrasound Equipment Market Dynamics

The increasing popularity of ultrasound equipment due to development in diagnostic imaging and increasing cases of chronic and lifestyle diseases is the primary driver to the growth in the market. Ultrasound is applied in cardiology, obstetrics and gynecology, vascular and musculoskeletal imaging among others. Importantly, the rising cases of CVDs, which WHO estimates cause about 17.9 million deaths annually, make it crucial in healthcare delivery. According to the CDC in USA, approximately 805,000 people have heart attacks every year, pointing to the increasing demand for ultrasound equipment in cardiac treatment.

The use of portable and point-of-care ultrasound systems has therefore increased especially in the emergency and the primary care sectors. These systems offer immediate imaging at the patient’s side, making diagnostics and clinical decision a faster process. They are most effective and convenient when used in emergency, for example, in evaluating the patient’s condition after a traumatic event or in directing a physician’s actions during a surgery. In addition, the COVID-19 pandemic influenced the increased use of telemedicine and remote patient monitoring, which creates a need for portable ultrasound equipment to be used during remote consultations. These developments correlate with the general trend of applying innovative technologies into patient-orientated care processes, thereby underlining the strategic importance of ultrasound in contemporary medicine.

The application of ultrasound imaging has been enhanced by the recent innovations in equipment that provide better image resolution and accurate planning of treatment. As a matter of fact, ultrasound is cheaper, safer, and more flexible in comparison with other imaging techniques, such as CT and MRI scans. The latest innovation in this field is Mindray’s introduction of the Imagine I9 in June 2022 for demanding obstetrics and gynecology practices. These technological enhancements along with the growing use of ultrasound devices in various clinical applications are enhancing the role of ultrasound devices on the global healthcare platform.

Global Ultrasound Equipment Market Segment Analysis

Ultrasound Equipment Market By Product

· Diagnostic Ultrasound Devices

o 2D

o 3D/4D

o Doppler

· Therapeutic Ultrasound Devices

o High-Intensity Focused Ultrasound

o Extracorporeal Shockwave Lithotripsy

In 2023, diagnostic ultrasound devices accounted for the largest market share in the ultrasound equipment market. In this segment, 2D ultrasound devices were most popular because of their use in general imaging, lower cost, and well-proven utility in healthcare. The demand for diagnostic ultrasound devices was due to its applicability across many specialties such as cardiology, obstetrics/ gynecology and vascular imaging. Real time imaging for diagnosis and treatment planning was one of the main areas that gave them a competitive edge in the market. Furthermore, there is an increase in the number of patients with chronic diseases, and the development of new imaging techniques provided more support to use in clinical practice.

Ultrasound Equipment Market By Portability

· Compact

· Handheld

· Cart/Trolley

o Higher-end Cart/Trolley Based Ultrasound

o Point-of-Care Cart/Trolley Based Ultrasound

The cart/trolley based ultrasound segment held the largest share in the Ultrasound Equipment Market based on portability in 2023, with a market share of around 68%. This dominance is due to their application in hospital and imaging centers, providing portability, high image resolution, and suitability for point-of-care uses. These systems are most useful in extended procedures such as 3D and 4D and the portable nature of the systems allows for its use in emergency and intensive care. Although the market of handheld devices is rapidly growing because of their miniatures and adaptability to home care and emergency use, cart/trolley systems are still preferred for high-end diagnostic.

Ultrasound Equipment Market By Application

· Anaesthesia

· Cardiology

· Critical Care

· Emergency Medicine

· Primary Care

· Obstetrics/Gynaecology

· Orthopaedic

· Radiology

As per market analysis, oncology segment has emerged as the largest segment of the Ultrasound Equipment (NGS) market mainly because of the increasing incidence of cancer and the increasing use of NGS in oncology. Next-generation sequencing technologies are useful for identifying mutations in cancer-related genes, epigenetic modifications and chromosomal rearrangements. These applications facilitate the study of cancer biology and hence open the door for targeted therapy and personalized medicine. Due to constant decrease in the costs of sequencing and growing incorporation of CGP in oncology research and diagnostics, this segment continued to hold a large market share globally.

Ultrasound Equipment Market By End-Use

· Hospitals

· Imaging Centres

· Research Centres

The hospital segment is expected to dominate the market share of ultrasound equipment during the forecast period from 2024 to 2032. Hospitals are the largest consumers of the ultrasound equipment since they require imaging services in numerous subspecialties such as cardiology, obstetrics and gynecology, and emergency medicine. As the hospital system continues to expand and new technologies are developed, hospitals continue to be the most active users of ultrasound. An increase in patient centric care, increase in the rate of chronic diseases and the need for immediate diagnosis will lead to the growth of the ultrasound systems in these areas.

Ultrasound Equipment Market Regional Analysis

North America held the largest share of the ultrasound devices market in terms of revenue in 2023. The strong market growth in the region can be attributed to research and development (R&D) and the presence of key ultrasound device manufacturers along with technological development. The major market players like GE Healthcare, Philips, and Siemens have had a notable role in the growth of the regional market through continuous product development and new ultrasound systems’ release. Furthermore, North America has a developed health care system, which guarantees the usage of diagnostic technologies in all regions. Priorities in the region’s patient care and the extensive healthcare systems integrated in the region are expected to retain its premier position in the coming years.

However, the Asia-Pacific (APAC) region is expected to show the highest compound annual growth rate (CAGR) during the forecast period. The factors that are contributing to the market growth include the increase in the geriatric population, the increase in the incidence of chronic diseases like cardiovascular disorders, and the need for early diagnosis and treatment of diseases. Moreover, the healthcare industry in the APAC countries especially China and India is evolving fast and people can afford to use more advanced ultrasound devices. Market growth in this region is supported by government activities and raising the awareness of the significance of early disease diagnosis. These developments put APAC on the right footing as the ultrasound devices market growth driver in the global market.

Ultrasound Equipment Market Leading Companies

The Ultrasound Equipment market players profiled in the report is Canon Inc., ESAOTE SPA, Fujifilm Corporation, General Electric Company, Hitachi, Ltd., Koninklijke Philips N.V., Mindray Medical International Limited, Samsung Healthcare, Siemens Healthineers AG, and Zimmer MedizinSysteme GmbH.

Ultrasound Equipment Market Regions

North America

· U.S.

· Canada

Europe

· U.K.

· Germany

· France

· Spain

· Rest of Europe

Latin America

· Brazil

· Mexico

· Rest of Latin America

Asia-Pacific

· China

· Japan

· India

· Australia

· South Korea

· Rest of Asia-Pacific

Middle East & Africa

· GCC

· South Africa

· Rest of Middle East & Africa